Egad! Binance Coin, that sprightly scamp, is eyeing the $2000 mark with the zeal of a hungry terrier chasing a sausage. All thanks to Bitcoin’s jolly momentum and the whispers of CZ’s potential pardon. What ho, indeed! 🤑

Binance Coin, the darling of the crypto set, has been bounding about like a jack-in-the-box on a sugar rush, keeping pace with Bitcoin and setting new records faster than Jeeves can mix a martini. 🍸

On the 21st of September, BNB gave a cheeky wink at $1,083 before settling back to the $1,050 range. Another feather in its cap, or rather, another notch in its rally belt, which began after it broke through resistance levels with the finesse of a seasoned cricketer. 🏏

Market eggheads, those clever chaps, now predict BNB will aim for $1,187. If Bitcoin holds steady above $115,000, BNB might well shimmy toward $1,500 and, heavens above, possibly $2,000 in the coming months. 🌟

Binance Coin: The $2000 Tango After a Record-Breaking Jig

The $740 resistance level, which had BNB in a stranglehold for months, finally crumbled in July like a poorly constructed soufflé. 🥧

After the breakout, the token did a spot of retracing, retested the zone, and then bounced higher in August. A move as reassuring as finding a fiver in an old trouser pocket, confirming strong buyer support and marking the start of a new upward phase. 📈

Since then, BNB has climbed with the determination of a mountaineer on a mission, making fresh highs. Its latest peak at $1,083 shows investors are as confident in Binance’s ecosystem as I am in Jeeves’ ability to iron a pair of trousers. Despite some traders taking profits, the market trend remains as rosy as a debutante’s cheeks. 🌹

On longer timeframes, BNB’s behavior is as predictable as Aunt Agatha’s disapproval. During the 2020-2021 rally, it spent nearly 18 months under $40 before exploding to $691. While its market cap is now as hefty as a Christmas pudding, analysts warn against calling the top too early. 🎄

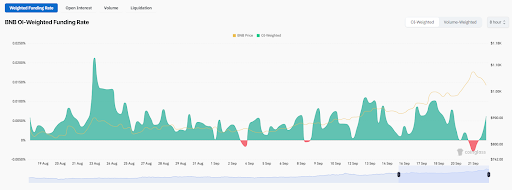

While the long-term outlook is as bright as a summer’s day, short-term traders are bracing for corrections like a chap preparing for a spot of rain. The price action shows this, and data from CoinGlass indicates funding rates for BNB futures dropped to a two-month low. More traders are betting against the rally, the old bears. 🐻

If bearish sentiment continues to gain strength, BNB could retrace toward the $1,000 psychological level, triggering $61 million worth of liquidations in long positions. A deeper drop could test demand around $950-$1,000, and in a worst-case scenario, $800. But holding above $1,083 would invalidate bearish expectations and open the path to $1,100 and higher. 🛤️

Changpeng Zhao: The Speculation Spice in BNB’s Stew

Beyond the technicals, Binance Coin has been buoyed by speculation about its founder, Changpeng Zhao (CZ). The former Binance CEO stepped down in 2023 after a $4.3 billion settlement with U.S. authorities and served a short prison sentence. Now, rumors are swirling about a possible pardon from President Donald Trump. Betting markets once priced CZ’s chances above 60%, though they’ve since slipped closer to even. Still, the speculation has lifted sentiment for BNB like a well-timed compliment. 🕊️

Zhao’s recent changes to his X profile created further talk of a comeback. Traders see a pardon as a possible turning point for Binance, which continues to live under regulatory monitoring. 🕵️♂️

A cryptocurrency with ties to Binance Holdings Ltd. struck an all-time high as speculation builds that the digital-asset exchange’s co-founder Changpeng Zhao will be granted a US presidential pardon

– Bloomberg (@business)

The Road to $2,000: A Path Paved with Hope and Volatility

Binance Coin continues to prove its mettle, both as a utility token and a speculative asset. Its technical strength, Bitcoin’s support, and market narratives have all converged to push BNB higher. If Bitcoin maintains its trend and demand for BNB continues, a climb to $1,500 and possibly $2,000 could be within reach. Short-term volatility remains a worry, but the overall structure suggests more upside ahead. 🚀

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- 🚨 Last Call for $BEST: The Wallet Revolution Ends in 3 Hours! 🚀

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- Nasdaq’s Nano Labs Plots Billion-Dollar BNB Grab—Did Binance Just Get a New Frenemy?

- MSTR’s $1.44B Cash Cushion: Bitcoin Lifesaver or Doomscroll Fuel? 🚀💸

- USD VND PREDICTION

- BNSOL PREDICTION. BNSOL cryptocurrency

2025-09-23 09:09