So, Binance Coin (BNB) is still hanging in there above $660, even though it’s been a bit of a rollercoaster ride. I mean, who needs a smooth market when you can have some good old-fashioned volatility, right? 🤪

But here’s the thing: BNB’s managed to hold its ground, which is kind of impressive. Analysts are all over this like flies on a… well, you get the idea. They’re watching every little move, trying to figure out if BNB’s going to make a big move or just stay put. 🕵️♂️

Rejection at Resistance Sets the Stage for Potential Recovery

On the intraday chart, BNB/USDT tried to break out, but it was like trying to get a seat at a crowded comedy club—no dice. The price hit $660.17 on July 8, and for a moment, it looked like it might actually go somewhere. But then, *poof*—it reversed. 🔄

When BNB tried to push above $662, it hit a wall. A big, red, seller-filled wall. The price closed around $660, and the volume bars turned red, which is a pretty clear sign that the sellers were still in control. 🚫

But wait, there’s more! @trader_raiii shared a chart that showed a classic inverse head-and-shoulders pattern. It’s like BNB was doing a fancy dance, forming a support base near $656–$658. And guess what? It worked! After breaking past the neckline resistance, BNB rallied to $663. 🎉

So, the bulls are still watching, waiting for that higher breakout. But let’s be real, they’re probably just as confused as the rest of us. 🤔

Volume Surge Confirms Accumulation Amid Tight Price Range

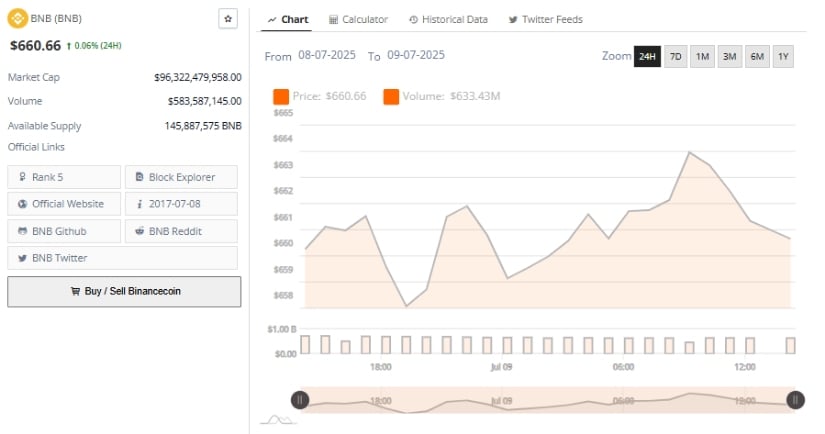

According to BraveNewCoin, BNB moved between $657 and $664 over the past 24 hours, and it even managed a tiny 0.06% gain. When it dipped to $658, buyers swooped in like vultures, pushing the price back up to $664 by early July 9. 📈

The volume during this session was around $583 million, which is a lot, considering BNB’s market cap is over $96 billion. That’s a lot of zeros, folks. 🤑

The volume trends showed steady interest during key price movements, especially during the morning rally on July 9. But the lack of follow-through volume during the retracement phase suggests that people were just taking profits, not panicking. 🤷♂️

Analysts think this could be a sign of institutional or whale activity. These big players tend to accumulate during low-volatility periods and support retests. If the volume picks up again above $664, it could mean a bullish breakout. But who knows? Maybe they’re just playing a long game. 🎲

Indicators Show Gradual Momentum Build-Up

TradingView’s technical insights show that BNB is in a phase of cautious bullish activity. The RSI is at 55.01, which is slightly above the neutral 50 mark and trending above its moving average at 53.38. This suggests modest bullish strength, with room for growth if the RSI keeps climbing toward 60. 📊

The RSI’s recent crossover into positive territory aligns with recent price behavior, which means we should keep an eye on it for any signs of trend continuation. 🕵️♂️

The MACD (Moving Average Convergence Divergence) is also showing a build-up in buying momentum. The MACD line (3.26) is above the signal line (1.75) with a histogram value of 1.51. This setup suggests that buying momentum is building, but the values are still close to the baseline. 📈

So, market participants are waiting for more confirmation, like a volume spike or a price advance beyond $664. Until then, BNB is just going to sit there, consolidating and making us all a bit nervous. But hey, that’s the market for you. 🤷♂️

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- SEI PREDICTION. SEI cryptocurrency

- FET PREDICTION. FET cryptocurrency

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- EUR ILS PREDICTION

2025-07-09 23:36