Ah, the mysterious world of cryptocurrency — a realm where fortunes soar and plummet with the grace of a drunken ballet dancer, yet somehow, Bitcoin manages to cling stubbornly to the 115K mark. Who would have thought?

BTC Braves the Storm, Teeters on the Edge of $115K (Maybe for a moment, at least)

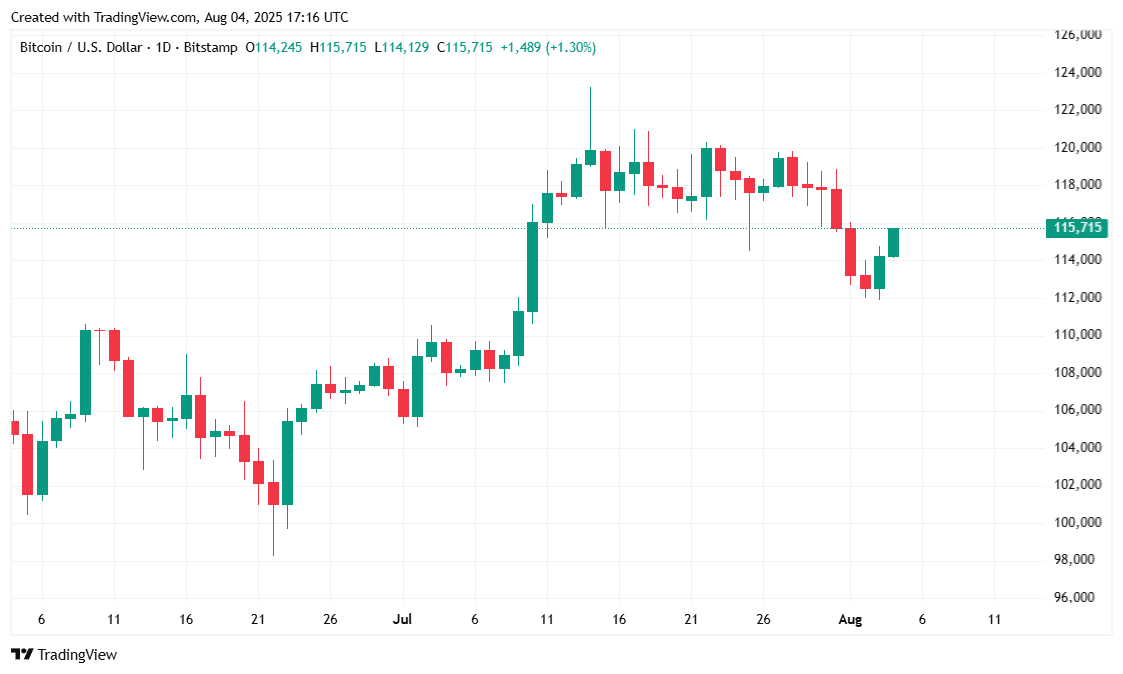

Last week, Bitcoin was the star of a tragicomic opera, descending precipitously to a humiliating $112K on Saturday — as if it had suddenly remembered it’s only a digital asset and not a superhero. But behold, like a stubborn mule, it hauled itself back during those glamorous pre-trading hours on Monday, flirting with $115K again. The macroeconomic melodrama was nothing short of theatrical: strong GDP numbers tried to impress, only to be overshadowed by a jobs report that made everyone yawn. Meanwhile, the Federal Reserve, keeping its poker face, stayed put in the 4.25-4.50% range — perhaps worried about what the Trump administration might do next, or maybe just bored of playing the same hand. Naturally, BTC took a nosedive after Jerome Powell’s Wednesday speech, because who doesn’t love a good plot twist?

The stock markets, not to be left out of the chaos, staged their own drama, ending the day with gains — S&P 500 up 1.30%, Nasdaq 1.75%, and Dow 1.12%. And crypto? It swaggered along with a 1.88% rise on Coinmarketcap, probably jealous of the stock’s flair for theatrics. 😏

Bloomberg’s erudite Eric Balchunas credits the calmer seas to institutional investors finally taking the helm, pouring billions into Bitcoin with ETFs launching in January 2024. Imagine, ordinary folks fret about swings while billion-dollar firms hoard crypto like squirrels with acorns. If he’s right, that rollercoaster that once made our stomachs churn might just be a thing of the past — at least until the next epic crash.

