O, ye trembling soul of Bitcoin, art thou not yet recovered from the abyss of last week’s correction? Yet, lo, the market standeth at a crossroads, where the path of recovery and the shadow of despair doth intertwine. Though the price hath leapt upward, the spirit of the market is but a timid wretch, cowering in the corner of uncertainty. The question that doth gnaw at the very heart of the market: is this leap a true reversal, or but a fleeting sigh before the next descent into the chasm?

Technical Analysis

By Shayan

The Daily Chart

Behold, the daily chart, where BTC, like a weary traveler, found respite upon the 200-day moving average, a sanctuary of $108K, which hath stood as a bastion of demand in yore corrections. Yet, the beast hath not yet breached the sacred threshold of $115K, where the dotted midline and the 100-day MA doth reign. Until the daily close doth ascend beyond these fortresses, the buyers shall remain in the shadows, their power but a flickering candle.

Lo, the 4H timeframe, where BTC doth test the descending trendline, a serpent coiled around the $111K mark. Should it break the $112K threshold, a shift in momentum may come to pass, yet the path is fraught with peril. The RSI, that most fickle of companions, doth inch toward 60, a sign of burgeoning bullish pressure, yet not yet in excess. If the trendline yieldeth to the upside, the price shall aim for the $116K stronghold. But if the breakout faltereth, a plunge into the $100K abyss awaiteth.

Sentiment Analysis

Open Interest

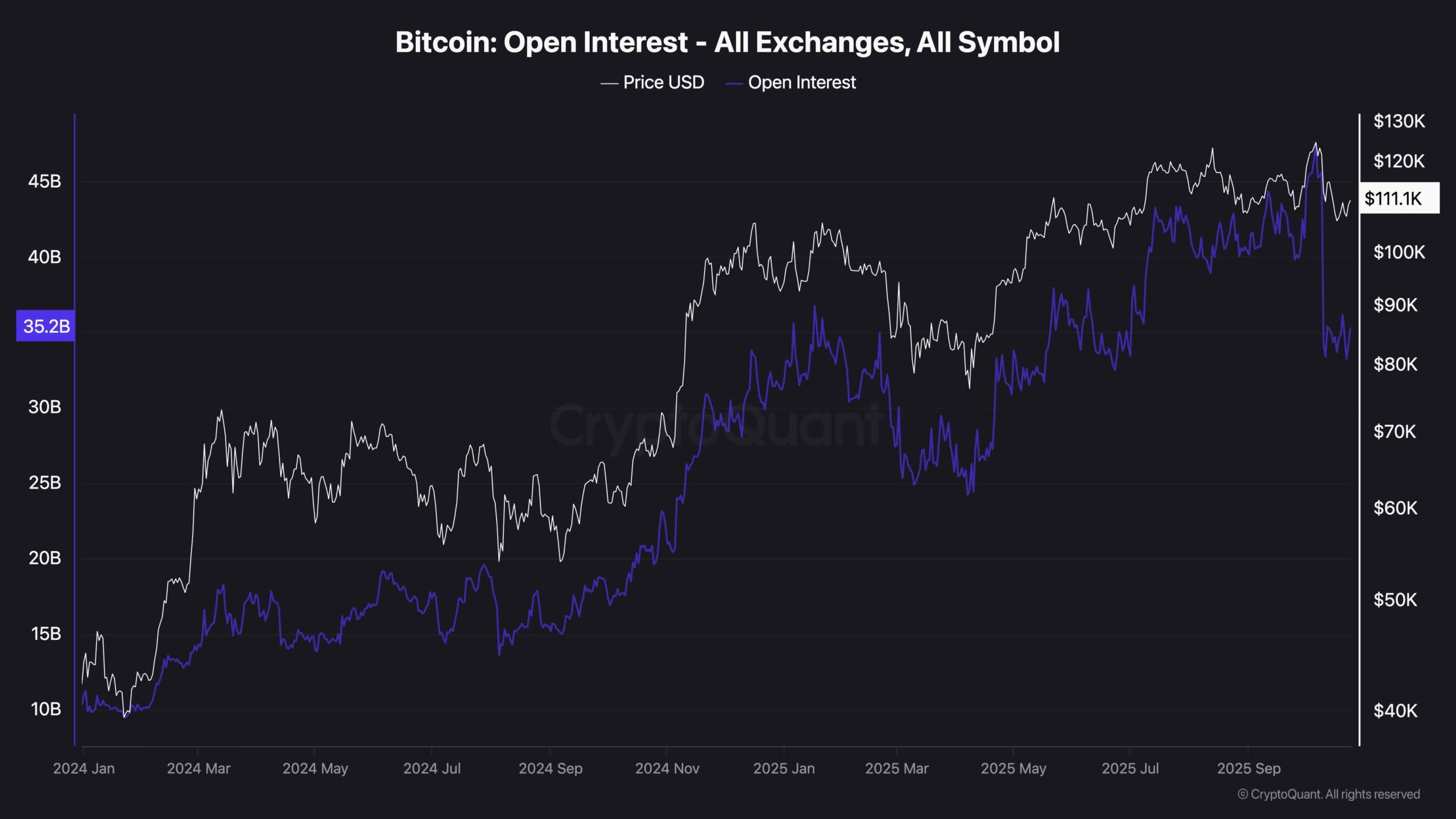

The open interest, like a gathering storm, hath formed a base around 35 billion, a testament to the traders’ hesitant return to leveraged positions. Yet, the market’s heart remaineth uncertain, a tempest of doubt. The specter of liquidation loometh, a grim reaper awaiting the market’s misstep. Should BTC falter in reclaiming $115K, another wave of long liquidations shall follow, a harrowing tide as the weekend draweth near.

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- USD CAD PREDICTION

- Gold Rate Forecast

- USD THB PREDICTION

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- USD BRL PREDICTION

2025-10-24 16:08