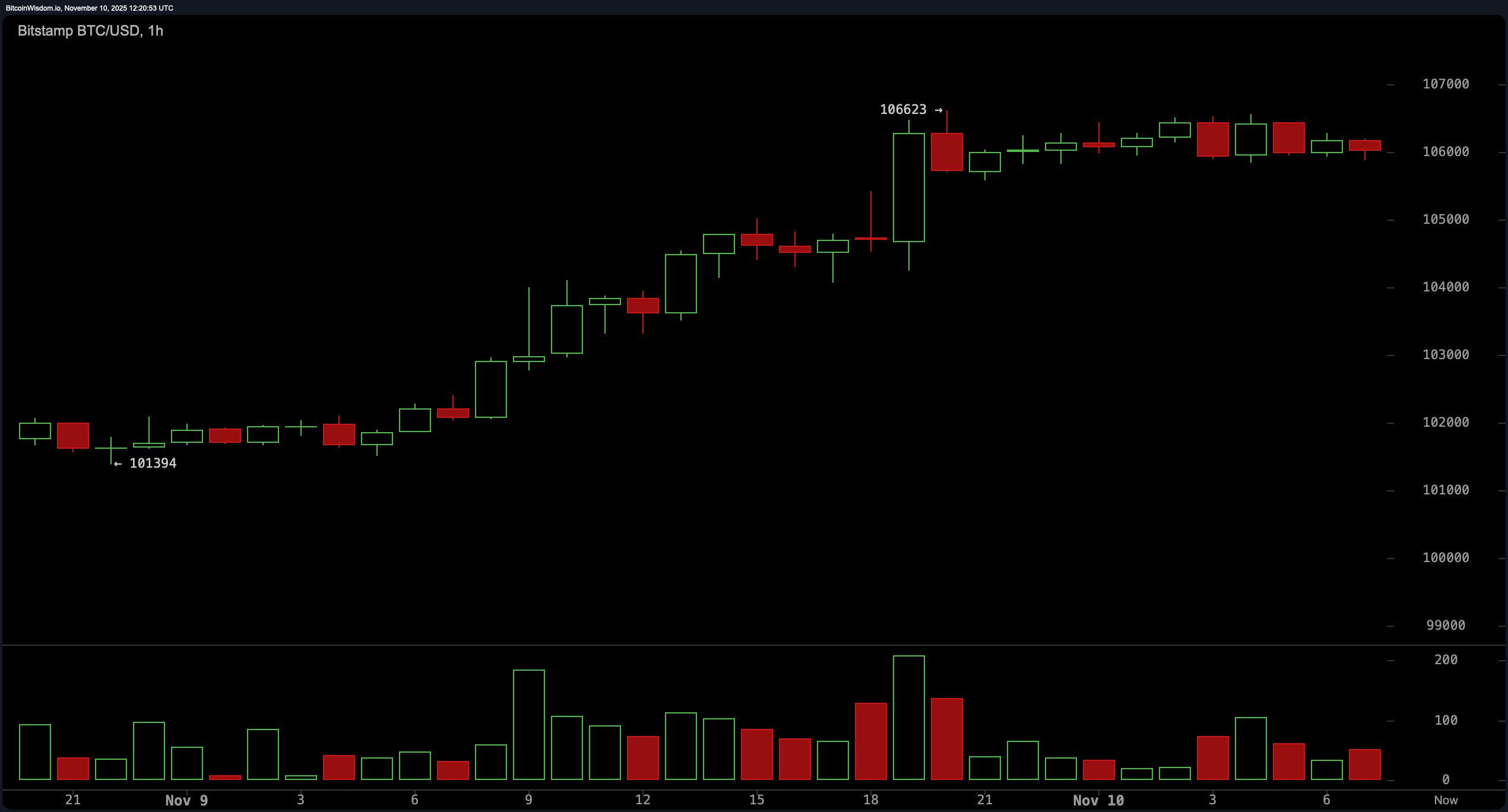

Bitcoin sashayed into November 10 like a diva at a discount store, flaunting a $105,950 price tag and a $2.11 trillion market cap. With a daily trading volume of $70.67 billion and an intraday range that swung from $102,061 to $106,623, the charts looked like a buffet of mixed signals-all-you-can-eat confusion. 🍱💹

