In the shadowed corridors of modern finance, where hopes are often as fragile as a porcelain teacup, Bitcoin has lately exhibited a certain melancholy—its fleeting ascent in July now but a memory, as if chasing a ghost that dances just beyond reach. Ah, the caprice of markets! Three weeks of turbulent silence below the admirable $120,000 — a figure that sounds more like a royal decree than a coin’s worth—have left the crypto enthusiast sighing with a mixture of longing and skepticism. 🧐

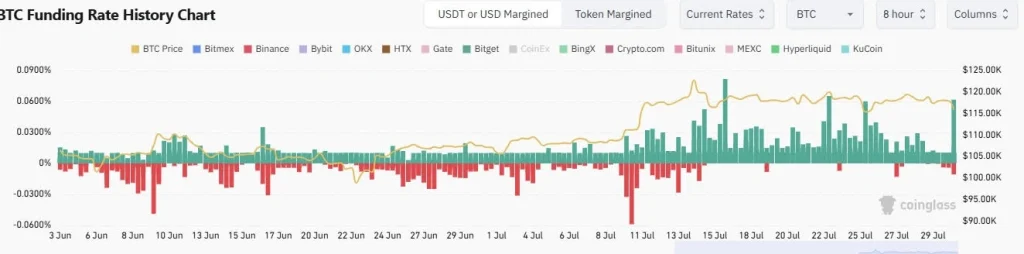

Market whispers from TradingView tell us that on a strange Wednesday, the brave BTC dipped below $117,000, ruthlessly liquidating those brave enough to take long positions, only to be left holding empty bags with a faint smile of irony. Yet, amidst this chaos, Bitcoin’s funding rate—weighted by open interest—clings stubbornly to positive territory, whispering of macroeconomic hopes and the possibility that this dance isn’t over just yet. Ah, the eternal game of hope versus despair! 🎭

Bitcoin’s Melancholy: A Tale of Monitory Insecurity

This past Wednesday, the digital darling lost about 1.4% of its value, tumbling to a modest $116,246 — a number that makes one wonder: was it inflation, or merely the whims of central bankers? The Federal Reserve, that august institution, elected to keep its interest rate steady at 4.5%, as if hesitating before a crucial decision—perhaps pondering whether to dance or to sit tight, much like us at a family dinner. Meanwhile, the Bank of Canada and the Bank of Japan, in a show of steadfastness, maintained their rates, perhaps in a bid to avoid panic or simply because they think investors like a good suspense story.

As the Fed prepares to wind down its treasury holdings—like a poor host who’s run out of party favors—the market sighs, awaiting the dreaded yet tantalizing possibility of Quantitative Easing. Trump, ever the tactician, suggests a rate cut might still be in the cards, reigniting hopes that perhaps, just perhaps, the roller coaster isn’t over. 🎢

The Grand Panorama

Long-term, the BTC/USD duo still signals a bullish crescendo—despite midterm fears of capitulation, that is. From a technical perspective, Bitcoin has crafted a bullish flag—a pattern so optimistic that it resembles a sailor’s hanky fluttering proudly at the ship’s mast—perhaps hinting at a rally toward $130,000 on the horizon. Who knows? Perhaps the crypto gods are just waiting for an opportune moment to chuckle at our naivety. 😉

The larger narrative, of course, remains buoyed by eager corporate giants like NASDAQ’s NASDAQ: MSTR, whose demand adds a splash of color to the otherwise monochrome of uncertainty. The U.S., in an act of regulatory diplomacy, has recently given a thumbs-up to the creation and redemption of crypto assets via ETPs—proof that even in chaos, there’s a flicker of order. Perhaps the crypto realm is more resilient than a cockroach in a nuclear war. Or so we cling to that hope, slipping between despair and delight, like a youthful dancer skimming across a slick floor. 💃🕺

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- Gold Rate Forecast

- USD THB PREDICTION

- ⚡Chekhov Spills The Tea-Will ADA’s $1.50 Dream Get a Chekhovian Plot Twist?😂

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

2025-07-30 23:34