Good heavens! It appears Bitcoin, that most digital of currencies, is having a bit of a moment. Currently perched at a rather respectable $113,710 – quite a sum, what? – and backed by a market cap of a thoroughly substantial $2.25 trillion, it’s bouncing about like a particularly energetic beach ball. Trading volume, a cool $26.39 billion in the last 24 hours, suggests a fair amount of flutter. The thing is doing its level best to resemble a tightrope walker, if the tightrope were made of pure, unadulterated speculation and the walker had laser eyes. 🤔

Bitcoin Chart Outlook

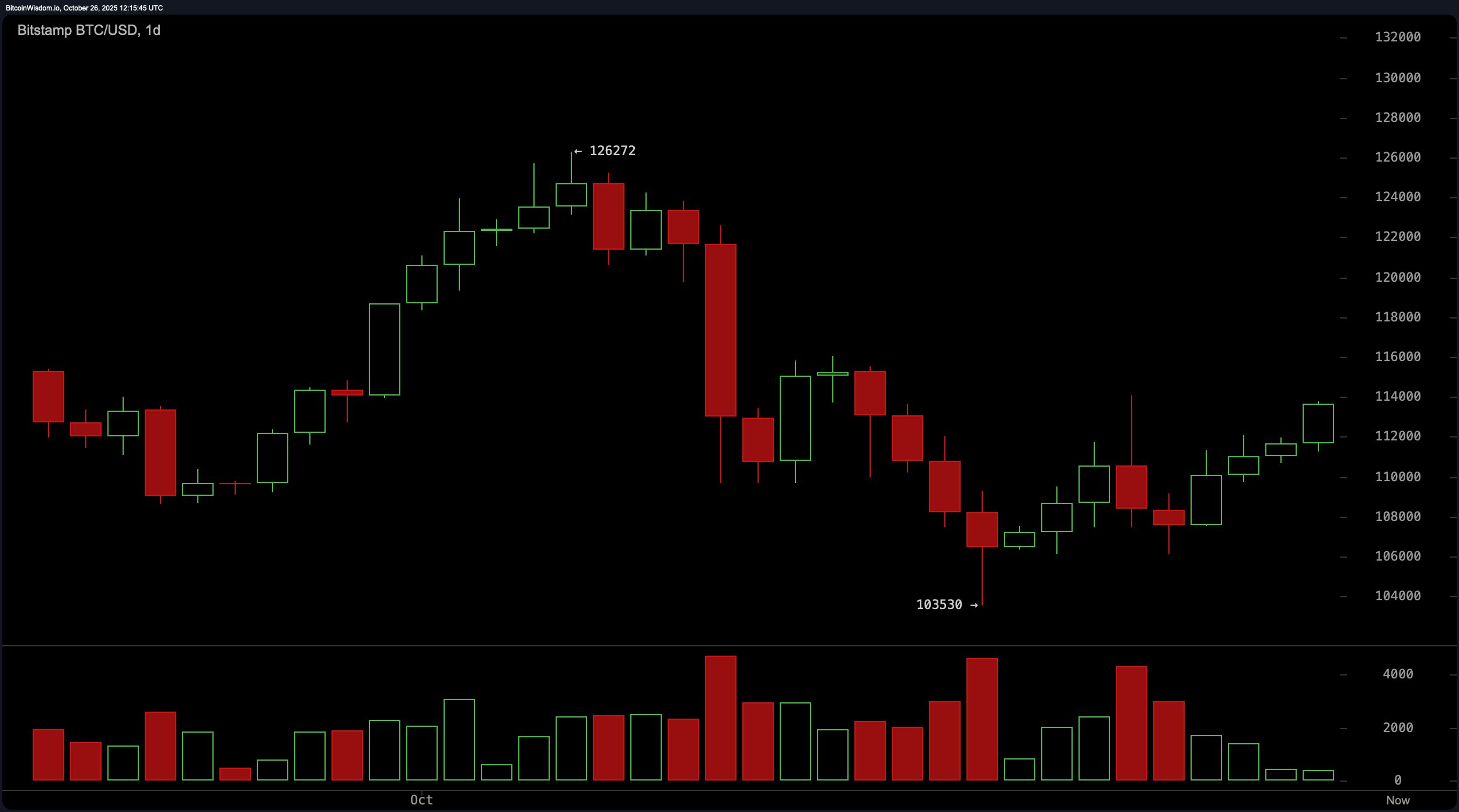

Now, the chaps poring over the daily charts tell me it’s recovering from a bit of a tumble – a retreat from a high near $126,272 to a low of $103,530. A rebound, you see, forming a short-term uptrend. Though, and this is the crucial bit, the volume doesn’t exactly shout “conviction.” A rally without proper support is rather like a picnic without sandwiches – distinctly lacking.

Apparently, current candles show a continuation pattern, but with a distinctly fragile air. Resistance lurks near the $115,000-$116,000 region, which, one suspects, will give the old price a bit of a bother.