Bitcoin Chart Outlook: A Drama in Three Acts 🎭

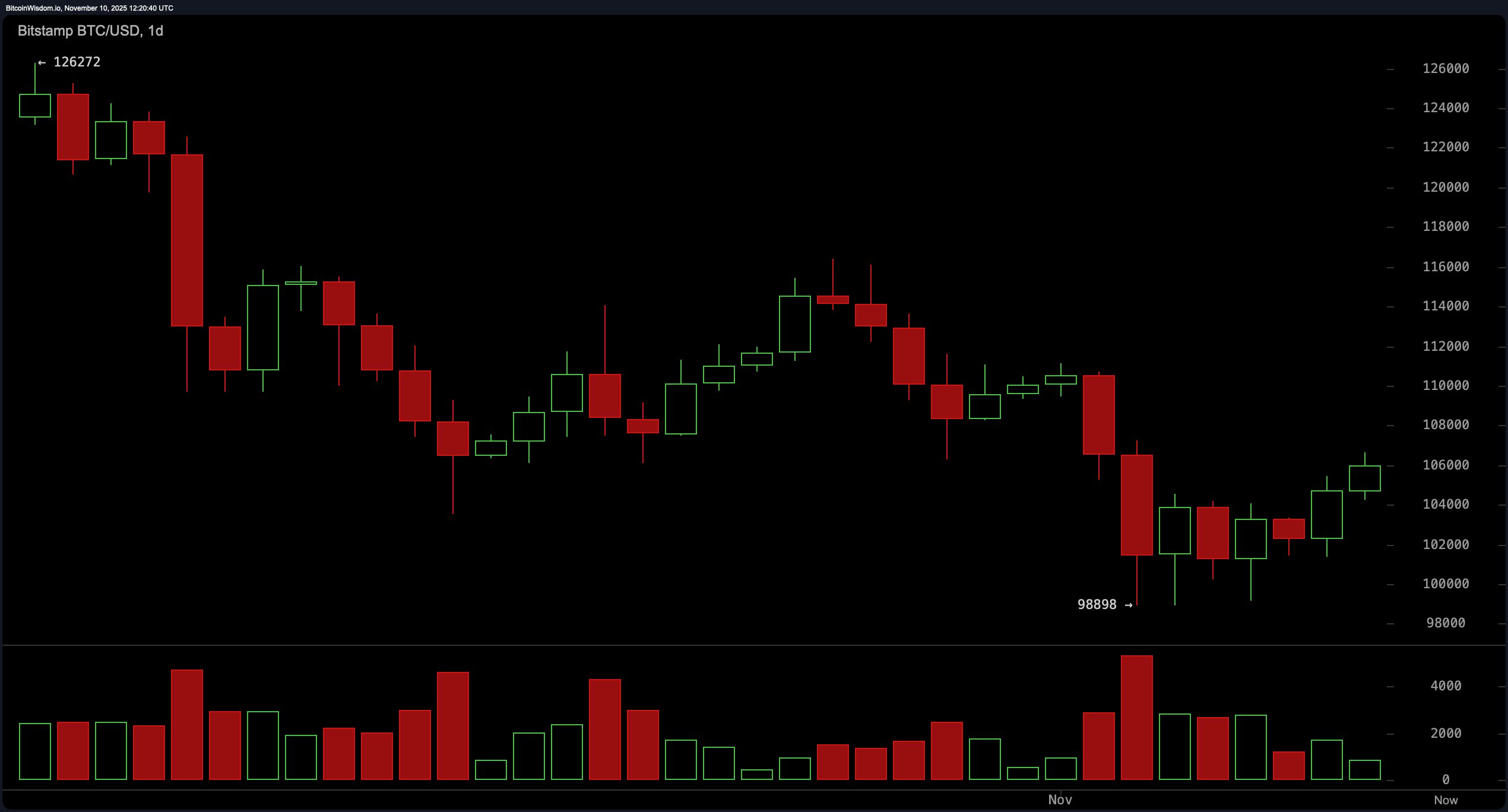

On the daily chart, Bitcoin was like a cat trying to regain its dignity after a brutal correction, clawing its way back to a $98,900 support level. A higher low finally broke the streak of lower lows, hinting that the bearish train might be running out of coal. 🚂💨

