Let me start by saying I’ve never been great with money, but I’m pretty sure if I had a Bitcoin, it wouldn’t be hanging out in a macroeconomic “bailout” group chat right now. According to Lyn Alden, a macro analyst who clearly hasn’t met my budget spreadsheet, Bitcoin’s latest attempt to play Wall Street’s favorite game of “Print Me a Rescue” is less “nuclear option” and more “slow drip of disappointment.” Imagine showing up to a party with a piñata expecting it to explode with cash, only to find it’s filled with lint and the ghost of 2022’s retail investors.

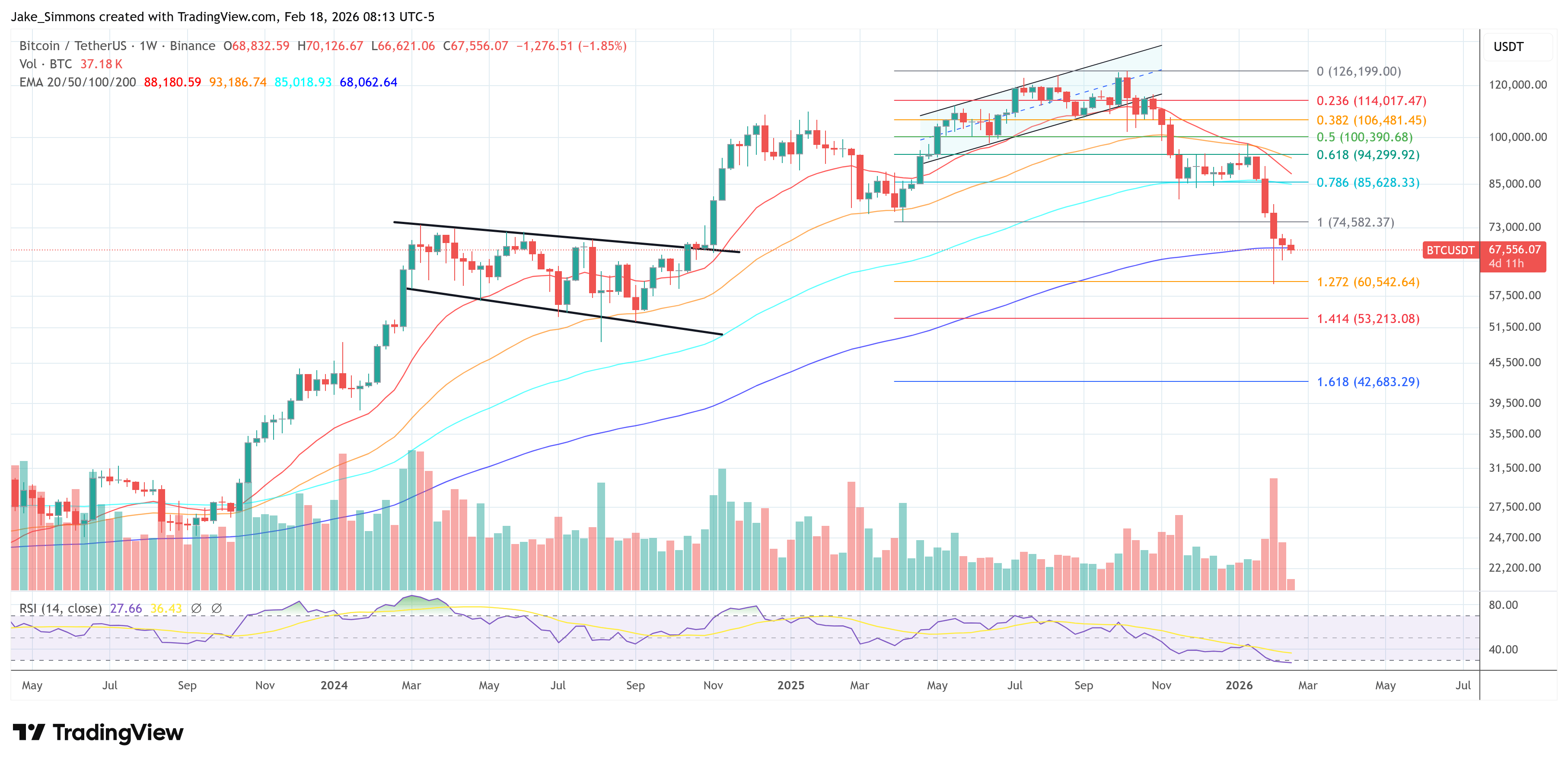

Alden, in a chat that felt less like financial analysis and more like a therapy session for crypto, explained that Bitcoin’s current cycle is so underwhelming it could double as a metaphor for a Monday morning. She noted that sentiment is “worse than 2022,” which is saying something considering that year was basically crypto’s version of a bad breakup followed by a restraining order. The problem? No one’s buying tickets to Bitcoin’s comeback tour. Retail investors are MIA, “alt season” is a ghost town, and even the broader crypto market has forgotten what a “narrative” is. Bitcoin peaked at $126,000, which Alden called “not my idea of a satisfying cycle”-I assume she meant emotionally, not financially.

When asked about the Fed’s famously vague timeline for balance-sheet expansion, Alden delivered a masterclass in sarcasm: “Oh, they’ll print when the treasury market stops breathing or when interbank lending turns into a TikTok dance.” Translation: Don’t expect the Fed to save you unless you’re a corporation with a six-figure LinkedIn headline. As for Bitcoin’s hope that a $40 billion Treasury bill purchase will be its knight in shining armor? Alden said it’s “supportive” but added that Bitcoin now has to compete with Nvidia for attention. Good luck with that; Nvidia’s stock price probably has better drama than your ex’s Instagram stories.

And let’s talk about the Fed’s new love language: “slowly expanding the balance sheet.” It’s like dating someone who takes three hours to order coffee. Alden pointed out that banks are still sitting on “high cash ratios,” so unless there’s a global war or a crypto-related zombie apocalypse, we’re stuck with incrementalism. She also downplayed derivatives and ETFs as the real villains, which is surprising because those two are basically the crypto world’s Bonnie and Clyde. The real issue? Demand is so weak, even a “marginal amount of new buyers” feels like a standing ovation at a library.

Looking ahead, Alden warned that Bitcoin’s next move might involve a lot of grinding-like a 24/7 gym playlist-and little V-shaped recoveries. She suggested that Bitcoin could eventually win back attention if AI stocks crash and “undebasable savings” suddenly trend on Pinterest. Until then, it’s competing against everything from gold to your neighbor’s crypto ETF newsletter, which is written by someone who probably still thinks Bitcoin is a type of bean.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- Bitcoin Wakes Up, Pretends It Has Its Life Together ✨📉🚀

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- You Won’t Believe This Cryptic Cash Crunch! 😲💸

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

2026-02-19 08:41