Ah, the fickle mistress of cryptocurrency! Bitcoin languishes below the vaunted $70K, a mere shadow of its former glory, as Wintermute observes with a bemused grin.

Here we find Bitcoin, that rebellious child of the digital age, still clinging to its meager existence below the mighty threshold of $70,000. Investors, like lost sheep, seek direction after a chaotic purge of liquidations only a fortnight past. The price dance resembles a drunken sailor, swaying precariously, driven by the capricious winds of futures trading rather than the sturdy sails of real spot market demand.

A recent barrage of economic data has thrown yet another spanner in the works, swiftly altering the landscape of interest rate expectations. Wintermute, ever the sage, points out that confidence has taken a vacation, leaving behind a fragile price structure despite valiant support levels that refuse to crumble… for now.

Relief Rally Fades as Bitcoin Struggles to Build Momentum Above $68K

As I pen these words, our dear Bitcoin sits at a pitiful $68,300, having made several futile attempts to ascend and reclaim its rightful throne at $70K. Meanwhile, its dominance teeters below the illustrious 60%. Post-liquidation positioning is as light as a feather, and yet the spot volumes mimic a ghost town. Oh, how the derivatives take center stage, driving the short-term fluctuations like a puppeteer with a twisted sense of humor!

Sharp swings in both directions echo through the market, a testament to the absence of a robust bid. Without the warm embrace of steady spot buying, rallies flounder, while pullbacks deepen faster than a sinking ship.

In January, we were graced with strong job data that defied expectations, whisking unemployment down to a mere 4.3%-a number that would make any economist giddy. However, as fortunes turned, Treasury yields rose like bread from the oven, dousing hopes for imminent rate cuts. Alas, the Bitcoin ETFs suffered heavy outflows as investors decided to play it safe, trimming their risk like a gardener pruning away dead branches.

But wait! A glimmer of hope appeared when the January CPI revealed a gentler inflation rate of 2.4%, down from 2.7%. This cooling sparked a relief rally reminiscent of summer rain on cracked earth, carrying us through Saturday. Yet, come Sunday, a modest pullback dashed our spirits, with ETF flows remaining under pressure, casting shadows of doubt upon our joy.

Meanwhile, in the grand circus of finance, investors began to juggle their portfolios, tossing money from tech and AI stocks into cyclical and value names, much like a magician performing a sleight of hand. The consumer discretionary, industrial, and chemical sectors suddenly found themselves basking in renewed interest.

Ah, but this was not a spontaneous act; it followed updates from Anthropic regarding U.S. FY25 earnings and product advancements, including the delightful Opus 4.6. Wintermute notes that this shifting tide had been brewing for months, much like a fine wine waiting to be uncorked.

Crypto Feels Heat as Investors Rotate From Tech to Hard Assets

In this elaborate game, tech stocks found themselves overpriced heading into earnings season, and some results fell flat, failing to justify the earlier rally. Investors, weary of uncertainty, opted to pocket their profits and rebalance their portfolios, like cautious squirrels preparing for winter.

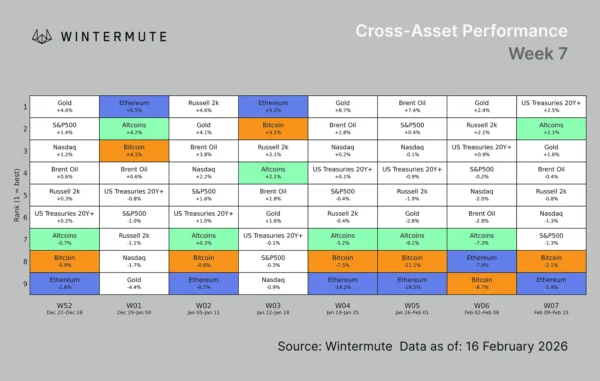

Image Source: Wintermute

Now, a deeper question lingers like a cloud over risk assets. Costs tied to AI innovation are plummeting faster than prices at a clearance sale. Lower barriers threaten disruption among established software models, while the risk premiums on growth assets rise as investors reassess their long-term fortifications.

Gold and precious metals, too, rallied earlier, buoyed by concerns over U.S. dollar debasement, only to overheat and correct, leaving many with a bitter aftertaste. Nevertheless, the appetite for hard assets remains part of a broader portfolio rebalancing, while crypto, perched precariously at the high-beta end of growth exposure, experiences the sting when capital runs away from momentum trades.

Bitcoin Rangebound With Downward Bias, Says Wintermute

Wintermute wisely warns against declaring a lasting regime shift. For two years, dip-buying in technology has ruled the roost. But fear not, dear reader! If macro data improves, narrative-driven flows may return quicker than you can say “bull market!” A revived interest in growth could once again breathe life into digital assets.

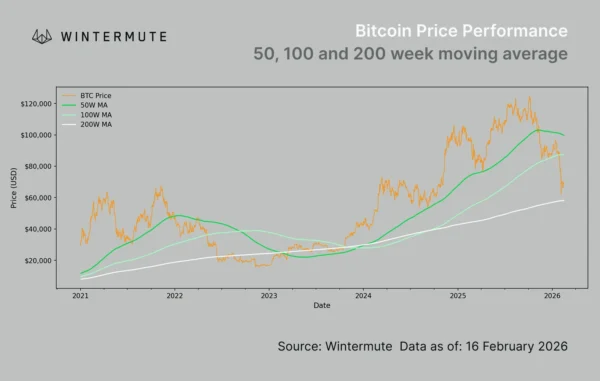

On a technical note, Bitcoin has found solace near its 200-week moving average-a level that historically aligns with bear market bottoms. Clinging to this level staves off more serious structural damage, but repeated rejections near $70,000 keep our short-term bias leaning toward the abyss.

Image Source: Wintermute

“Positioning is light, conviction is absent,” Wintermute muses wisely, “and until macro clarity returns, every rally will simply serve as an excuse for derisking, rather than a chance to chase momentum.”

Oh, the dramatic irony! Bitcoin may shuffle along within a tight range in the coming weeks, with volatility strutting about and futures markets orchestrating price movements. Clear signals on interest rates and inflation could shift expectations, but for now, patience is the name of the game. Wintermute urges investors to bide their time, as a recovery in the second half of 2026 looms on the horizon, albeit a challenging feat for those who’ve exhausted their stamina for uncertainty.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- SEI PREDICTION. SEI cryptocurrency

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- SPX PREDICTION. SPX cryptocurrency

- FET PREDICTION. FET cryptocurrency

- Raoul Pal’s Moron Trade: Crypto’s Great Unwashed 🤑

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- Bitcoin Stalls as Big Firms Shift Focus to Altcoins, Says Novogratz

2026-02-17 18:33