Darling, traders and analysts are clutching their pearls over BTC’s price action, with some audaciously whispering sweet nothings about $250,000 by December. How utterly thrilling-or delusional. 😏

Technical Setup: Bullish Pennant Formation (Or Just Wishful Thinking?)

On the daily chart, Bitcoin is flaunting what some call a “bullish pennant”-a continuation pattern that, much like a bad party guest, overstays its welcome after a strong uptrend. If resistance breaks, darling, we might see another upward sashay. If not? Well, cue the violins. 🎻

Charting analyst Cas Abbé, ever the optimist, chirped on social media: “$BTC bullish pennant formation. Next week is going to be very crucial. Bulls are expecting a breakout to the upside, while bears are expecting more pain.” How original. 🐻💔

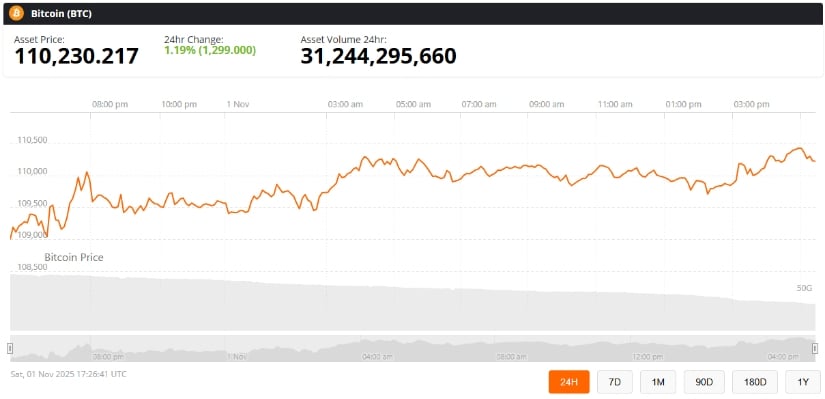

Current consolidation around $110,000, paired with trading volumes that suggest momentum (or desperation), has analysts whispering sweet nothings about $134,000. Retail inflows? Market optimism? Darling, pass the smelling salts. 💨

BTC’s Ambitious Target: $250,000 (Because Why Not?)

Some starry-eyed observers now claim Bitcoin could waltz its way to $250,000 by year-end. A 127% surge? How quaint. For context, Bitcoin’s biggest monthly gain-October 2021-was a mere 89%. So, naturally, this is completely reasonable. 🙄

Technically possible? Perhaps. Likely? Well, darling, $4.2 billion in short positions might just rain on this parade. And let’s not forget consolidation above $105,000-because even Bitcoin needs a breather between delusions of grandeur.

Macro Tailwinds: Fed Liquidity Injection (Or Just Free Money?)

The Federal Reserve, ever the generous host, recently tossed $29 billion into the overnight repo punchbowl. History suggests such gestures preceded Bitcoin’s past highs-so naturally, traders are already drunk on optimism. 🍸

Will it actually help? Who knows! But liquidity injections historically prop up risk assets, and Bitcoin loves a good free-money narrative. Cheers to that. 🥂

Market Risks and Sentiment (Because Nothing’s Ever Simple)

Despite all this giddy optimism, Bitcoin could still trip over its own shoelaces. A dip below $105,000-$108,000 might send it tumbling toward $100,000. The daily RSI looks a tad peaky, darling-perhaps it’s time for a lie-down. 😴

And let’s not forget: bullish pennants have a 54% success rate. So, nearly half the time, they either fail or underwhelm. But who needs statistics when you have hope? ✨

Final Thoughts (Or Just More Speculation)

If Bitcoin breezes past $115,000-$120,000, the next targets could be $135,000-$150,000. With enough momentum (and perhaps a sprinkle of fairy dust), $250,000 isn’t entirely impossible-just wildly improbable. 🧚♂️

But if Bitcoin stumbles? Well, darling, prepare for a tedious consolidation around $105,000-$110,000. Because nothing says excitement like sideways trading. 💤

Read More

- US Crypto Regulators Finally Decide What They Actually Mean – Time to Buy?

- Tether’s Big Heist: $500B Valuation or Just a Stablecoin’s Wild Dream? 💸

- Altcoins? Seriously?

- Gold Rate Forecast

- Silver Rate Forecast

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- Brent Oil Forecast

- Bitcoin’s Bounce: A Bullish Ballet or Just a Blip? 🎭💰

- USD CNY PREDICTION

- USDe Booms Post-GENIUS Act, But Is Ethena’s Stablecoin the UST of This Cycle?

2025-11-02 03:16