Oh dear, Bitcoin just can’t catch a break! It’s stuck below $90,000, like a mouse trapped in a cheese-free maze. Sellers are having a field day, pushing the price lower and lower, while bulls just can’t seem to get their act together. Every time they try to make a comeback, a giant “No Entry” sign slaps them in the face. The market is now as unpredictable as a raccoon in a candy shop – fear and uncertainty everywhere! 🐾

According to Axel Adler’s data (who sounds like someone who might just know what they’re talking about), there’s been a huge shift in the game. The liquidation dominance oscillator is now sitting at a whopping 32%, the highest it’s been in years. This means that the poor bulls are taking a beating, with their long positions getting wiped out faster than a cake at a birthday party. 🍰

Instead of just sitting tight and taking a bit of pain like the grown-ups they pretend to be, traders are scrambling to get out, adding fuel to this never-ending fire. Every time they liquidate, it’s like someone kicked the bottom of a barrel and the market just keeps tumbling down. Ouch!

These liquidations aren’t just little bumps-they’re deep dives that make Bitcoin’s price take one step forward, two steps back. The market’s watching closely to see if the selling will ever stop, or if it’ll drag Bitcoin all the way to the pits. 🏚️

Liquidation Madness: Bitcoin’s Struggle to Find Stability

Adler’s not done yet-oh no. He explains that the liquidation dominance oscillator is like a scoreboard for the crazy game of long vs. short positions. Positive numbers mean the bulls are getting steamrolled, and negative numbers mean the bears are on top. Right now, we’re seeing a serious dominance of long liquidations, and that’s about as pleasant as a mosquito bite at a picnic. 🦟

Just look at November-it was like a liquidation parade, with not one, not two, but THREE waves of long liquidations, each exceeding $400 million! 🎉 And guess what? Each spike was perfectly timed to match a sharp decline in Bitcoin’s price. It’s like the bulls just can’t catch a break, and each liquidation is making things worse. Talk about a vicious cycle.

The latest liquidation wave hit $221 million, and just as Bitcoin was trying to crawl back up, BAM, it got hit like a dropped sandwich, and down it went again to the $86,000 range. Seriously, if Bitcoin were a person, it’d be crawling around, bruised and battered, trying to find its footing. 🏃♂️

Bitcoin Eyes a Lifeline-But Will It Hold?

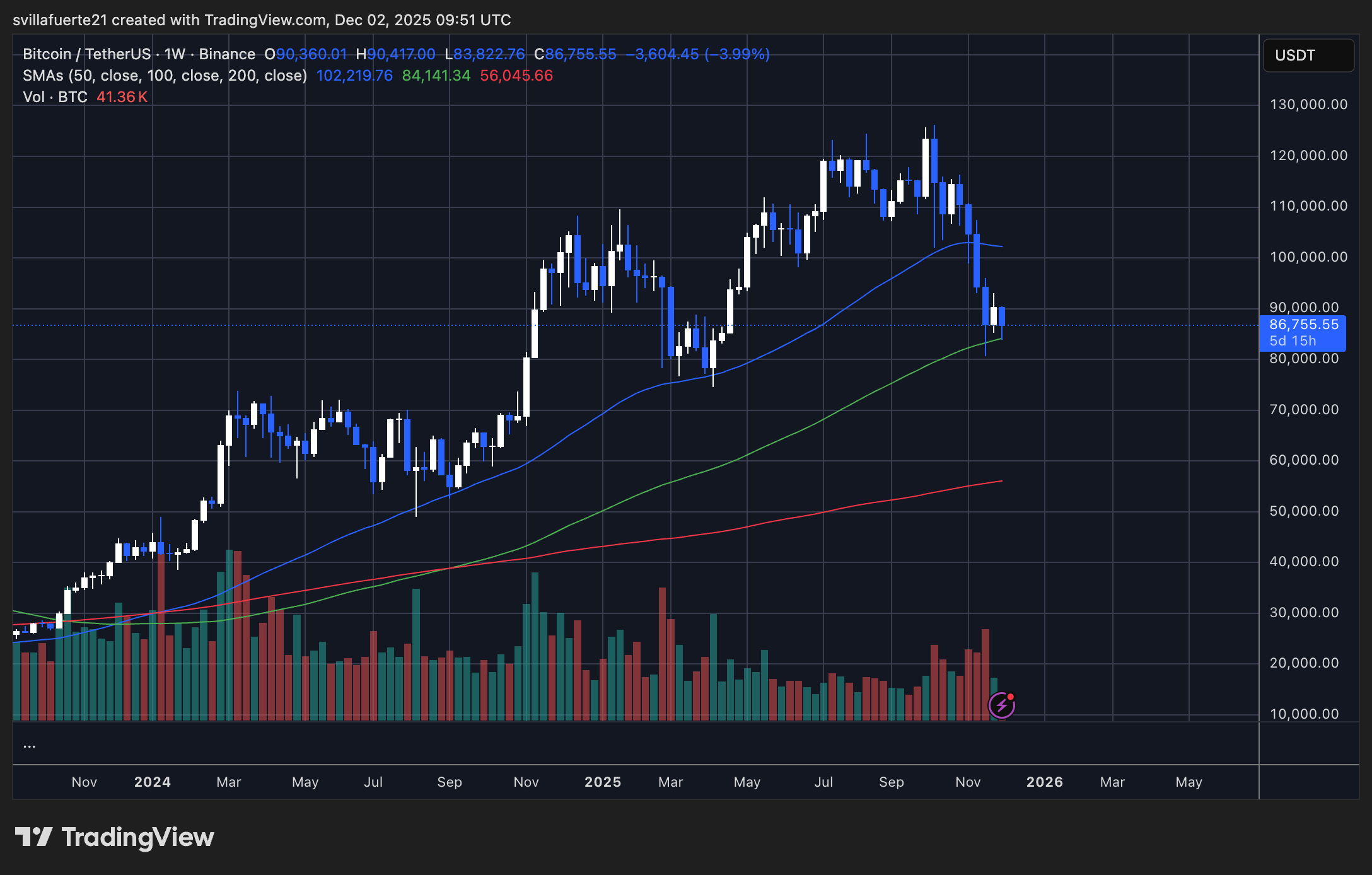

Bitcoin is currently testing a critical support zone, like a teenager trying to pass their driver’s test (it’s nerve-wracking). It’s dropped from the $115,000 mark to the $86,000-$88,000 range, where it’s now knocking on the door of the 100 SMA. This moving average has been a hero in past cycles, so if Bitcoin can hold on here, it might just have a chance at redemption. (Fingers crossed! 🤞)

But it’s not all sunshine and rainbows. The candles are showing volatility at its finest-Bitcoin dipped to $84,000 before a few brave buyers stepped in. But their efforts were about as effective as trying to patch a leaking boat with duct tape. The rebound was weak, and the 50 SMA is still pointing downward, signaling that sellers are still in control. Come on, bulls, pull yourselves together! 🐂

If Bitcoin can’t get back above $95,000, it might as well put on a “Game Over” sign for the short-term. And the volume? It’s not helping. Selling spikes have dominated recent weeks, showing that fear and forced liquidations are calling the shots, not good old-fashioned profit-taking. Until Bitcoin can break through the 50 SMA, it’s like trying to win a race while running through molasses. 🍯

If the 100 SMA gives way, brace yourself, because the next big level of support sits around $70,000-$72,000, where we could see Bitcoin go on a serious rollercoaster ride. It’s all about that next weekly close, so stay tuned! 🎢

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

- Gold Rate Forecast

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Brent Oil Forecast

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

2025-12-03 07:32