What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

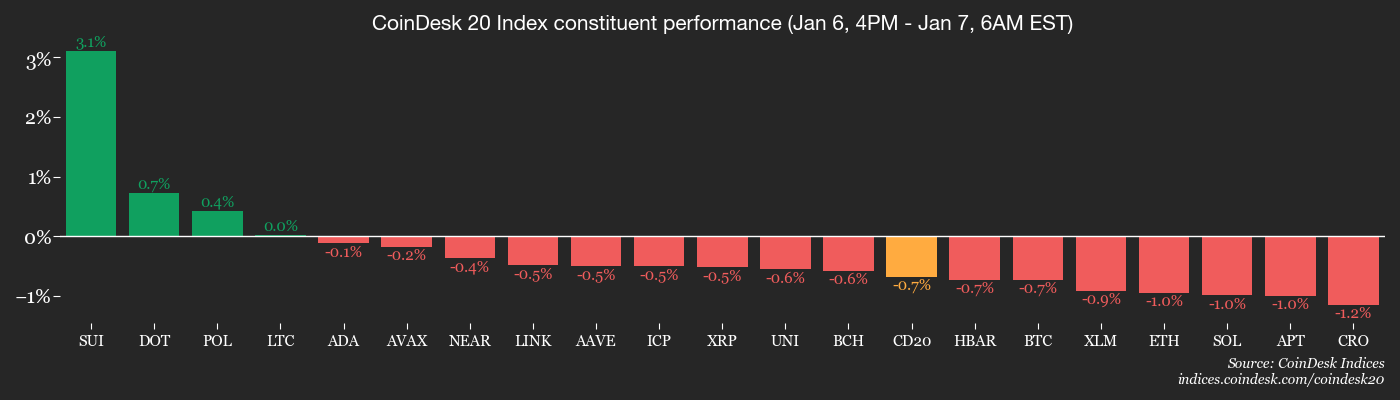

Ah, dear reader, behold the plight of our digital saviors-bitcoin, solana, and their ilk-now trembling under the weight of 1.5% losses! 📉 The CoinDesk indices, those harbingers of doom, all bleed crimson, with DeFi’s Select Index weeping 3.6% more than a melancholic poet. 🦋

Shall we question the motives of those who once hailed the New Year’s rally? Was it conviction, or merely the seasonal whims of investors, like children chasing fireflies? 🕯️ The U.S.-listed ETFs, those modern-day alchemists, once drank from the fountain of $1 billion but now sip from the chalice of $243 million. 🍷

“The rally’s fragility is a mirror to our souls,” laments Samer Hasn, a man of letters at XS.com. “Liquidity’s fickle as a lover’s promise, and the upside fades like a dream upon waking.” 🌙

The Coinbase Premium, that measure of U.S. investor longing, remains negative, a shadow over the land. Yet, the derivatives market whispers of hope, with open interest climbing like a phoenix. 🦅

Funding rates, that curious dance of fees, rise ever so slightly-yet still, they linger below the threshold of decisiveness. 🧭 “Historically, sustained gains demand more than mere whispers,” warns Glassnode, the oracle of crypto. 📜

In the land of traditional markets, Japanese bonds scale new heights, sending tremors through the crypto realm. 🌋 The yen’s embrace with Bitcoin grows tighter, a bond both sacred and ominous. 🤝

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Crypto

- Macro

- Jan. 7, 8:15 a.m.: Dec. ADP Employment Change Est. 45K. 📊

- Jan. 7, 10 a.m.: Dec. ISM Services PMI Est. 52.3. 📈

- Earnings (Estimates based on FactSet data)

- Nothing scheduled. 🕯️

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Day 1 of 2: BUIDL Europe 2026 (Lisbon, Portugal). 🇵🇹

