Egad, old bean! Bitcoin (BTC), that wily digital chap, has taken a bit of a tumble, down 2.3% in the past 24 hours, hovering around $108,800. 🪙💨 The “Black Friday” crash, as the chaps are calling it, has left the market in a bit of a pickle. But fear not, for the short-term holders (STH) are swooping in like Bertie Wooster at a free lunch, buying every dip with the enthusiasm of a terrier after a postman. 🐶📉

This jolly accumulation, spotted right after the October 10 correction, suggests a dash of optimism, even as the broader trend remains as cautious as Jeeves with a newt. 🧐 But hold your horses, there’s more! The STH trend now aligns with technical validations, hinting at a potential Bitcoin price rebound-or, dare I say, a rally? 🚀📈

Short-Term Holders: The Dip-Loving Heroes We Need 🦸♂️🍟

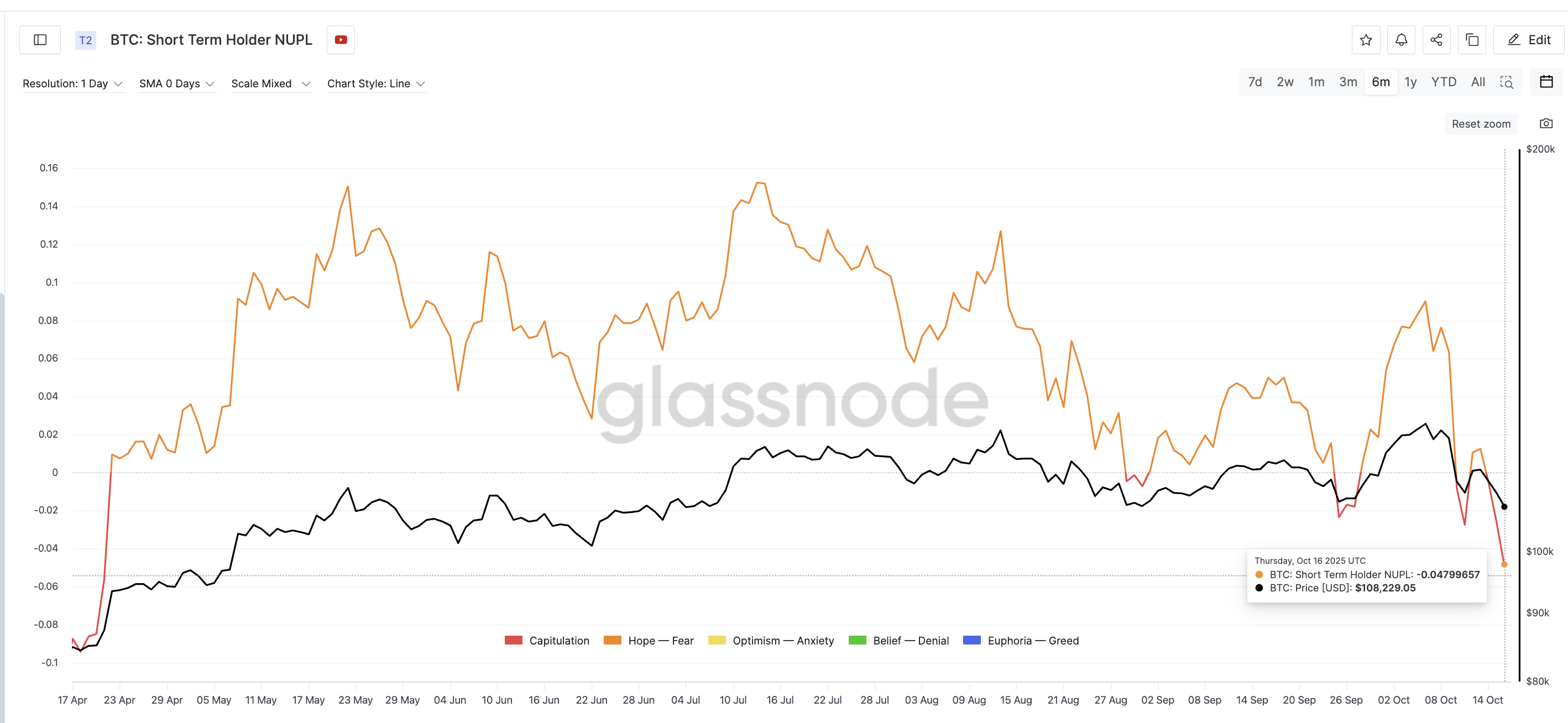

The Short-Term Holder Net Unrealized Profit/Loss (NUPL)-a metric as mouthful as Aunt Agatha’s fruitcake-has plummeted to -0.04, the lowest since April 20, 2025. 😱 A negative reading means most short-term holders are nursing losses, which, oddly enough, often signals a market bottom or early recovery, as selling pressure fades like a bad joke at a dinner party. 🥄🤫

Craving more token tidbits like this? Dash over to Editor Harsh Notariya’s Daily Crypto Newsletter, what? 📩✨

Such lows have historically led to rebounds quicker than Gussie Fink-Nottle can say “newts.” 🦎⚡

- On September 25, when NUPL hit -0.02, Bitcoin leapt 4.9%, from $109,000 to $114,300 in a mere four days. 🏇💨

- On October 11, NUPL dipped to -0.02 again, and BTC climbed 4.1% from $110,800 to $115,300 in three days. 🌟📈

Now, with NUPL even lower and losses deeper than a philosophical conversation with Bingo Little, short-term holders are doubling down instead of fleeing like a startled rabbit. 🐇💼

