Ah, the fickle embrace of the market! Standard Chartered, that bastion of financial wisdom, has once again adjusted its Bitcoin and Ether targets, proving that even the most august institutions are not immune to the whims of Lady Fortune.

In a move as predictable as a socialite’s scandal, the financial firm has lowered its Bitcoin forecast, citing the usual suspects: market swings, ETF outflows, and a risk appetite as feeble as a debutante’s resolve at a tea party. How quaint!

Bloomberg, ever the chronicler of such dramas, reports that this is the second price revision in less than three months. One can almost hear the analysts whispering, “Southbound, darling, southbound!” as they clutch their ledgers in despair.

ETF Withdrawals: The Crypto World’s Latest Tragic Farce

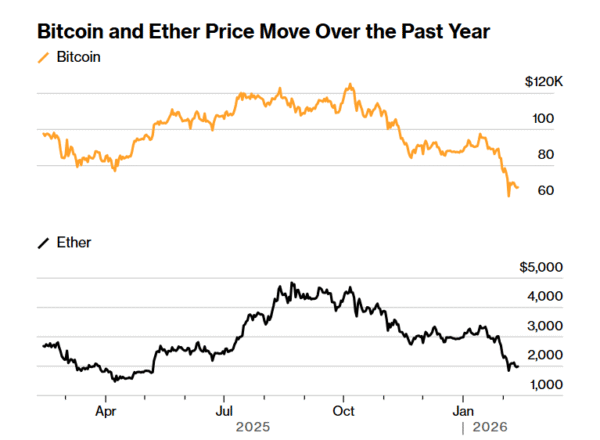

Standard Chartered, with all the gravitas of a tragedian, now predicts Bitcoin will close the year at a mere $100,000. Gone are the heady days of $150,000, and the fantastical $300,000-a figure as distant as a Victorian gentleman’s promise of eternal fidelity. Bitcoin, poor dear, languishes near $67,939, leaving investors as jittery as a cat in a room full of rocking chairs.

Image Source: Bloomberg

Geoffrey Kendrick, the global head of digital assets research, warns of further capitulation-a word as dramatic as it is foreboding. Bitcoin, he suggests, may tumble to $50,000 before its inevitable rebound. One can almost hear the collective gasp of the crypto elite.

US-listed spot Bitcoin ETFs, those darlings of the financial world, have shed nearly 100,000 tokens since their October peak. Investors, having entered near $90,000, now nurse losses as bitter as a wit’s retort. Oh, the humanity!

Meanwhile, the US economy slows its dance, and Kevin Warsh prepares to take the helm at the Federal Reserve. Rate cuts? Not a chance, say the markets. Fresh capital for crypto? As likely as a Wildean protagonist finding true happiness.

Ethereum’s Plight: A Tragedy in Three Acts

Ethereum, too, has been cast into the shadows, its end-of-year target slashed to $4,000 from $7,500. At present, it trades below $2,000, with Kendrick predicting a fall to $1,400 before a recovery. How the mighty have fallen!

Bitcoin, once the belle of the ball, has plummeted over 40% from its October peak. The broader crypto market, once valued at a staggering $2 trillion, now lies in tatters, according to CoinGecko. Even the Nasdaq and S&P 500 look on with a mixture of pity and disdain.

Yet, Kendrick, ever the optimist, describes this downturn as “orderly”-a term as absurd as a moralist at a masquerade. No major platforms have collapsed, he notes, and the market structure appears stronger. Maturity, it seems, may yet save the day, even as prices continue their descent into the abyss.

Read More

- Silver Rate Forecast

- Brent Oil Forecast

- Gold Rate Forecast

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Steak ‘n Shake & Bitcoin: Utterly Baffling!

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

2026-02-13 03:23