Market Movements

- BTC is down 1.66% from 4 p.m. ET Tuesday at $91,677.51 (24hrs: -1.77%) 💸

- ETH is down 2.26% at $3,200.70(24hrs: -0.27%) 🏦

- CoinDesk 20 is down 1.97% at 2,981.11 (24hrs: -2.08%) 📉

- Ether CESR Composite Staking Rate is up 3 bps at 2.88% 📈

- BTC funding rate is at 0.0084% (9.175% annualized) on Binance 🔄

- DXY is unchanged at 98.55 📐

- Gold futures are down 0.19% at $4,473.50 💰

- Silver futures are down 1.53% at $79.30 ⚖️

- Nikkei 225 closed down 1.06% at 51,961.98 📈

- Hang Seng closed down 0.94% at 26,458.95 🧾

- FTSE 100 is down 0.53% at 10,069.29 🧭

- Euro Stoxx 50 is down 0.27% at 5,915.51 📊

- DJIA closed on Tuesday up 0.99% at 49,462.08 🚀

- S&P 500 closed up 0.62% at 6,944.82 📈

- Nasdaq Composite closed up 0.65% at 23,547.17 📈

- S&P/TSX Composite closed up 0.58% at 32,407.00 📈

- S&P 40 Latin America closed up 1.02% at 3,255.61 📈

- U.S. 10-Year Treasury rate is up 1 bps at 4.18% 📉

- E-mini S&P 500 futures are down 0.14% at 6,978.25 📉

- E-mini Nasdaq-100 futures are down 0.28% at 25,748.75 📉

- E-mini Dow Jones Industrial Average futures are unchanged at 49,744.00 📐

Bitcoin Stats

- BTC Dominance: 58.8% (-0.15%) 🌍

- Ether-bitcoin ratio: 0.03502 (-0.41%) 📉

- Hashrate (seven-day moving average): 1,043 EH/s 🔥

- Hashprice (spot): $39.14 💸

- Total fees: 2.76 BTC / $258,065 📉

- CME Futures Open Interest: 110,835 BTC 📊

- BTC priced in gold: 20.5 oz. 🧾

- BTC vs gold market cap: 6.15% 📉

Technical Analysis

- The chart shows BTC’s daily price swings in candlestick format. 🕯️

- The recovery rally has stalled at horizontal resistance originating from the Dec. 9 high of 94,635. 🛑

- A move above that level would signal a breakout, strengthening the case for a rally to $100,000. 🚀

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $250.56 (-1.71%), -0.67% at $248.88 in pre-market 📉

- Circle Internet (CRCL): closed at $84.85 (+0.06%), -1.11% at $83.91 📉

- Galaxy Digital (GLXY): closed at $26.08 (-0.84%), -0.46% at $25.96 📉

- Bullish (BLSH): closed at $41.25 (-0.55%), -1.28% at $40.72 📉

- MARA Holdings (MARA): closed at $10.31 (-2.64%), -0.68% at $10.24 📉

- Riot Platforms (RIOT): closed at $14.98 (+1.28%), -0.67% at $14.88 📉

- Core Scientific (CORZ): closed at $16.79 (+0.36%), unchanged in pre-market 📐

- CleanSpark (CLSK): closed at $11.99 (-2.52%), -1.25% at $11.84 📉

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $44.99 (-2.11%) 📉

- Exodus Movement (EXOD): closed at $15.92 (+1.60%) 📈

Crypto Treasury Companies

- Strategy (MSTR): closed at $157.97 (-4.10%), +3.69% at $163.80 📈

- Semler Scientific (SMLR): closed at $21.26 (+0.95%) 📈

- SharpLink Gaming (SBET): closed at $10.34 (+0.68%), -1.74% at $10.16 📉

- Upexi (UPXI): closed at $2.28 (+0.44%), +1.32% at $2.31 📈

- Lite Strategy (LITS): closed at $1.54 (+0.65%) 📈

ETF Flows

Spot BTC ETFs

- Daily net flows: -$243.2 million 📉

- Cumulative net flows: $57.52 billion 💰

- Total BTC holdings ~1.31 million 🧾

Spot ETH ETFs

- Daily net flows: $114.7 million 📈

- Cumulative net flows: $12.8 billion 💰

- Total ETH holdings ~6.16 million 🧾

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

- Gold Rate Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- USD THB PREDICTION

2026-01-07 15:59