Markets – A Tale of Two Toys

What to Know, or Pretend You Care About:

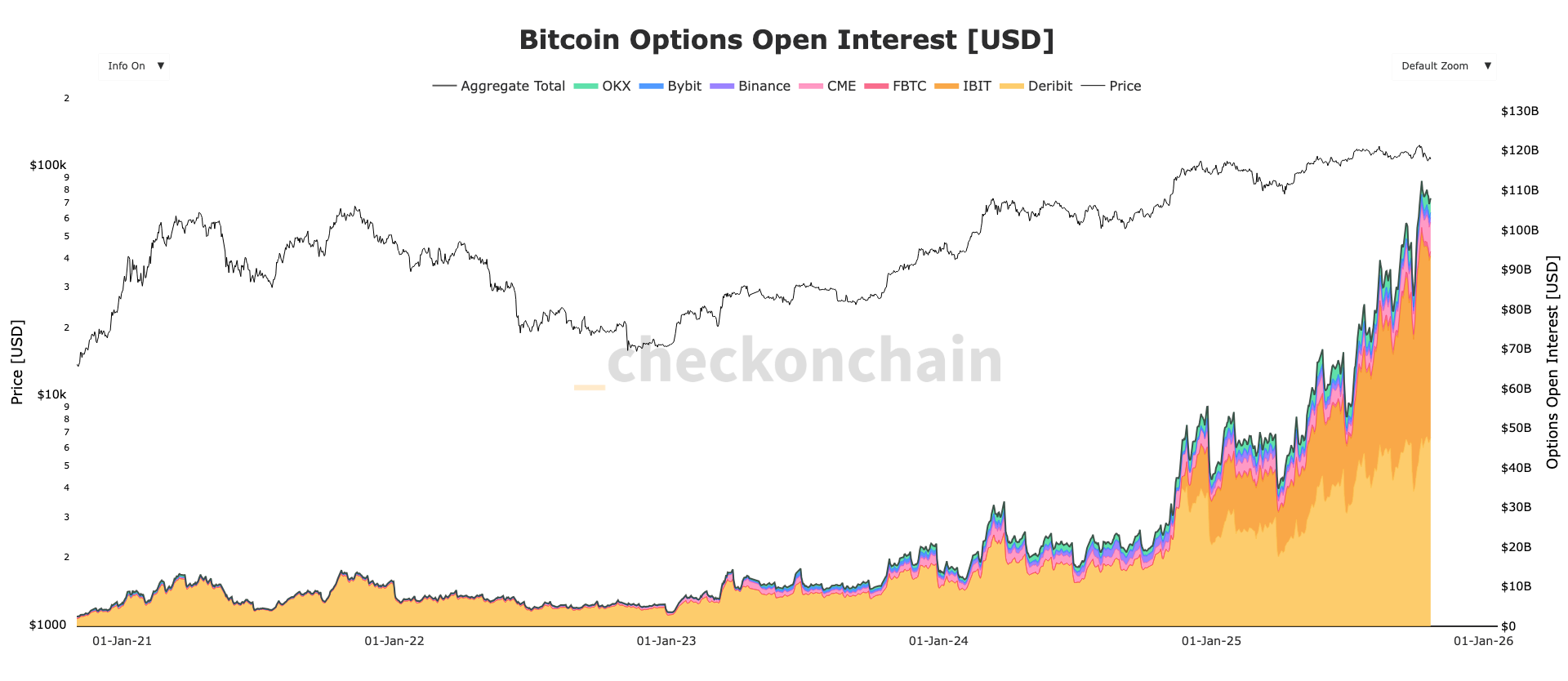

- The options open interest market now surpasses futures by a whopping $40 billion, making it one of the widest gaps ever, as traders sober up after last week’s Liquidation Olympics.

- Thanks to big players like BlackRock’s IBIT, the market is sprouting maturity tendrils, taming volatility like a well-trained puppy.

In what might be the financial equivalent of a slow-burning romance, the options open interest (OOI) now outstrips futures open interest (FOI) by approximately $40 billion, per CheckonChain data. Who knew hedging could be so punchy?

Just to dissect this for those who prefer their chaos with a side of technical jargon: OOI is the grand total of unsettled options contracts-think of them as promises to buy or sell later, but without the awkward family dinners. FOI, on the other hand, measures the dance of open futures positions-futures being the bet-the-farm kind of game that tends to set off fireworks when liquidations go awry.

The rise of the options scene supports all sorts of sophisticated shenanigans-hedging, delta-neutral gymnastics, volatility trading, and twisting structured products. Meanwhile, futures markets often resemble the hub of leverage-induced chaos-think tightrope walkers without a net, especially during last month’s crypto meltdown.

Remarkably, bitcoin’s price showed resilience-dropping only 18% from its historic pinnacle to a modest $103,000, a gentle correction for this boomlet. Back in the day, such a dip might’ve been a free fall. Now, it’s just a minor wobble.

CheckonChain reports OOI ebbing at around $108 billion, baldly flirting with its peak of $112 billion. Meanwhile, FOI is sitting at a more modest $68 billion-down from its glory days of $91 billion-probably thanks to the recent liquidation genocide that wiped out over $20 billion in futures leverage.

All this chatter about a growing options bazaar, especially on the more buttoned-up platforms, hints at a future where hedgers rule and market swings become less dramatic-less fireworks, more slow-burning candlelight.

The launch of options trading on BlackRock’s IBIT in November 2024 turbocharged this trend, swiftly making it the biggest bitcoin options playground, outshining Deribit. Who needs a rollercoaster when you’ve got smart money in a velvet-lined lounge?

As OOI takes the crown and overshadows FOI, expect the markets to lean toward stability, perhaps even getting comfortable enough to take a nap during downturns. But beware-less volatility might also mean fewer fireworks during the bull runs, leaving traders to clutch their coffee in quiet anticipation.

Read More

- Crypto Chaos: 3 Stocks Dancing on the Edge of Madness 🌪️💸

- Bitcoin Frets and Fears: The Great Crash of 2025! 🚨💥

- Truebit’s Midlife Crisis Costs $26M – 2026’s Hacking Spa Day 🛁💰

- Ethereum’s Wild Ride: From $4K to the Moon 🚀💰

- Mark Twain – The Big Donald & His Bitcoin Bonanza: A Tale of Money & Mirth

- Get Ready! XLM’s About to Blast Off Like a Rocket! 🚀💥

- Tax Fraud Mastermind Caught: You Won’t Believe How He Did It! 💸😱

- How a Little Paper on the Monopoly Board Might Unlock Chainlink’s Future (Or Not)

- Tokenized Gold: The 21st Century’s Glittering Revolution You Can Bank On (Literally!)

- GBP RUB PREDICTION

2025-10-22 18:29