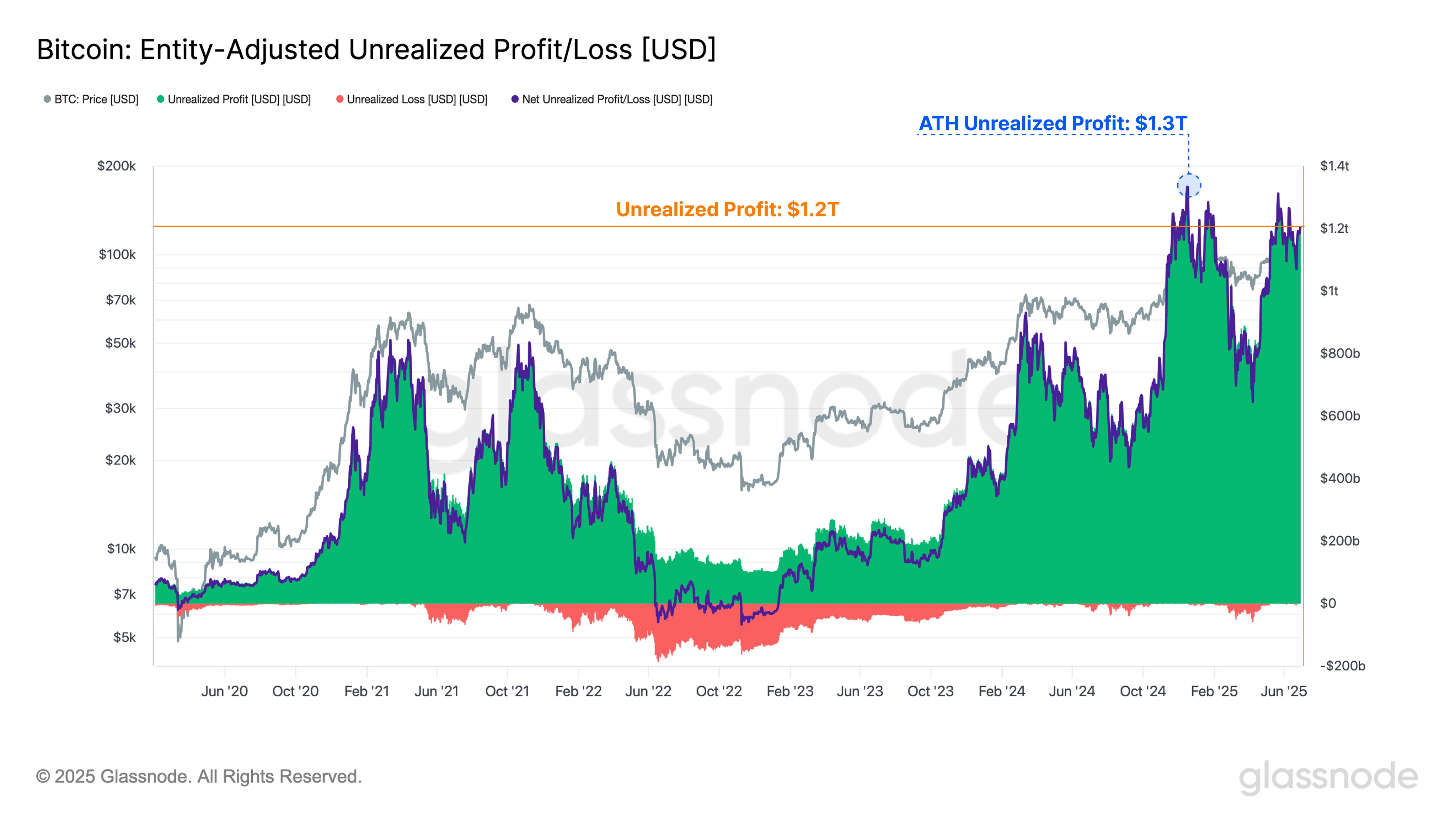

Well, shucks, folks! It seems that Bitcoin investors are sitting on a whoppin’ $1.2 trillion in unrealized profits, according to them fancy on-chain analytics folks at Glassnode. That’s a mighty big pile of cash, if I do say so myself.

