Have you ever wondered what really happens to corporate treasuries neck-deep in Bitcoin when the crypto winter blows in? Well, What Bitcoin Did host Danny Knowles and his guest, Dylan LeClair (of Tokyo’s MetaPlanet), have a few uncomfortable truths that will make your accountant want to hug a spreadsheet. LeClair, who probably dreams in candlestick charts, insists the survival of these so-called “Bitcoin treasury” firms is determined less by crypto religion and more by whether or not you can do basic maths and keep a cool head when prices go down faster than a soggy soufflé. “It’s a ‘gradually then suddenly’ situation,” he said, slyly implying that disaster is never far away—just tucked behind a bullish press release. 🚨

Bear Market: Where Bitcoin Treasuries Go to See If They’re Real Companies or Just Cosplayers

Here’s the dirty secret: Bitcoin might be the same everywhere, but companies sure aren’t. According to LeClair, you basically need to be the Godzilla of balance sheets to survive. Size matters. Liquidity rules everything. “Strategy’s only trading at a measly 1.8x premium, but that’s about $50 billion,” he said, which is another way of saying the rest of you should eat your vegetables and come back when you weigh in at a proper heavyweight. Premiums don’t last forever: as companies shovel in more Bitcoin or prices climb (or, let’s face it, careen off a cliff), those tasty valuations flatten unless you can lure endless amounts of new money. Sound exhausting? That’s because it is.

But what if—hear me out—things go sour? LeClair is adamant that a bear market is not necessarily a three-year trip in purgatory, but he’s equally confident that companies with wobbly finances are going to feel like they’re wrestling a bear, and not one of those friendly cartoon ones. “Are you levered? What kind of debt? Is your Bitcoin locked up like your gym membership contract? Do you owe money tomorrow?” These are, apparently, not hypothetical questions. The magic bullet? Permanent preferred equity: pay dividends, never have a panicky debt deadline, and keep your Bitcoin stashed like your grandmother’s emergency chocolates—never to be touched. 🍫

Being boring is the new cool at MetaPlanet. Forget YOLO trades; it’s all about “staying pristine” (which sounds suspiciously like not having much fun). LeClair boasts a “BTC rating” of 16.5x—translated, that’s sixteen dollars of Bitcoin for every buck of debt, or, in the business, what’s known as sleeping at night. This isn’t just for show: when the 70% drop comes (and he’s pretty sure it’s not an if but a when), “some companies will absolutely explode… in the bad way,” he explains, in the kind of voice usually reserved for describing falling anvils. 💥

Strategy: The Bitcoin Titanic That’s Actually Doing Quite Well

So what’s the secret moat? Not just being a “public” company, but mastering the dark arts of fixed-income. Early on, many treasury giants flirted with convertibles (“desks woo you,” LeClair snarks, “then short your stock like they’re trying to win a bet with their mother-in-law”), which ended up dampening the very wild volatility these companies hoped for. Enter the hero: permanent capital in the bland but mighty shell of preferred equity. Strategy (formerly MicroStrategy) has basically built a Wall Street Iron Man suit: multiple layers of custom-engineered securities, the latest being “Stretch,” which sounds more like Pilates than finance, but stay with me.

Stretch’s job? Pay a dividend, never die, and stay as close to $100 as a magnet glued to your fridge. If things get dicey, Strategy can toss out more shares or buy them back, all while investors relax and pretend volatility doesn’t exist. Strategy sold a mountain of these things and now sits atop a hoard of Bitcoin big enough to make Smaug jealous.

LeClair points out that unlike those tragic “algorithmic stablecoins”—whose entire defense mechanism was “hope and vibes”—Strategy’s preferreds are locked down tight, over-collateralized, and about as transparent as a goldfish bowl. Even jaded outside analysts seem quietly impressed: “variable dividend around $100,” “heaps of Bitcoin,” blah blah—basically, nothing to see here except a very large, very calm iceberg made entirely of cryptocurrency. 🧊

The upshot? During bad times, these preferreds let you pick off weaklings and scoop up cheap Bitcoin, all while fending off the short sellers (aka, financial trolls under the bridge). MetaPlanet isn’t trying to merge with every company in sight. They’re content to sit in their digital bunker and stare menacingly at their BTC pile.

Can Anyone Beat Strategy? Spoiler: Not Unless Zuckerberg Gets Bored of AI

Could someone challenge Strategy for the throne? Sure, if a company the size of Jupiter suddenly decides Bitcoin is more fun than the metaverse. LeClair, ever the diplomat, concedes “more public Bitcoin is good,” but unless someone the caliber of Zuckerberg goes full-orange-pill, Strategy’s 629,000 BTC lead will remain as unassailable as your grandma’s Bingo record.

