Ah, the glorious world of Bitcoin-where fortunes are made and lost faster than you can say “HODL.” According to the latest Glassnode report, BTC has strutted into Q1 2026 with all the confidence of a catwalk model-well, at least more than last October’s panic. After a ruthless purge of leverage that made October look like a Sunday picnic, Bitcoin now trades below 29% from its sky-high peak of $125,000. Yes, folks, it’s like the market took a deep breath and decided to stop screaming for a moment. But don’t get sentimental just yet-market soul-searching seems to be shifting from “Risk-On” to “Risk-Averse,” like a moody teenager.

Macro Backdrop Supports Risk Assets for Now

Meanwhile, the macro scene is playing its usual game of pretend-confidence. Inflation’s tamed to a reasonable 2.7%, and the economy grooved in Q4 2025 with a juicy 5.3% GDP growth. Expectations of Fed rate cuts are like a sweet lullaby to risk assets-if they can find sleep amidst the economic chaos. But watch out! The U.S. job market, that stubborn beast, has slowed down. AI might be pumping up productivity, but even robots can’t fake enthusiasm forever. Investors are sniffing around cautiously-like a cat eyeing a too-good-to-be-true fish.

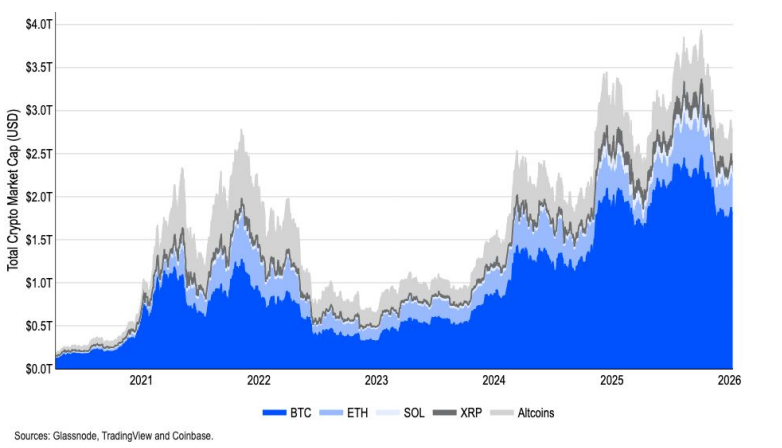

Bitcoin Dominance Holds Firm Despite Altcoin Stress

In this circus, Bitcoin remains the heavyweight champion, maintaining a commanding 59% dominance. While the rest of the altcoin zoo struggles-mid-cap and small-cap coins are that guy at the party trying to keep his dignity-the king holds his ground. This stability comes amidst a great de-leveraging event, especially in perpetual futures markets that are about as stable as a house of cards in a hurricane.

Open interest in BTC options has overtaken futures, signaling folks are more interested in protecting their butts than chasing quick riches. The options market’s cautious tone, with its positive skew, screams “Don’t worry, we’ve got our insurance, thank you very much.”

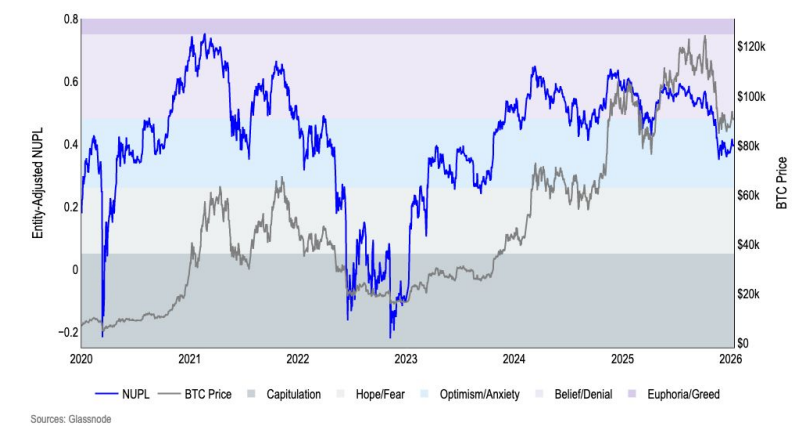

On-Chain Sentiment Slips Into Anxiety Zone

Technically speaking, the Net Unrealized Profit/Loss (NUPL) indicator shows sentiment has nosedived from “Belief” to “Anxiety,” thanks to October’s selloff. But don’t break out the funeral music just yet-this gloomy mood resembles late-cycle fatigue rather than outright disaster. Meanwhile, Bitcoin’s supply activity has skyrocketed by 37% in short-term hands and only slightly shrunk in long-term wallets-probably all those “HODLers” realizing their coins aren’t worth what they hoped. This chaotic activity suggests that those who held on tight are now slowly letting go, like a gambler waving goodbye to his last chips.

Cost Basis Levels Gain Importance

The markers that measure profit and loss show a grim picture-most BTC is mired in unprofitability, hinting at an accumulation zone around $80,000-$85,000. Think of it as a sad reunion where everyone hopes to break even someday. Meanwhile, the Puell Multiple, a fancy way of measuring miner revenues, has dipped to 0.9-mildly below average, whispering gently that margins are tightening but not collapsing. The stablecoins and transaction volumes are still humming along, but the economic wind suggests this party might wind down after Q1.

BTC Price Entered 2026 With Selective Strength

In sum, the Glassnode report paints a picture of a healthier crypto landscape-more cautious, more planning, less reckless. Bitcoin is playing it safe, like a veteran at a poker table-watching, waiting, and hoping the liquidity tide turns in its favor. But make no mistake: the real game depends on macro stability and whether the distribution frenzy gives way to genuine accumulation. Or will we have another October déjà vu? Stay tuned, folks-this show is far from over.

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- USD VND PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- GBP MYR PREDICTION

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Shiba Inu Shakes, Barks & 🐕💥

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

2026-01-28 19:37