It is a truth universally acknowledged—by speculators and skeptics alike—that Bitcoin would sooner contemplate its own beauty than respond to the senseless frolics of world economies. Do not disturb the King; he is meditating, or perhaps just napping.

The Languor of Liberty: Bitcoin Snoozes Through the Fourth of July

As America shut its illustrious trading floors in celebration of Independence Day, Bitcoin (BTC) partook in the festivities by pretending to be a statue. “Crypto never sleeps,” they say, and yet, Bitcoin appears to have discovered the splendor of a week-long siesta, dozing around $107K with the steadfastness of a marble sphinx. Despite every economic firework lighting up the stock markets, our digital darling remained unmoved, channeling the spirit of that one poet at a party who refuses to dance.

The U.S. President, ever the prolific author of plot twists, signed a treaty with Vietnam, the labor force acquired 147,000 new wage slaves—pardon, jobs, unemployment tumbled, the grandly named “One Big Beautiful Bill” (OBBB) passed like a fashionable scandal, and—lest we forget—the House heralded an entire “Crypto Week”. Bitcoin, however, greeted these events with all the enthusiasm of a cat confronted by a cucumber: barely a twitch.

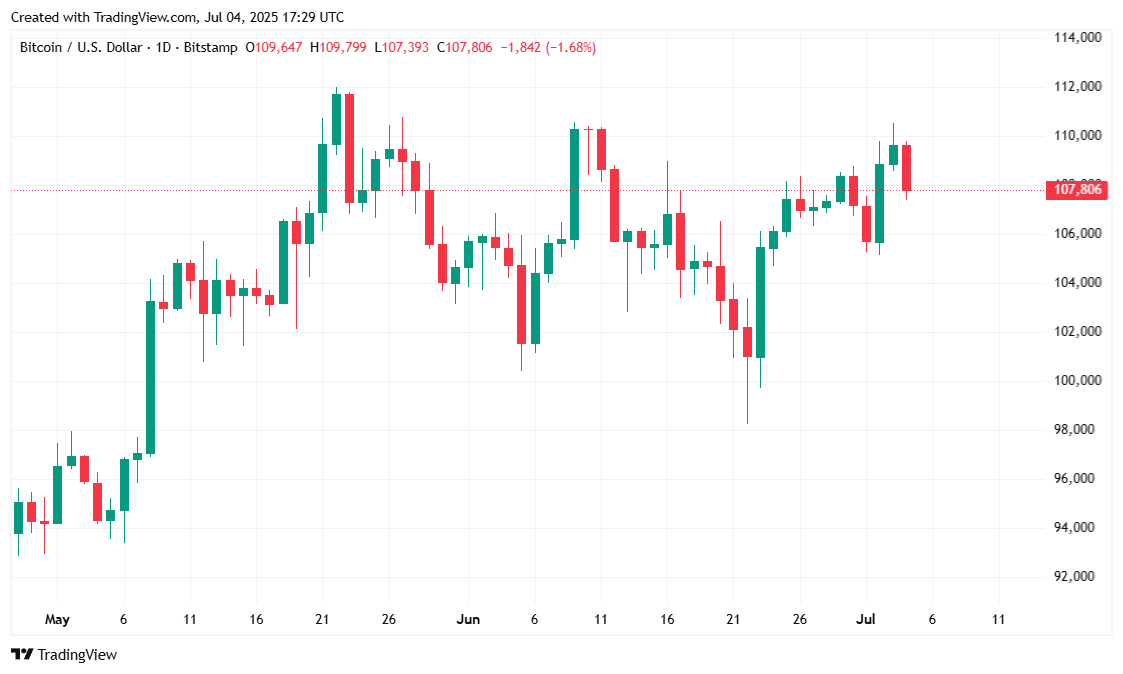

Meanwhile, stock indices achieved all-time highs, simpering for attention like debutantes at a Victorian ball. Even with a 60% correlation to the S&P 500, Bitcoin lounged listlessly on the proverbial chaise, occasionally startling the market with a spike, only to settle again into soporific stagnation. Fancy some excitement? You’ll have better luck watching paint dry—or better yet, watching paint consider the concept of drying.

Exquisitely Tedious Market Metrics

Bitcoin’s price frolicked—if hopping between armchairs is “frolicking”—between $107,390.46 and $110,039.68 over 24 hours, dawdling at a poetic $107,847.27. Down 1.5% from yesterday (so tragic! Quick, fetch the fainting couch!), but up a positively riveting 0.53% for the week. Bravo, Bitcoin, for being just volatile enough to avoid complete torpor.

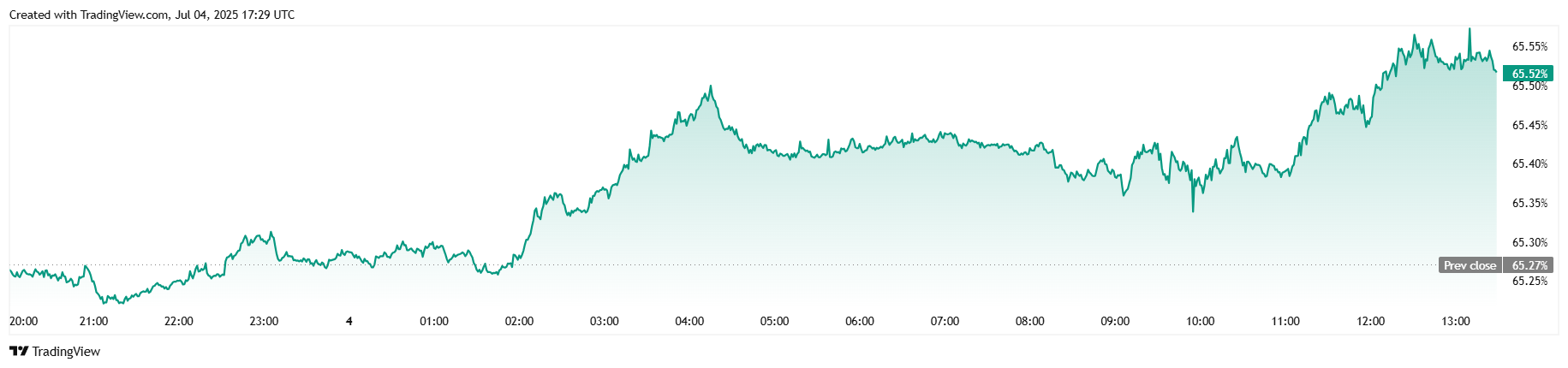

Trading volume descended 23% to $43.31 billion. Traders, evidently, chose barbecue over market making—which, all things considered, may be the wisest trade of all. Market capitalization put on a melancholy air, drooping 1.49% to $2.14 trillion, but BTC’s dominance eked out a mighty 0.02% gain, the statistical equivalent of a limp handshake.

BTC futures open interest toppled 4.26% to $73.20 billion—a number as restless as a Wildean dandy before a mirror. Leveraged traders suffered liquidations totaling $47.22 million, with the bulls (so typically bullish) donating $42.66 million in longs to the abyss, while the shorts lost a mere $4.56 million. The lesson? In crypto, optimism is just a more expensive form of despair. 🥂

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- SEI PREDICTION. SEI cryptocurrency

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- FET PREDICTION. FET cryptocurrency

2025-07-04 22:02