It appears that the crypto masses are descending upon the markets like a horde of, well, crypto enthusiasts. Glassnode, a reputable analytics firm, claims that demand for Bitcoin is outpacing new supply by a rather significant margin 🤯.

According to Glassnode’s X (because who needs a proper name for a social media platform, anyway?) post, wallets with less than 100 Bitcoin are buying up the crypto king at a rate of $2.359 billion per month. Meanwhile, miners are only producing about $1.638 billion worth of new Bitcoin per month 🤑.

“We’re seeing accumulation by wallet size: shrimps, crabs, and fish – wallets with <100 BTC – are accumulating ~19,300 BTC/month, while miner issuance stands at 13,400 BTC/month. It’s like a never-ending game of crypto Pac-Man, and the little guys are winning!”

//pbs.twimg.com/media/Gvk294gWkAAe0Fs?format=jpg&name=4096×4096″/>

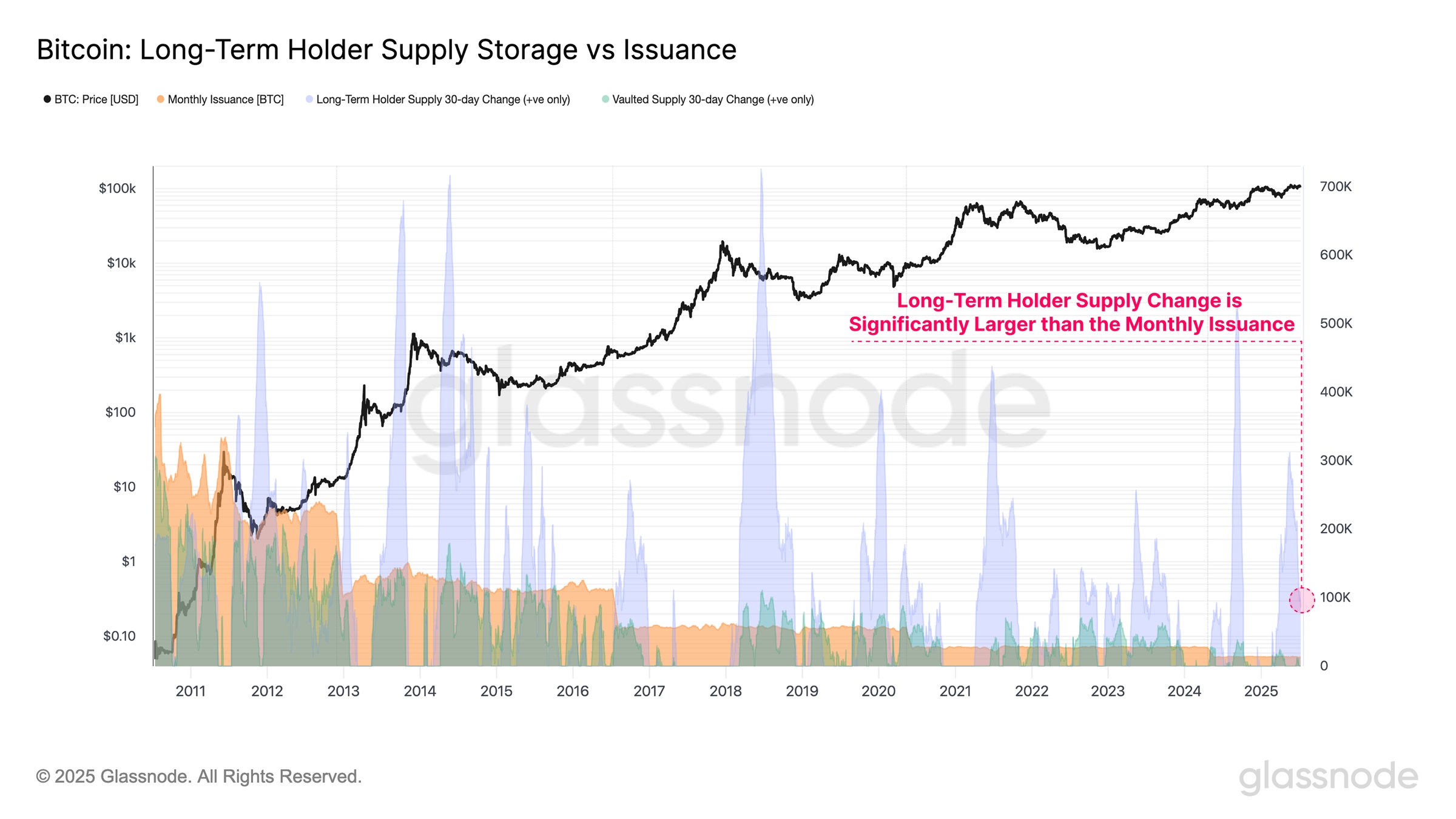

Glassnode also notes that long-term holders, or entities that have held their coins for at least 155 days (which is, like, an eternity in crypto time), are also buying up Bitcoin at a rate that’s “significantly larger than monthly issuance.” Because who needs cash when you can have crypto, right? 💸

“’BTC balance on exchanges dropping = supply shock’ is a meme. But that doesn’t mean there aren’t supply constraints. Long-term holders are absorbing more BTC than miners issue. That’s where pressure builds. And by pressure, we mean the pressure to buy more crypto.”