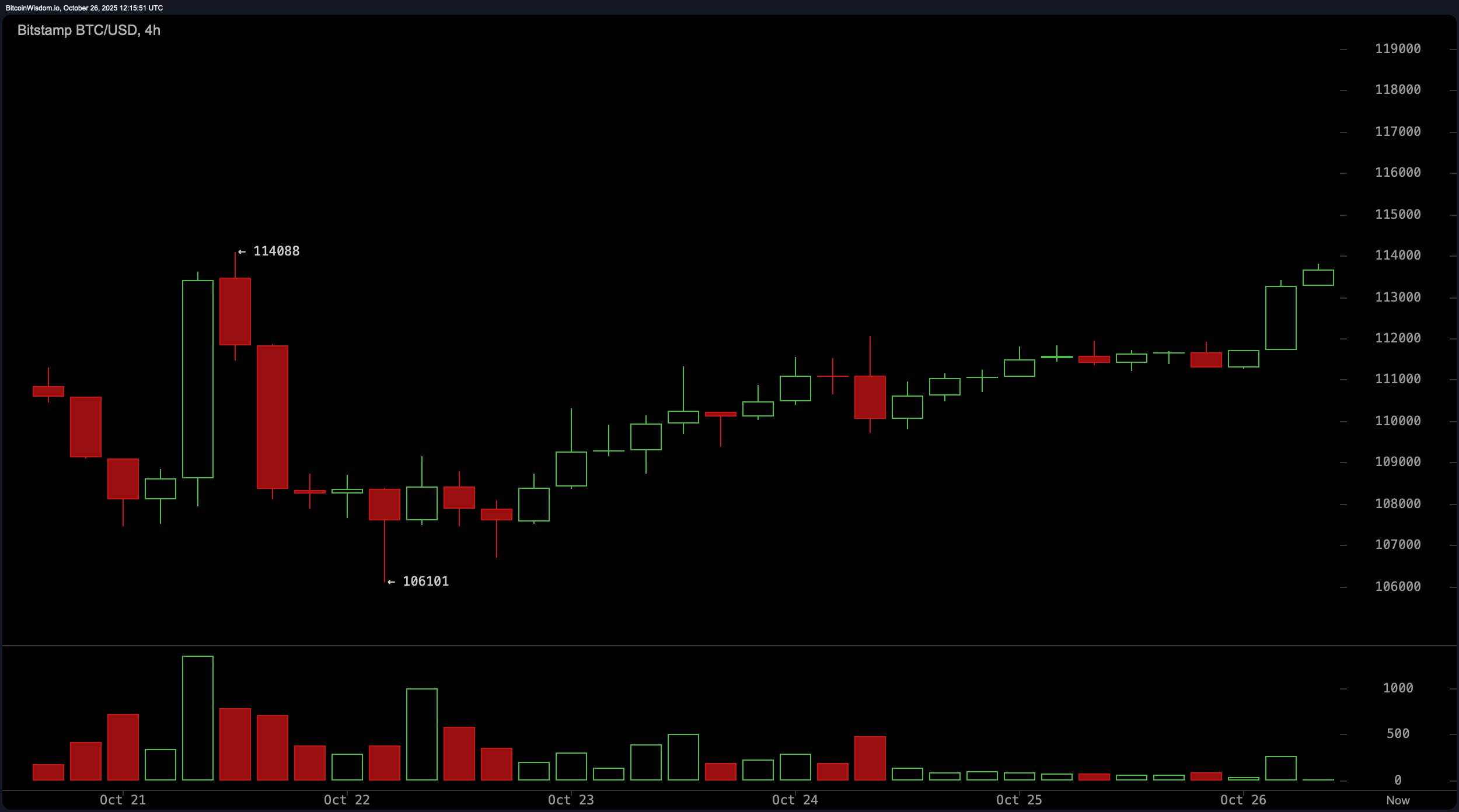

The four-hour chart reveals a ‘double bottom’ – a rather dramatic phrase, isn’t it? – near $106,000. Apparently, it’s a signal of potential reversal. The price has crept upward, supported by a bit of a volume surge. Though it hasn’t got the oomph of a truly vigorous rally. Momentum might slow as it approaches that $114,500 to $115,000 area, suggesting a bit of a pause for breath.

And the hourly chart? Well, it’s had a bit of a breakout, haven’t we? From $111,000 to $113,800 with a rather enthusiastic thrust! Supported by – you guessed it – volume. Currently consolidating above the breakout level, with support forming near $112,800 to $113,000. Should the volume hold, one might see further gains. But a drop in volume? Oh dear, that could mean a bit of a retreat.

Oscillators are being frightfully neutral. The RSI is at 52 and stochastic at 68, suggesting a distinct lack of anything terribly exciting happening. Though there’s a bit of positive momentum, and MACD level is at -1,313. So, a slight tilt towards optimism perhaps.

Moving averages seem rather bullish. EMAs are trending in the right direction. SMAs, however, are being a bit awkward and resisting. A bit of friction, I gather.

Bull Verdict:

Breakout confirmations, bullish momentum and supportive EMAs suggest a potential challenge to upper resistance levels. If it manages to bust through $115,000, and, crucially, with a bit of volume, then we’re likely in for further gains.

Bear Verdict:

Despite the recent gains, the rather meek volume and those unconvinced SMAs suggest underlying vulnerability. And an failure to hold on to $113,000 or showing rejection around $113,500-$115,000 and all that . It might be off to test lower support zones.

FAQ 🧠

- What is the current bitcoin price?

As of October 26, 2025, bitcoin is priced at $113,710. - What is bitcoin’s market cap today?

Bitcoin’s market capitalization stands at $2.25 trillion. - How much bitcoin was traded in the last 24 hours?

The 24-hour trading volume for bitcoin is $26.39 billion. - What is bitcoin’s intraday price range?

Bitcoin traded between $111,216 and $113,800 over the past 24 hours.

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Gold Rate Forecast

- USD CAD PREDICTION

- Brent Oil Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- EUR CNY PREDICTION

- Bewitching Meme Coins That Will Surely Charm August 2025

2025-10-26 15:58