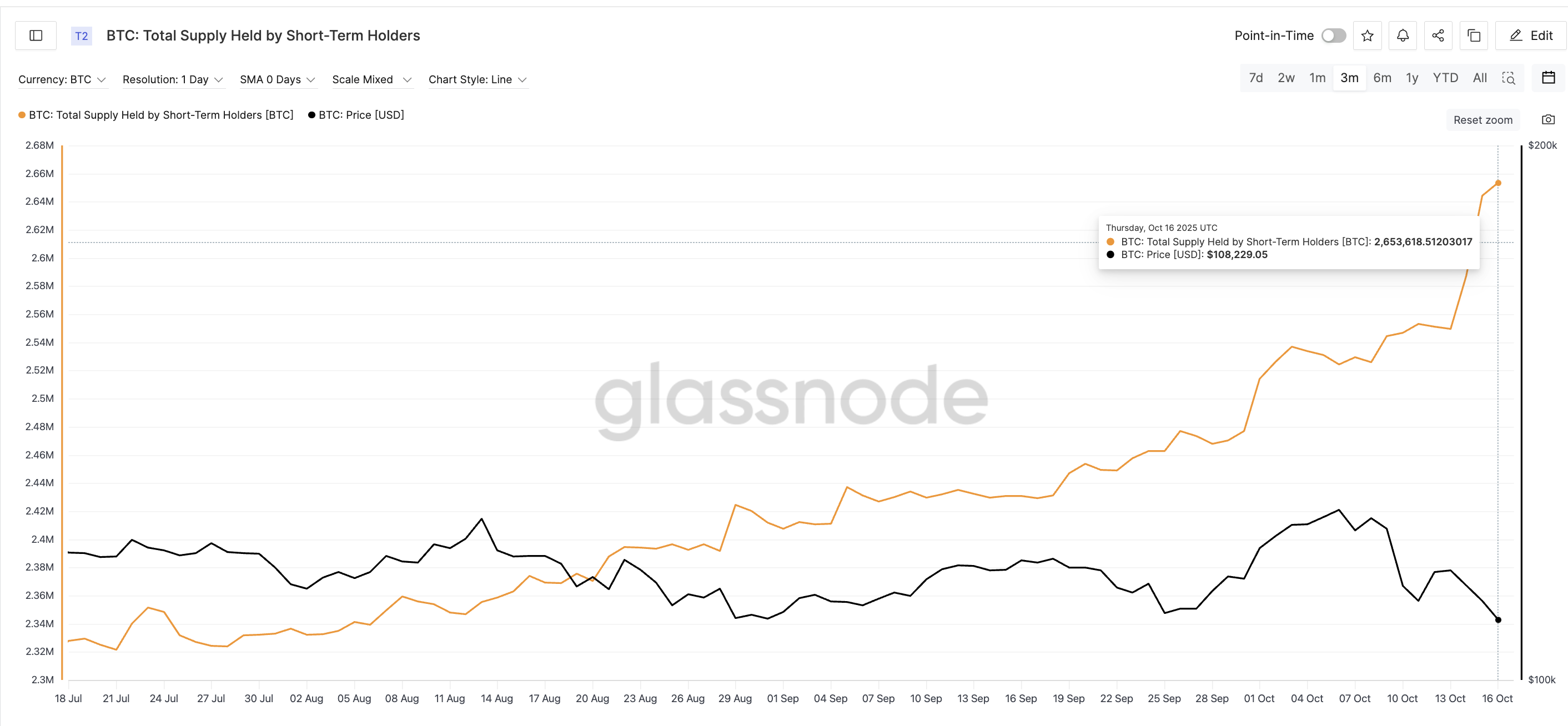

According to Glassnode, the total supply held by STH has surged from 2.54 million BTC on October 13 to 2.65 million BTC as of October 16-a 4.3% increase in just three days. 🌪️💰 This means our intrepid traders have added roughly 110,000 BTC (almost $12 billion at the current BTC price), showing aggressive buying despite the drop. Also, the STH supply has hit a 3-month high, despite prices being as wobbly as a tipsy uncle at a wedding. 🥂📊

This mix of negative NUPL and growing supply usually marks a phase of quiet accumulation, when short-term holders position for a potential rebound, much like Jeeves plotting to save Bertie from another scrape. 🕵️♂️🔍

Bitcoin Price: Will It Break Free or Stay in the Wedge? 🛑🚪

Bitcoin’s 4-hour chart shows BTC forming a falling wedge-a pattern as predictable as Aunt Dahlia’s temper. 📉🔒 It’s where lower highs and lower lows compress into narrowing boundaries, often leading to a bullish breakout. 🌪️🚀

Since October 11, BTC has made a lower low on price, but the Relative Strength Index (RSI)-a fancy way of saying “market momentum”-has made a higher low. This is called a bullish divergence, a technical signal that momentum might be turning upward, like a stiff upper lip after a spot of bad news. 😶⬆️

To confirm a rebound, Bitcoin must climb around 7.4%, breaking above $115,900 to escape the wedge. Before that, the price needs to close above $112,100 and $113,500, two resistance zones that have rejected recent recovery attempts like a snob at a cocktail party. 🍸🚫

If Bitcoin breaks past $115,900, it could open the path toward $122,500, the next major resistance level. However, if the $107,200 support fails, BTC might revisit its cycle bottom near $102,000, like a bad penny turning up again. 🤦♂️🔙

The short-term setup is as clear as a bell at a country house party: short-term holders are buying heavily, momentum is stabilizing, and key technical patterns hint at relief. But for this to evolve into a rally, Bitcoin must hold $107,000 and close above $115,900. These two levels will decide if this $12 billion buying wave turns into something bigger-or fizzles out like a flat champagne. 🍾🤞

Read More

- Silver Rate Forecast

- Brent Oil Forecast

- Gold Rate Forecast

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Steak ‘n Shake & Bitcoin: Utterly Baffling!

- Shocking UK Law Turns Cryptos into Private Property-The Future of Digital Assets?

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- 🚀 LINK Leaps as Grayscale’s ETF Debuts on NYSE Arca! 🤑

2025-10-17 11:34