He does have some warnings, though. Not everyone in this game is here for the right reasons. Some companies are “cosplaying as Bitcoiners,” ready to bail at the first sign of discomfort—like wearing a parachute in a restaurant just in case. The real test is ahead: prices will drop, funding will freeze, and you’ll find out who’s playing for keeps. The survivors? Unencumbered assets, debts that don’t come due until the sun burns out, and management with nerves of steel and the patience of a monk staring at a mossy rock. 🧘

Still, this is only the beginning. Corporate Bitcoin adoption is somewhere between dial-up internet and the second season of a show no one’s heard of. Most of the finance world doesn’t care—yet. But once those deep pools of “boring old money” get a taste, things could get Olympic-level competitive. If Bitcoin is ever going to “eat the world,” it has to start with all those capital markets who think volatility is only for teenagers and weather reports.

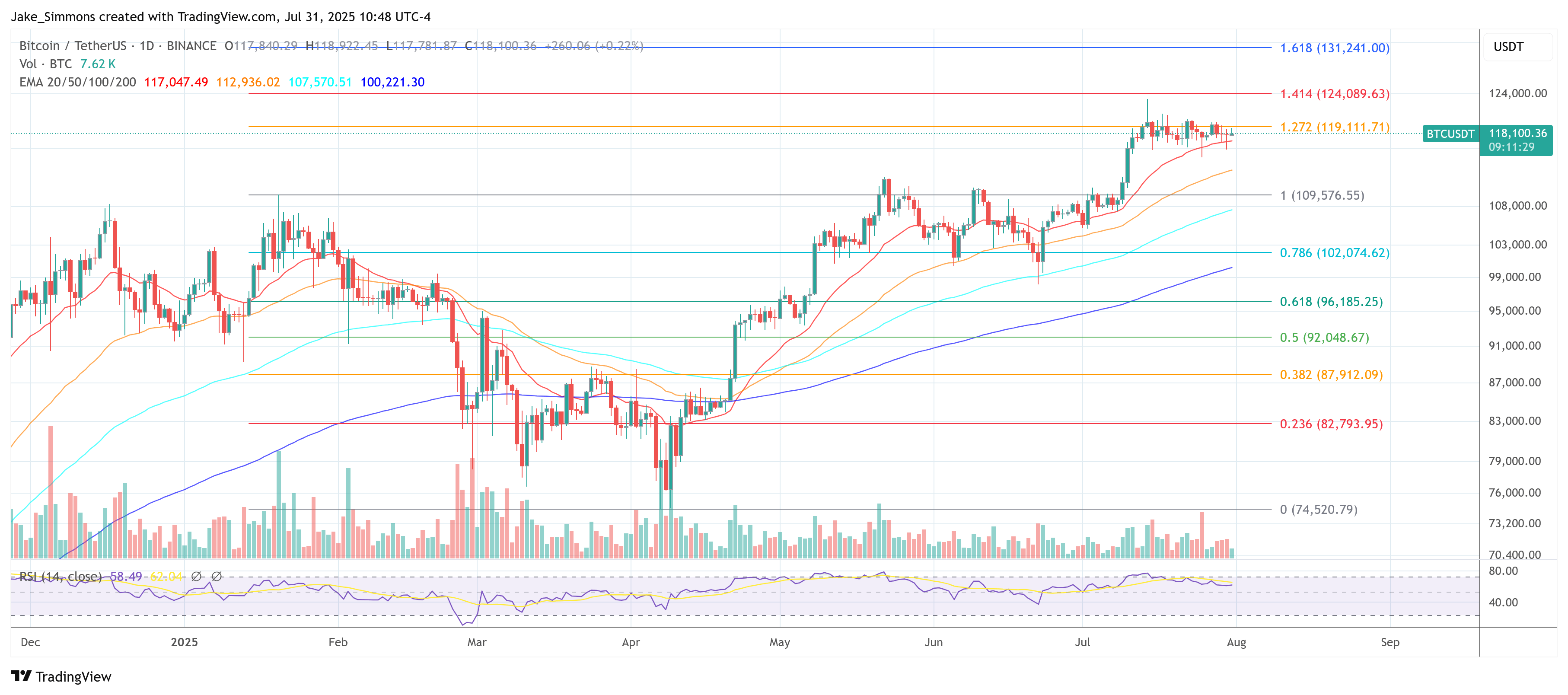

Current score: Bitcoin sits at $118,100. Keep your popcorn handy.

Read More

- Altcoins? Seriously?

- Gold Rate Forecast

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- USD VND PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- IP PREDICTION. IP cryptocurrency

- USD CNY PREDICTION

- EUR USD PREDICTION

- Crypto Unicorns: Investors Throw $10 Billion Party, and Everyone’s Invited! 🎉

2025-07-31 23:13