Now, I know what you’re thinkin’: what in tarnation is an “unrealized profit”? Well, it’s like this: it’s the profit you’d make if you sold your Bitcoin right now, but you haven’t sold it yet, so it’s still just a bunch of numbers on a screen. Make sense? 🤔

The Times They Are a-Changin’…

It seems that the Bitcoin investor base is shiftin’ like the sands of the desert. Gone are the days of fly-by-night traders lookin’ to make a quick buck. Nowadays, it’s all about them long-term institutional allocators, like pension funds and whatnot.

According to Glassnode, the average unrealized profit per investor is around 125%. That’s a mighty fine return on investment, if you ask me. But what’s even more interestin’ is that investors don’t seem to be in a hurry to sell their Bitcoin. 🤷♂️

Now, I know some of you young whippersnappers might be thinkin’, “But Mark, why aren’t they sellin’?” Well, it’s like this: investors are waitin’ for a more decisive price movement before they make their move. They’re like a bunch of cowpokes waitin’ for the dust to settle before they ride off into the sunset. 🌅

“This underscores that HODLing remains the dominant market behavior amongst investors, with accumulation and maturation flows significantly outweighing distribution pressures,” says Glassnode.

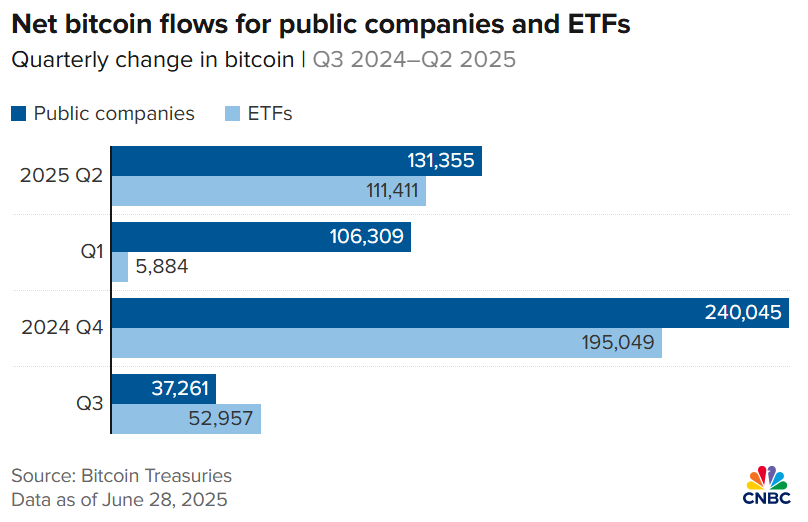

And don’t even get me started on them institutional players, like ETFs and public companies. They’re like the cavalry comin’ to the rescue, buyin’ up all the Bitcoin they can get their hands on. 🚀

“The holder base has changed – from traders seeking exit to allocators seeking exposure. MicroStrategy, sitting on tens of billions in unrealized gains, keeps adding. ETFs = constant bid, not swing traders,” says Rezo, a Bitcoin analyst.

And let me tell you, them public companies are gettin’ in on the action too. Strategy, formerly MicroStrategy, increased their Bitcoin holdings by 18% in Q2, while ETF exposure to Bitcoin climbed by 8% in the same period. That’s a whole lotta Bitcoin, if you ask me! 🤑

So there you have it, folks. It seems that Bitcoin investors are in it for the long haul, and they’re not about to sell their Bitcoin anytime soon. And who can blame ’em? With returns like that, I’d be holdin’ on for dear life too! 😂

Read More

- Brent Oil Forecast

- Silver Rate Forecast

- Gold Rate Forecast

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- SEI PREDICTION. SEI cryptocurrency

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- The Grand Melancholy of Crypto: A Tale of Greed, Fear, and Foolish Hope

2025-07-06 01:41