For what seems like an eternity, Bitcoin-our shiny digital gold-was locked into the idea that halving events were the grand puppeteers of its price movements. Every four years, the world braced itself for a supply shock, like clockwork, believing that this celestial event would launch Bitcoin into the promised land of exponential gains. Ah, the innocence of early crypto dreams! 😏

Currently, Bitcoin’s price is flirting with the $111,249 mark, a number so precise it feels like it was picked by a particularly meticulous mathematician-or perhaps a very bored accountant. Volatility has cooled to a meek 1.5%, and the market cap hovers grandly at $2.22 trillion, as if to say, “We’ve grown up-sort of-without needing your halving drama.”

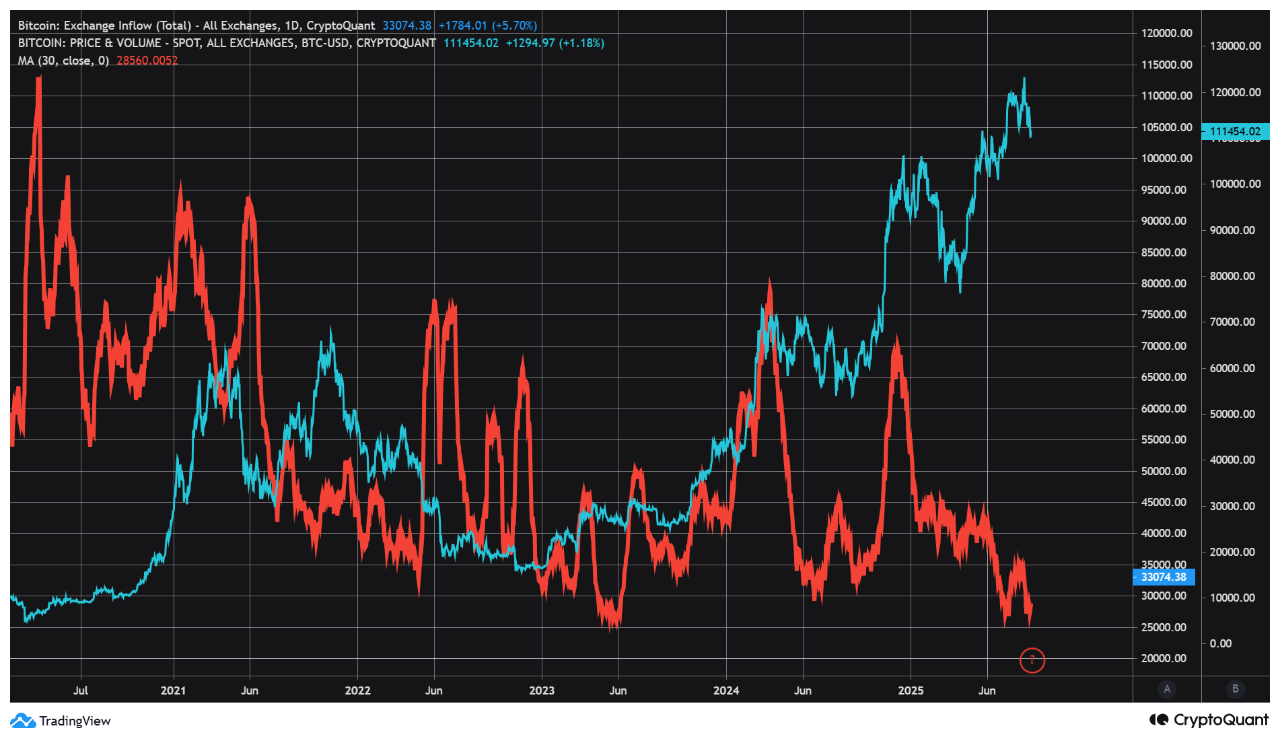

Bitcoin exchange inflow across all exchanges | Source: CryptoQuant

Beyond the Magical Halving: What’s Really Driving Prices?

James Check, on a good day an on-chain analyst of some repute, claims Bitcoin’s three major cycles have little to do with those elusive halving events. Instead, they dance to a different tune-focused on adoption, market maturity, and the ever-fickle institutional players. Because, who needs predictable events when you can have chaos, right? 🤷♂️

In my opinion, Bitcoin has experienced three cycles, and they are not anchored around the halvings.

They are anchored around the trends in adoption and market structure, with the 2017 top, and 2022 bottom being the transition points🔴 Retail early adoption🟠 Wild West, Boom &…

– _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) August 26, 2025

Yes, the current “maturity cycle” is apparently less capricious-more institutional hugs, fewer rug pulls. The peaks and valleys, once tied to halving hype, are now more about where the crowd is willing to jump in or stand firm, rather like waiting for the tea to steep just right before diving in.

What the Numbers Say (Besides Confusing the Uninitiated)

The MVRV chart, that charming little graph, used to spike wildly at tops and bottoms-like a rollercoaster for mathematicians. Now it’s all a smooth cruise, thanks to the influence of long-term investors shrugging off short-term noise. CryptoQuant’s data shows inflows to exchanges plummeted to levels not seen since May 2023-clearly, everyone’s holding their cards close and refusing to sell, with demand politely rising like a well-fed soufflé.

Bitcoin daily chart with momentum indicators as of Aug 27 | Source: TradingView

The Technical And The Slightly Obvious

Bitcoin’s price attempts to hang around the $111,200 level, like a nervous cat on a ledge-curiously strong but warning of an impending leap. The RSI (Relative Strength Indicator) whispers of further gains before overbought signals claw their way back-think of it as a “do not disturb” sign for traders. Meanwhile, the MACD still smiles positively, though perhaps a tad less enthusiastically.

If Bitcoin manages to dodge the $108,000-$110,000 support zone, a breakout toward $120,000 or $126,000 might be on the menu. And if that happens, prepare for a price party at $135,000-who invited that number? Only the brave and the crypto-loving! 🎉

Should it retract to $90,000-$95,000, don’t panic. Broader trend lines say the bull isn’t dead, just taking a breather. Or maybe checking if you’re paying attention. Either way, keep your eyes peeled, and remember-no one ever went broke holding onto their coins.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- USD THB PREDICTION

- Nasdaq’s Nano Labs Plots Billion-Dollar BNB Grab—Did Binance Just Get a New Frenemy?

- Satoshi’s 14-Year-Old Wallet Just Moved 150 BTC! 🚀

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- UNI PREDICTION. UNI cryptocurrency

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

2025-08-27 15:54