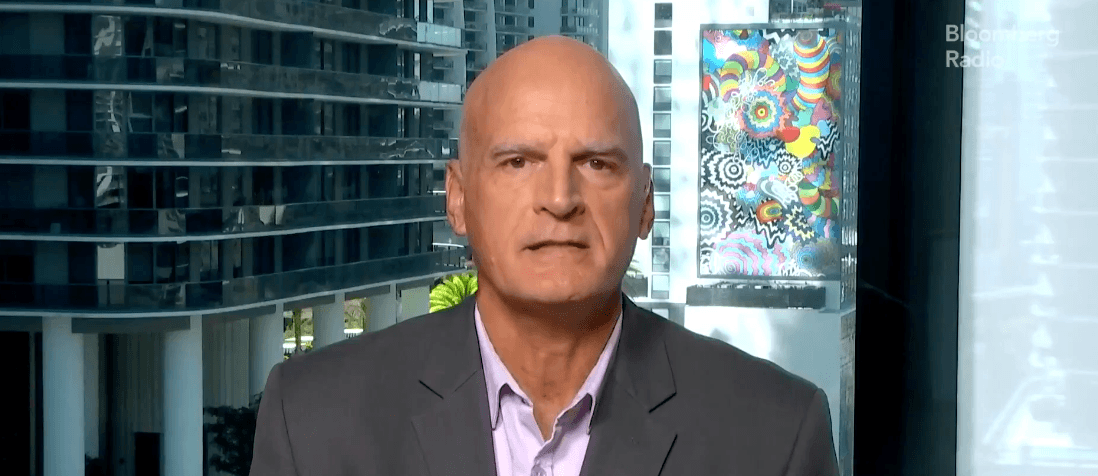

Mike McGlone is dusting off one of his old calls – the kind that made headlines in 2018 – and applying it to today’s overheated crypto market.

McGlone Sees a Deeper Pullback Forming

The Bloomberg strategist Mike McGlone says his earlier prediction that bitcoin would “drop a zero” when it traded near $10,000 was only partially right, noting the asset bottomed around $3,000 instead of plunging into triple-digit territory. Now, he’s issuing a similar warning: bitcoin could slide back toward $10,000 if risk assets unwind in unison. 🐂💥

McGlone argues the backdrop is far more bloated than it was seven years ago. In 2018, the crypto market was crowded with a few thousand coins; today, it’s teeming with millions of tokens, a wave he sees as textbook late-cycle mania. Add in exchange-traded fund (ETF) hype and political tailwinds – he points to the Trump administration’s acceleration of crypto enthusiasm – and he draws a straight line to the kind of euphoric peaks seen in the past. 🧠💸

He also leans heavily on volatility for his macro case. McGlone notes the VIX’s 200-day moving average has formed what he calls a “bull flag,” with implied volatility poised to break higher as equities sit in an unnervingly calm pocket. The 120-day realized volatility for stocks hovers around 10% – on pace to be the lowest since 2017 – a combination he views as complacency before a reset. In his view, bitcoin’s weakness isn’t contained; it’s the first domino. 🎱

On the technical side, McGlone says bitcoin’s old support at $100,000 has flipped into resistance, with the asset now boxed between $90,000 and $100,000. A bounce isn’t off the table, but he expects “responsive sellers” to cap any breakout. The long-term trend, he argues, has already cracked: bitcoin’s 200-day moving average has rolled over, and Strategy’s has been sliding since August. 🕳️📉

His downside target sits at $50,000 on a long-term chart, a level he considers “normal” in the context of a broader risk-off cycle. He warns investors not to be fooled by sharp rallies, calling them a hallmark of bear markets rather than evidence of recovery. 🐻🐻

McGlone points to the Bloomberg Galaxy Crypto Index – now down about 14% on the year after previously climbing roughly a third – as another signal that the reversal is already underway. If equities follow the same arc, he believes the entire market structure could tilt lower into year-end. McGlone’s prediction comes as BTC dropped beneath the $90,000 range on Wednesday. 📉

For him, one clue stands above the rest: gold is outperforming. When gold grabs alpha, he argues, something is structurally off. And the last time he saw this setup with such clarity? 2008. 🧠💣

FAQ ❓

- What is Mike McGlone warning about?

He says bitcoin could fall sharply, potentially revisiting levels as low as $50,000 or even $10,000 if risk assets unwind. Which is basically saying, “Don’t be surprised if the market decides to take a nap and leave you high and dry.” 💸💤 - Why does he think bitcoin may drop further?

McGlone points to token oversupply, ETF-driven euphoria, and weakening long-term technical trends. Because nothing says “serious investment” like a government that’s more excited about crypto than a toddler at a candy store. 🍬👮♂️ - How does the broader market factor into his outlook?

He believes declining crypto prices may spill into equities as volatility indicators begin to rise. Like a game of Jenga, but with your savings. 🧱💸 - What role does gold play in his analysis?

McGlone highlights gold’s outperformance as a signal that risk markets could be entering a defensive cycle. Which is like a penguin winning a race against a speedboat-something’s definitely wrong. 🐧🏎️

Read More

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Altcoin Frenzy: BANK Soars 60% While MET Plays Catch-Up 😱💸

- BNSOL PREDICTION. BNSOL cryptocurrency

- Privacy Coin Frenzy: Zcash’s $741 Surge Stirs the Crypto World

- USD VND PREDICTION

- 🚨 Last Call for $BEST: The Wallet Revolution Ends in 3 Hours! 🚀

- Heist, Hacks & Tornado Cash: How $2M Evaporated From NGP Protocol

2025-11-19 23:30