Jurrien Timmer, the ever-optimistic director of global macro at the investment behemoth Fidelity, has shared a most audacious thought with the world: that Bitcoin may now “pick up the slack” following gold’s faltering rally. Oh, what a bold proclamation for one who’s been watching markets as closely as a hawk eyeing a mouse from the sky.

“The price of gold continues to churn, working off what in retrospect seems like a dramatic blow-off. Yes, Timmer’s words have the soft melancholy of someone who’s lost faith in the shiny yellow metal, which, let’s face it, was perhaps slightly overhyped by the masses for its liquidity-driven rise,” he mused with the sagely wisdom of someone who’s seen it all. “A period of churn, now, seems inevitable,” he concluded, perhaps casting a last, longing glance at his portfolio.

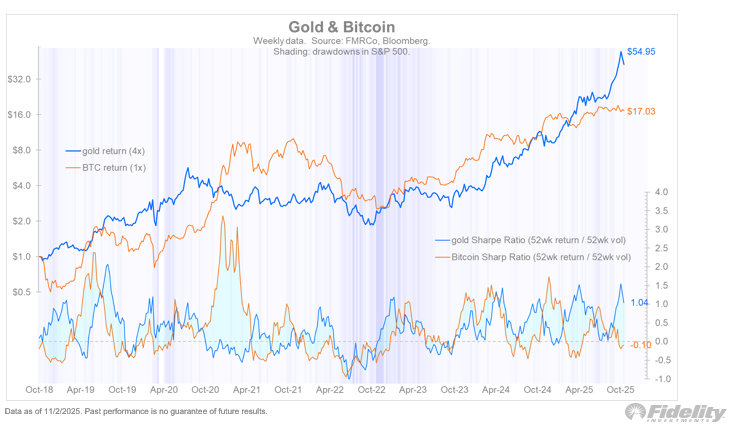

He also kindly pointed out that the Sharpe ratios-the holy grail of risk-adjusted performance-of Bitcoin and gold have been performing a curious waltz in opposite directions for quite some time now. One wonders whether these ratios are more in tune than their actual assets. Let’s ponder.

“Here’s to adulthood!”

In a moment of brilliant comparison, Timmer-no stranger to imaginative metaphors-once likened Bitcoin to Dr. Jekyll and Mr. Hyde. A creature of duality, capable of both impulsive thrills and cold, calculating restraint. Is there anything Bitcoin can’t do? Perhaps it’s time to stop referring to it as just a “cryptocurrency” and start calling it “the man of many faces.”

But fear not, for Timmer believes that Bitcoin has outgrown its youthful indiscretions. It is now, he claims, “becoming a more mature and less precocious asset class.” Whether that’s a compliment or a backhanded insult is left to the reader’s discretion. A sober Bitcoin, now there’s an image! The cryptocurrency equivalent of a grizzled old man sitting in his rocking chair, knitting his own blockchain.

And in his most recent post, the analyst made a rare concession. This new uptrend, he declared, is “normal”-not the explosive, euphoric parabola of past cycles, but an exponential climb. A “normal” climb. What a heartwarming thought for the longs, no doubt!

Timmer vs. McGlone

Meanwhile, in the opposite corner, we have Mike McGlone, Bloomberg’s chief commodity strategist and the resident doomsayer, who recently predicted that Bitcoin could suffer a catastrophic 60% loss against gold. 60%-now that’s a number that stirs the heart. If that’s not a death sentence for digital assets, I don’t know what is.

Let’s rewind a little-Timmer once claimed that gold would graciously pass the baton to Bitcoin in the second half of the year. Well, that didn’t happen. The hopes of a digital savior have been dashed, with Bitcoin still limping along with a modest 9% gain in 2025, while gold, that steady beast, has surged a healthy 54%. The market can be so cruel, don’t you think?

And here we are, watching Bitcoin teeter on the edge of the sacred $100,000 mark, recently dipping below it like an awkward teenager at his first dance. As of this fine Friday, Bitcoin is trading at a cool $103,285, so at least it’s not plunging into total oblivion… yet.

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- Bitcoin & Gold: Because Money is Weird

- EUR AUD PREDICTION

- Michael Saylor’s Bitcoin Shenanigans: ‘Bigger Orange’ and Market Mayhem!

- Trump’s Davos Hot Takes: Greenland, Crypto, and ‘I’m Kind of a Big Deal’

- ONDO PREDICTION. ONDO cryptocurrency

2025-11-08 00:07