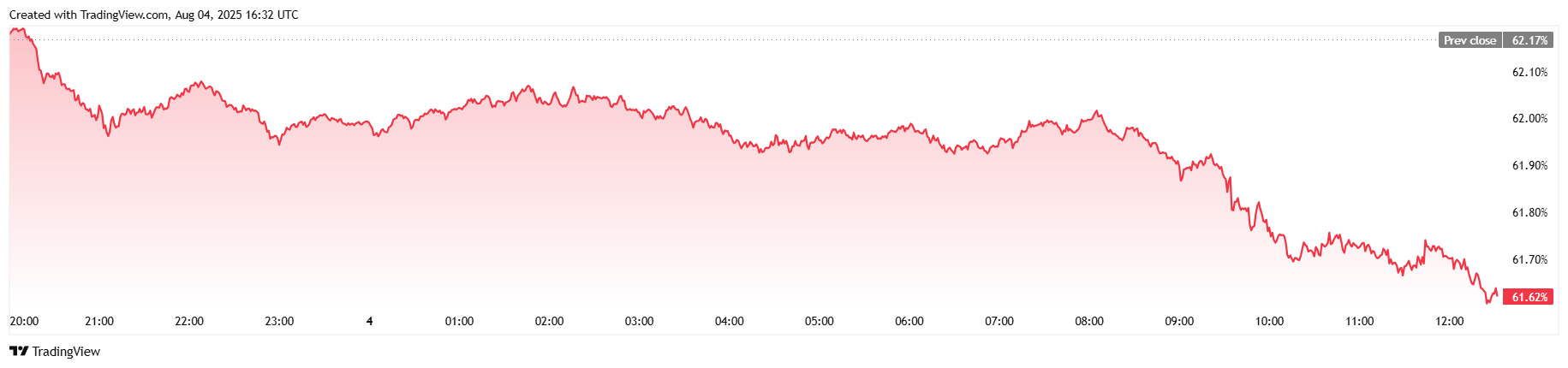

“Since the launch of the ETFs,” Balchunas chirped on X, “Bitcoin volatility has plummeted. The 90-day rolling volatility dropped below 40 — it was over 60 back when the ETFs strutted onto the scene.” Well, isn’t that just adorable? A calmer crypto world, maybe with less screaming and more sipping tea. ☕

Market Metrics: The Good, the Bad, and the Just Plain Weird

As I write this, Bitcoin hangs around $115,491.54 — a modest 1.24% bump from Sunday, yet down 2.05% for the week. It has been gamboling between roughly $113,967 and $115,562 over the past day, as if deciding whether it’s sleepy or mischievous. The trading volume, a surprisingly tame $53.43 billion, fell 2.21% — perhaps everyone’s waiting for the real fireworks. Market cap nudged up barely, hitting $2.28 trillion, while Bitcoin’s dominance dipped slightly to 61.56%, like a clingy celebrity trying to steal the spotlight.

Futures open interest? A modest $79.89 million, down just a smidge, 0.47%. Liquidations? Ah yes, the thrill of the game: $39.25 million since Sunday, most of which — a hefty $34.40 million — were short positions. Because, let’s face it, nothing says “fun” like a good old-fashioned liquidation party. 🎉

Read More

- Altcoins? Seriously?

- Tether’s Big Heist: $500B Valuation or Just a Stablecoin’s Wild Dream? 💸

- Gold Rate Forecast

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- GBP AED PREDICTION

- Bitcoin’s Bounce: A Bullish Ballet or Just a Blip? 🎭💰

- 🚨 Crypto Chaos: PI’s Drama, XRP’s Moon Shot, ETH’s Wild Ride 🚀💸

2025-08-04 20:58