The mighty BTCS, like a phoenix rising from the ashes of financial despair, has soared to unprecedented heights, boasting a Q3 2025 revenue of $4.94 million-a staggering 568% leap year-over-year and a 78% surge from the previous quarter! 🚀💸

With a bold Ethereum-first strategy, BTCS has transformed its financial fortress, netting a colossal $65.59 million in net income, fueled by the soaring price of ETH, which danced to $3,190 this quarter! 🌟📈

ETH

$3 190

24h volatility: 0.4%

Market cap: $387.03 B

Vol. 24h: $47.38 B

appreciated sharply throughout the quarter, as BTCS hoarded 70,322 tokens, worth a tidy $291.58 million. Now, the company stands as a titan of Ethereum, its fate intertwined with the digital gold! ⚖️💰

CEO Charles Allen, ever the optimist, declared this quarter a “defining moment,” as the company raised over $200 million and launched a share repurchase program, all while ETH per share expanded like a balloon in a hurricane! 😄

“The increase in ETH per share highlights the success of our capital-efficient model and integrated operations,” said BTCS CEO Charles Allen. 🤝📈

Strategic Capital Moves Strengthen Shareholder Value

The company’s nine-month revenue of $9.40 million, up 437% year-over-year, already surpasses its full-year 2024 revenue by more than 2.3x. A feat that would make even the most seasoned investor weep with joy! 🥹💸

In a masterstroke of capital alchemy, BTCS executed maneuvers that left investors grinning-issuing the first-ever Ethereum dividend and loyalty reward, which slashed short interest from 5.56 million shares to a mere 1 million in a blink! 🎉💰

A $50 million share repurchase program added further support, with BTCS buying back stock at prices roughly 15% below the average issuance. A move so clever, it’s almost criminal! 😎

Ethereum Price Forecast: Can ETH Recover Above $3,400 as Momentum Indicators Reset Lower?

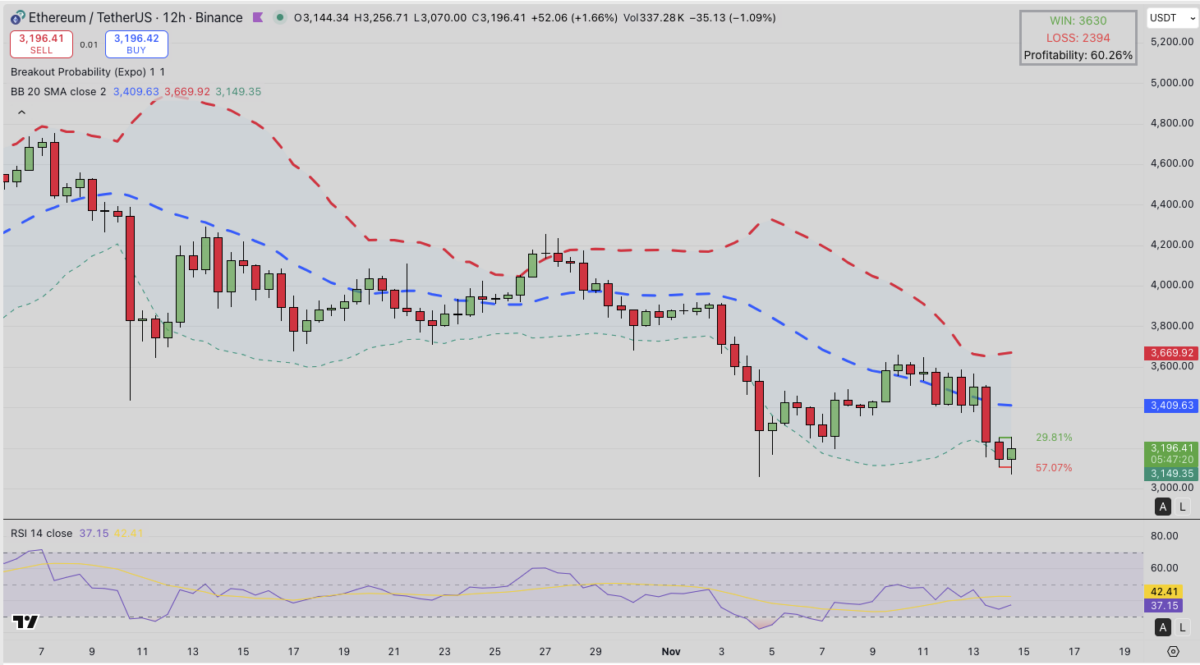

Ethereum trades around $3,183, on-course for a third consecutive losing session. The 12-hour chart shows ETH attempting to stabilize after a steady decline from the late-October highs, with candles now pressing against the lower Bollinger Band at $3,146. 🧗♂️📉

The middle Bollinger Band sits at $3,409, forming the first major resistance. ETH needs a strong breakout above that $3,409 midpoint to restore bullish structure and open room toward the upper Bollinger Band near $3,671, a level that rejected price multiple times in October. Until that reclaim occurs, the broader structure still leans corrective rather than impulsive. 🚨

Ethereum (ETH) Price Forecast | Source: TradingView

Momentum remains under pressure. The RSI at 36.51 hovers in bearish territory, with the signal line at 42.36 still trending downward. The indicator is not yet oversold, implying sellers retain control even as ETH tests the lower volatility boundary. If RSI dips below 30, a stronger reaction bounce becomes more likely, but in the current configuration ETH is still searching for direction rather than confirming reversal. 🧠📉

A clean candle close below $3,146 exposes deeper retracement into the $3,000 area, where ETH staged a previous reaction rally in early November. A dance of uncertainty, indeed! 💃🕺

For now, ETH’s path hinges on whether bulls can force a reclaim of the mid-band at $3,409, which would flip near-term sentiment and suggest the correction is maturing. Until then, Ethereum remains at risk of a corrective slide towards $2,900. 🛑📉

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- USD CAD PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- USD THB PREDICTION

2025-11-15 00:03