Oh, what a spectacle! Bitcoin has finally managed to break above its all-time high in the $125K range, like a bold hero emerging from the depths of an epic saga, signaling some serious momentum. But wait-do not rejoice too soon, for the market is entering a thrilling phase of suspense. Could it be consolidation, or dare I say, a short-term pullback before the great leap into the unknown? Only time will tell. 🎭

Bitcoin Price Analysis: The Thrilling Tale of Technicals

By Shayan

The Daily Chart – A Dance of Destiny

On the daily chart, behold! BTC has torn through the flag pattern that has shackled it since July, much like a hero breaking free from the chains of fate, confirming a strong continuation of its epic journey. As the price climbs higher, it meets the resistance at the mighty $124K-$126K zone, where sellers, much like villains in our tale, begin to show a slight reluctance to give in.

The bullish structure remains intact, supported by a golden cross between the 100-day and 200-day moving averages, which now act as trusty sidekicks, providing unwavering support. As long as Bitcoin stays above $120K, the broader uptrend remains on course. A glorious close above $126K may open the gates toward $130K-$132K in the short term, like the opening of a portal to the promised land.

But beware! If the price fails to hold above $120K, a healthy retracement toward the mid-range support near $115K could occur, much like a necessary pause in the story before the next big battle. This aligns with the 0.618 Fibonacci retracement-ah, the mystical Fibonacci, the true wizard of the charts!

The 4-Hour Chart – The Journey Continues

Our brave Bitcoin has recently surged above the $118K decision point, like a gallant knight claiming a victory, rallying toward the ATH zone around $125K. This impulsive movement has created a glorious imbalance, with potential retracement zones forming between $115K and $113K, like ominous clouds before a storm. These levels align with Fibonacci confluence levels (0.618-0.702 range), providing clues for the wise chart watcher.

This zone now serves as a short-term re-accumulation area. If Bitcoin holds above it, the bullish path will continue, like a journey progressing toward a bright future. The market is consolidating near a liquidity-rich area, implying that a brief pullback could create new opportunities for buying before the next major move.

However, if Bitcoin cannot defend its breakout block at $118K and the Fibonacci support between $113K and $115K, the next strong demand area lies between $109K-$110K, where previous buying has set the stage for this mighty breakout. Ah, the drama! The suspense is palpable!