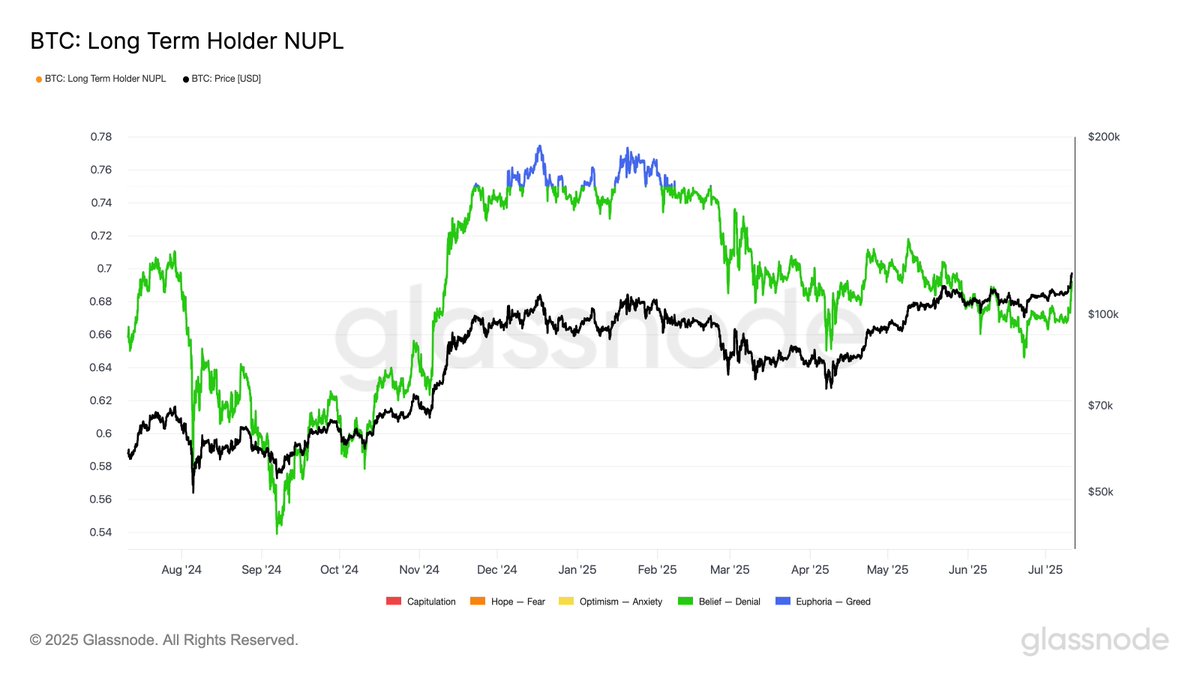

The analytics firm also claims that despite new all-time high prices for Bitcoin, the BTC bull market is still going strong based on the long-term holder net unrealized profit and loss (NUPL). Because who needs actual profits when you can have unrealized ones? 🤑

Glassnode data shows that the long-term NUPL, an on-chain metric that tracks whether long-term holders are in profit or loss, remains below historical peak levels. The data suggests that investors who bought at least six months ago are still holding and have not yet begun aggressively taking profits. Because why sell when you can hold and hope for the best? 🤞

“While BTC has made a new ATH (all-time high) above $118000. Long-Term Holder Net Unrealized Profit and Loss (NUPL) remains below the euphoria zone, currently at 0.69. This cycle has seen just ~30 days above the 0.75 threshold, compared to 228 days in the previous cycle. So, basically, we’re not quite at peak euphoria yet. Give it time.”

At time of writing, Bitcoin is trading for $122,250. But don’t worry, it’ll probably be worth a million dollars by the end of the week. Or not. Who knows? 🤷♂️

Follow us on X, Facebook, and Telegram, because why not? 🤷♂️

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox, because you clearly need more crypto news in your life.

Check Price Action, because prices are always action-packed 🎥.

Surf The Daily Hodl Mix, because who doesn’t love a good mix of crypto news and memes? 🤣

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- EUR USD PREDICTION

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Will Ethereum Hit $5K? The Surprising Twist You Won’t Believe! 😲

- Bitcoin & Gold: Because Money is Weird

2025-07-14 15:02