In the frozen tundra of late 2025, where the sun of hope sets on Bitcoin’s price chart, we find a world groaning under the weight of its own hubris. The market, once a proud stallion, now limps toward the stables of 2022’s despair, its hooves cloaked in the frost of realized losses. “How could it come to this?” one might ask, sipping bitter tea while watching the candlestick wicks wither. Alas, the answer lies in the cruel arithmetic of greed and the fickle whims of liquidity.

Glassnode, that modern-day scribe of blockchain tales, recounts a saga of woe: Bitcoin teeters above a cost-basis mirage but drowns in a sea of fading demand. Short-term investors, those poor souls, now dance on a tightrope of “difficult positions” while the market whispers, “Jump, and it may not break.” A fairytale, indeed.

The Return of the Phantom Losses 👻

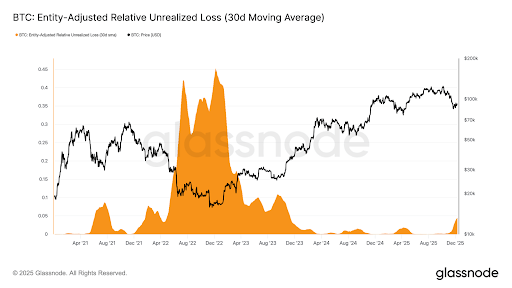

Realized losses, those specters of past folly, have returned to haunt the land. They swell to 2022 levels, a ghostly echo of the bear market’s grim chorus. The Relative Unrealized Loss (30D-SMA) now stands at 4.4%, a number that would make even Tolstoy’s peasants weep into their borscht. Why? Because when Bitcoin tumbles below $90,000, it’s not just a price-it’s a verdict on the moral character of every wallet holder.

And what of the recent bounce above $92,000? A temporary reprieve, like a peasant’s dream before the Tsar’s tax collectors arrive. Entities still bleed $555 million daily, their coins sold like last year’s fashion at a village market. The market’s memory? Shorter than a trader’s patience during a bear raid.

Yet, amid the gloom, long-term holders waltz at a grand ball of profit-taking, raking in $1 billion daily. A cruel irony, this: while the short-sighted sell their souls for bread, the patient feast on gains. One might call it justice-or perhaps the universe’s idea of a dark joke.

Bitcoin clings to the True Market Mean, a flimsy raft in a stormy sea. The price’s dive below $90,000 has tested its resolve, but a flicker of demand glimmers near $95,000. Will it rally, or will it drown in the abyss of quantile despair? Only time will tell-or the Fed’s next rate cut.

The Death of Liquidity 🪦

ETF flows, once a gushing spring of liquidity, now trickle like a parched man’s last sip of water. Spot markets, too, have turned brittle as old parchment. Order books sag under the weight of their own emptiness, and derivatives whisper of caution. Funding rates, once bold as a Cossack’s charge, now hover near neutral-a truce with fate.

The market’s tone? Defensive, like a peasant hiding from the storm. All eyes turn to the Fed’s rate cut, a distant bell that may toll either salvation or another dirge. And so, dear reader, we are left to ponder: is Bitcoin’s tale one of redemption-or a Russian winter that never ends? 🌡️🐻

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Gold Rate Forecast

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- LUNC’s Wild Ride: Bull or Just a Bull🐂 in a China Shop?🛒

- Shiba Inu Shakes, Barks & 🐕💥

2025-12-11 17:07