In a rather delightful twist befitting a Dickensian farce set in the bustling worlds of finance and fanciful currencies, Bitcoin has declared itself the darling of treasury strategies for companies yearning to stamp their mark on the digital realm. Just when you thought the plot couldn’t thicken, here we are with the latest chapters in this ever-suspenseful saga.

Upwards and Onwards

Our curious protagonist, the Ming Shing Group, a publicly traded gem hailing from the sparkling shores of Hong Kong, has recently attempted a rather extravagant heist-snaring a cool 4,250 bitcoins at the eye-watering sum of approximately $482 million. At a price of $113,638 per unit, one might question if they’ve mistaken Bitcoin for a rare vintage wine. This ambitious pursuit has catapulted them to the illustrious 45th position on the BitcoinTreasuries leaderboard, trailing the Nordic H100 Group, which clearly has a penchant for numbers, boasting a wee 911 BTC to its name.

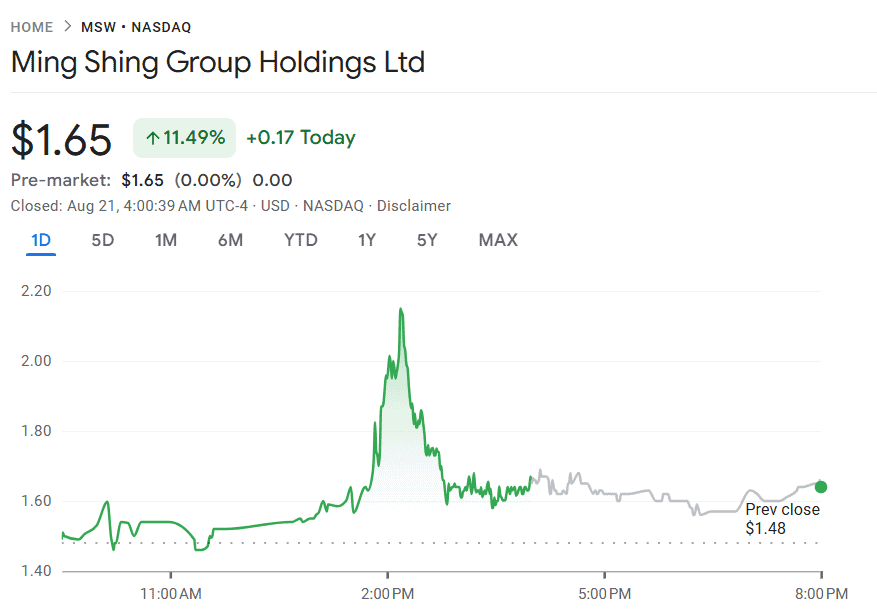

Ah, but alas! Their stock did indeed revel in this grand announcement, soaring over 11% earlier this week. Who knew a digital trinket could send shares spiraling skyward? Thank you, Google Finance, for your ever-reliable revelations!

A Familiar Countenance

On an adjacent note, earlier this very week, KindlyMD, that stalwart of American healthcare data aggregation, has magnanimously bolstered its holdings by 5,744 BTC, estimated to have cost them around $679 million, or as some would say, a slight miscalculation at an average of $118,204 per bitcoin. Their aspirations are as grand as their balance sheet, having merged recently with their Bitcoin-native counterpart, Nakamoto Holdings Inc. They entered the great digital gold rush with an ambitious quest to bag a million bitcoins-perhaps a case of overzealous optimism? Currently, they gleefully hold 5,765 BTC, nabbing the coveted 16th place on the leaderboard, significantly outpacing Semler Scientific’s modest haul of 5,021 BTC.

“This acquisition reinforces our conviction in Bitcoin as the ultimate reserve asset for corporations and institutions alike.

Our long-term mission of accumulating one million Bitcoin reflects our belief that Bitcoin will anchor the next era of global finance, and we are committed to building the most trusted and transparent vehicle to achieve that future,” announced their lofty CEO and Chairman, David Bailey, possibly in a fit of hyperbole.

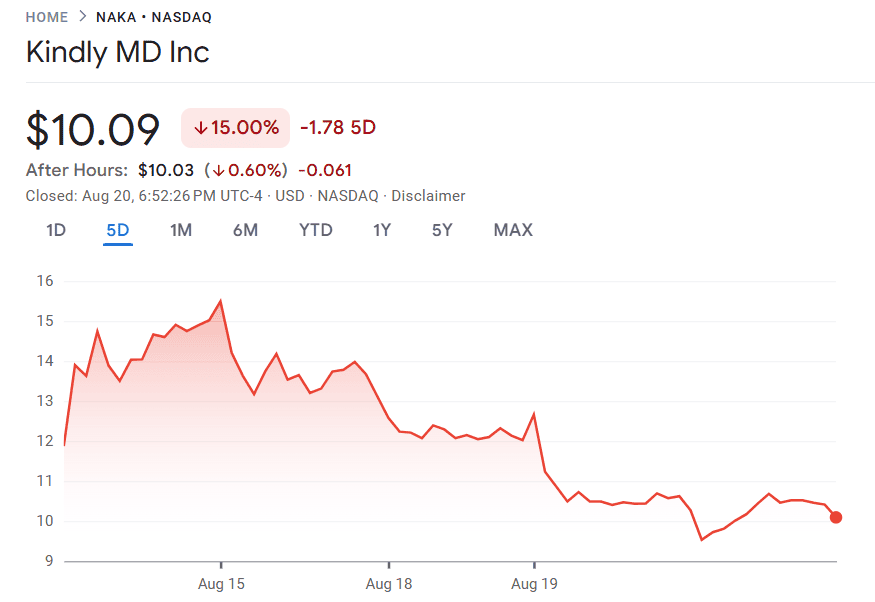

However, the stock market appears to have scoffed at their ambitious yarn, retreating into the shadows since the start of the week. A classic case of ‘what goes up must come down,’ as articulated by the wise Google Finance.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Czech Bank Bets on Bitcoin: A Million-Dollar Moon Shot! 🚀💰

- Bitcoin’s $110K Tango: Will It Waltz Higher or Stumble? 💃🕺

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Top 10 Fast-Growing Blockchains of 2025 – Who’s Gaining Users? 🎯

- Lido’s $10M Buyback: A Masterplan or a Muddle? 🤔

- GBP EUR PREDICTION

- Ethereum’s Wild Ride: Will This Crypto Riverboat Reach $4K or Crash a Paddle?

2025-08-24 10:26