So, there we were on a lovely Wednesday morning, sipping our artisanal coffees, when Bitcoin decided to take a little tumble-down 0.8% to a cool $113,467. Ah, the sweet scent of desperation mingling with that minty-fresh cryptocurrency. It could have been just one of those days, but no! U.S. trade tariff threats and signs that our global economy is slowly stumbling towards a cliff were heavy enough to scare off even the most adventurous of investors. Who needs roller coasters when you have crypto rollercoaster rides?

Strangely predictable, the dip followed a wave of profit-taking, because what’s the fun of having money if you can’t lose a little of it on the first heady highs? Just when you thought altcoins would stage a comeback worthy of their own motivational poster, the momentum fizzled out quicker than an expensive bottle of champagne at a bad wedding.

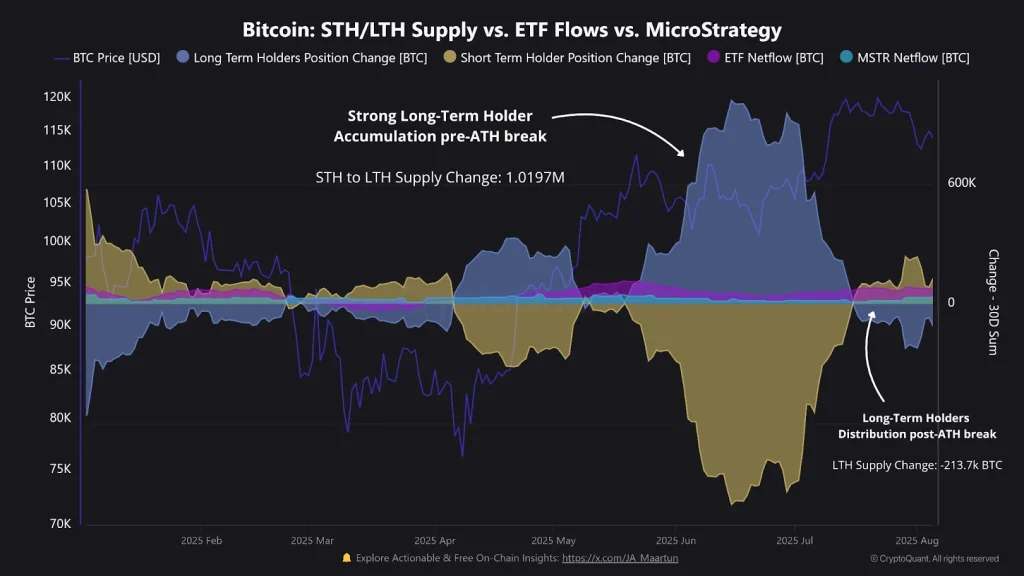

Profit-Taking from Long-Term Holders

According to some guy named Maartunn (because, of course, every financial analyst should have a name that sounds like a sneeze), the real drama unfolds from long-term holders (LTHs) cashing out like they’ve just found a five-dollar bill in the pocket of those jeans they haven’t worn since 2019. The hot gossip? One wallet from the good ol’ Satoshi days sold off 80,000 BTC! Meanwhile, Maartunn reassures us that it’s not just one wealthy sea monster causing this mess but a veritable tidal wave of long-term investors diving for cover.

“This isn’t just one whale, it’s a wave of long-term investors cashing out after the ATH breakout,” he explained-like the financial equivalent of your mom saying all her friends did it for her.

Retail and Institutional Activity

Oh, but it gets juicier! Retail investors, those brave souls, have stormed into the market like it’s Black Friday at Best Buy after Bitcoin’s record high. Typical! Meanwhile, institutions like Strategy and Metaplanet stepped up to the plate, probably wearing fancy suits and looking all serious, only to find that their combined buying power couldn’t keep prices above $120K. Talk about a disappointing dinner party!

Short-Term Holders Under Water

The true drama unfolds with the short-term holders (STHs) practically waving a white flag as they capitulate at a loss. It’s like watching a soap opera-on-chain data showed losses of 52,230 BTC in mid-July, followed closely by 42,493 BTC, and an impressive final act of 70,028 BTC after July 31. Maartunn says this last act not only stands out for its size but also its extended curtain call, suggesting that short-term sentiment is looking less buoyant than a broken inflatable pool float in a kiddie pool.

ETF Outflows Add to the Pressure

And just when you think it couldn’t get any worse, Bitcoin ETFs started cashing out too! Although Maartunn describes these as modest outflows compared to past episodes of crypto horror, they add fuel to the fire alongside the LTH profit-taking and STH capitulation. It’s like trying to find upwards momentum with one hand tied behind your back while standing on a teeter-totter!

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more. Because who wouldn’t want to witness this dumpster fire unfold?

FAQs

Why is Bitcoin’s price down today?

Because the combination of global economic fears, US trade tariff threats, and the classic wave of profit-taking from our beloved long and short-term holders has led us to this riveting moment. The show must go on!

Who is selling Bitcoin right now?

Everywhere you look! Long-term holders-including that infamous Satoshi-era whale-are cashing out like there’s a sale at the bank, but short-term traders are also crying into their portfolios.

What’s the impact of institutional buying?

While the likes of MicroStrategy keep piling up Bitcoin like it’s going out of style, they still can’t offset the massive sell-off from the retail crowd looking for a lifeboat on this sinking ship.

Is this a normal Bitcoin correction?

Yes! It’s just your standard, run-of-the-mill Bitcoin correction, featuring the classic LTH profit-taking and STH capitulation, all spiced up by some global economic chaos. Yum!

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- Crypto Chaos: 3 Stocks Dancing on the Edge of Madness 🌪️💸

- Bitcoin Frets and Fears: The Great Crash of 2025! 🚨💥

- USD THB PREDICTION

- ⚡Chekhov Spills The Tea-Will ADA’s $1.50 Dream Get a Chekhovian Plot Twist?😂

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

2025-08-06 13:28