Volume? It’s like a party where everyone’s leaving early-waning selling appetite, green candles with timid buying strength. Key resistance is camped out between $108,000 and $110,000, a historical hotspot for price rejection. If Bitcoin gets too close, expect fireworks-or a faceplant. 🎆💥

Zoom in on the 4-hour chart, and it’s like a high-stakes poker game where everyone’s bluffing. A rising wedge formation is brewing-usually a red flag for a downturn, but crypto’s a house of mirrors, remember? Higher lows since November 7 suggest Bitcoin’s still got some swagger. Volume on upward pushes? Intriguing, like a mystery novel you can’t put down. If it breaches $106,600-$107,000 with volume, it’s moon time; stumble below $102,000, and it’s back to the $100,000 therapy couch. 🌕💺

The 1-hour chart? Bitcoin’s short-term ego is peaking near $106,600, teasing a breakout or a burnout. Diminishing volume and sideways drift-classic bull flag or a whisper before a micro correction? Break above $106,700 with volume, and the bulls throw a party; fall below $105,800, and it’s nap time. 🦬💤

Oscillators are straddling the neutral line like a tightrope walker after three martinis. RSI at 46, stochastic at 31, CCI at −44, and ADX at 25-it’s a market that can’t decide if it’s left or right-handed. Awesome oscillator’s negative at −6,864, momentum’s up at −3,573, and MACD’s down at −2,399. It’s a tug of war between indecision and subtle optimism-or a coin flip with extra steps. 🤹♂️🪙

Moving averages are the reality check no one asked for. Short-term metrics are dressed for a party, but long-term ones are still cleaning up yesterday’s mess. EMA and SMA for the 10-period are green, but everything from the 20-period up is drowning in red ink. It’s like the near-term is wearing a tux while the long-term’s still in pajamas. 🕴️🧥

In short, Bitcoin’s waltzing in a market that’s half revival, half retracement. The trend’s got new sneakers, but the runway’s littered with resistance traps and momentum potholes. Watch your step. 👟🕳️

Bull Verdict: 🐂

If Bitcoin holds above $103,000 and punches through $106,700 with volume, the bulls might finally get their parade, targeting $110,000-$112,000. Higher lows and short-term momentum suggest a recovery’s brewing-if the oscillators stop being so wishy-washy. 🎉

Bear Verdict: 🐻

Break below $105,800 on the 1-hour or $102,000 on the 4-hour, and the bears will drag Bitcoin back to the $100,000 therapist’s couch. With most moving averages against it and MACD still bearish, volume drying up could spell trouble. 🛋️💨

FAQ ❓

- What’s Bitcoin’s price today?

Bitcoin’s strutting at $105,950 as of November 10, 2025. 💃 - Key levels to watch?

Support near $103,000, resistance between $106,600 and $110,000. Keep your binoculars handy. 🔭 - Bullish or bearish?

Short-term’s bullish, long-term’s bearish-it’s like a family dinner where everyone’s arguing. 🦃🗡️ - Market cap and volume?

$2.11 trillion market cap, $70.67 billion in 24-hour volume. That’s a lot of zeros. 🧮

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- EUR USD PREDICTION

- USD THB PREDICTION

- IP PREDICTION. IP cryptocurrency

- USD VND PREDICTION

- GBP MYR PREDICTION

- BNB PREDICTION. BNB cryptocurrency

- Brent Oil Forecast

2025-11-10 16:29