Well, howdy there! Welcome to the Asia Pacific Morning Brief—think of it as your morning jolt of crypto gossip, straight from the horse’s mouth!

So, pour yourself a steaming cup of green tea, sit back, and prepare for some jaw-dropping tales. Institutional folk are jumping into the crypto fray faster than a cat on a hot tin roof! Fidelity’s throwin’ its hat in the ring for MetaPlanet’s Bitcoin adventure, our friend Henry Chang is waltzing out of court scot-free, and SharpLink? They’ve hoarded more Ethereum than a squirrel during winter! 🐿️

Fidelity: MetaPlanet’s New Best Buddy

The good folks at National Financial Services, Fidelity’s little spin-off, have wiggled their way to being MetaPlanet Corporation’s main squeeze, holding a juicy 12.9% share worth ¥130 billion as of good ol’ June 30th. This nifty maneuver signals that even the big wigs are licking their chops for a bite of Bitcoin-related goodies.

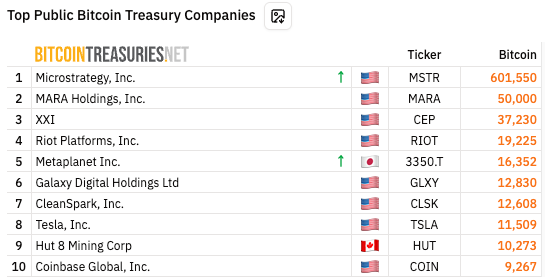

Affectionately dubbed “Asia’s MicroStrategy,” MetaPlanet has raked in over ¥150 billion this year, adding a whopping 797 BTC to its collection, bringing their treasure trove to 16,352 shiny bitcoins. Ranking fifth globally for publicly-traded Bitcoin hoarders, they’ve pulled off acquisitions totaling ¥239.6 billion, with a neat ¥47 billion in profits just hanging around like an old friend. Talk about making it rain! 💰

This surge in institutional interest shows that the stuffy old banking types are starting to see digital assets in a new light—who knew they could be flexible?

Henry Chang: The Free Man

In a plot twist fit for a dime novel, the Seoul Southern District Court has announced that Henry Chang, the former head honcho at Wemade, is not guilty of any shenanigans with those pesky WEMIX tokens. The court decided there wasn’t enough proof that WEMIX’s price swings were tied to Wemade’s stock like a baby to its pacifier.

Judge Kim Sang-yeon made it clear that “WEMIX pricing and Wemade stock don’t necessarily tango together,” tossing out the prosecution’s claims that Chang’s chatter about halting WEMIX liquidation while sneaking in some under-the-table dealings was market manipulation. Talk about a legal poker face! 🎭

The ruling underscored the difference between WEMIX tokens and Wemade shares, like apples and oranges, each with its own set of rules. Turns out, factors like global gaming performance and cash flow are what really gets the stock prices moving! Who knew?

As for WEMIX? It’s trading about 7% higher despite being left out of the Korean party on platforms like Bybit and Bitget. This decision is likely not the final curtain, as the prosecution may still take another stab at this business before it’s all said and done.

SharpLink Gaming: The Ethereum Kingpin

In a move that’s got the crypto world buzzing, Nasdaq-listed SharpLink Gaming (SBET) has eclipsed the Ethereum Foundation, strutting away with the title of the world’s largest corporate Ethereum holder, boasting an eye-watering 280,706 ETH as of July 13th. They snagged 74,656 ETH at a cool price of $2,852 per coin during a week of wild shopping, funded by an impressive $413 million equity raise. 💸

With their sights set firmly on the future, SharpLink has funneled 99.7% of its Ethereum into staking protocols, raking in 415 ETH in rewards since kicking off their treasury strategy back in June. Rumor has it they’ve made additional secretive purchases via Coinbase Prime, pushing their treasure chest to well over 294,000 ETH, with an average cost of about $2,695 per coin. Now that’s smart investing!

This aggressive accumulation has yielded an estimated $92 million in unrealized gains, and with $257 million still up for grabs, they’re poised for further forays into the crypto seas. SharpLink’s share price has soared 116% this past month—what a wild ride, eh? And it gained another 21.31% on Tuesday—talk about hitting the jackpot!

Read More

- USD CNY PREDICTION

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Gold Rate Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- Brent Oil Forecast

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

- Silver Rate Forecast

- USD VND PREDICTION

2025-07-16 07:00