The Sentiment Analysis – The Tale of Liquidation

By Shayan

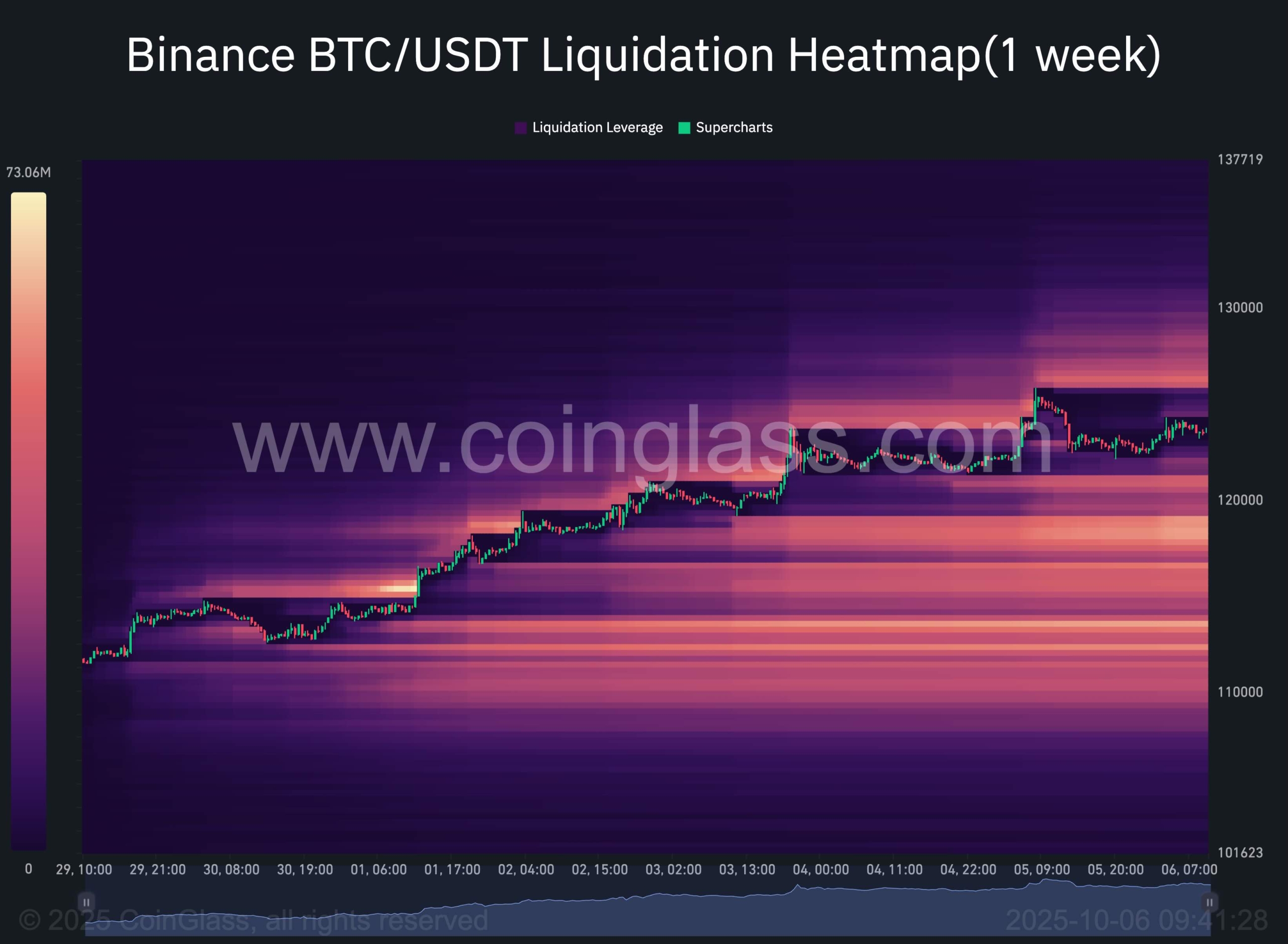

The latest Binance liquidation heatmap reveals a buildup of liquidity zones, with particularly dense liquidation clusters forming around $128K-$130K. These high-density regions are like the treasure hoards of dragons, where short positions have accumulated in vast numbers, ready to be swept away in a grand display of market action. ⚡

During the recent rally from $110K to above $123K, we’ve seen a steady absorption of lower-level liquidity, each upward movement clearing out prior short positions before consolidating. This has set the stage for another potential short-squeeze, pushing Bitcoin even higher as those short positions are forced to close in a dramatic act of market heroism.

If Bitcoin can hold above $120K, a short-squeeze continuation into the upper liquidity band seems likely. But if things go awry, brace yourselves for the inevitable retracement. The market moves in mysterious ways, my friend. 🎭

Read More

- USD THB PREDICTION

- Brent Oil Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- SushiSwap’s Stirring Saga: The DeFi Drama That Left Us in Stitches! 😂🍣

- XRP’s Daring Dance on $2.16: Will It Waltz or Wilt? 💸📉

- Bitcoin Frets and Fears: The Great Crash of 2025! 🚨💥

- Crypto Chaos: 3 Stocks Dancing on the Edge of Madness 🌪️💸

- Is Nubank Testing Dollar Stablecoins? Get Ready for a Crypto-Infused Future! 💸😱

- Shocking Revelations: Bitcoin’s Epic Financial Reign Leaves Altcoins in the Dust! 💰📉

- 🚀 Crypto’s Wild Ride: Trump, Tariffs, and $550B Comeback! 🤑

2025-10-06 19:45