What ho, dear reader-the crypto menagerie is behaving like a posh tea party that suddenly discovered it was also a tornado. Prices dance about with the grace of a drunk octopus, and yet the whole business carries a certain piquant charm, like a gossip in a drawing room with a secret to tell and a teapot to spout from.

Meanwhile, the GraniteShares 2x Short MSTR Daily ETF, begging for all the world’s attention under the ticker MSDD on Nasdaq, has managed to hit a record high. It’s the sort of triumph that makes professional speculators pat their hats and whisper, “The carnage, old man, is simply irresistible when you’ve got the right toy.” A most delicious paradox indeed: profit when the price goes down, as if one could auction off a flood and still get a decent cup of tea.

For the ordinary investor, this carnage yields a market where liquidity behaves like a shy debutante-present only in short bursts and then retreating to the library when you try to lend it a coin. It’s all rather disconcerting, like trying to thread a needle in a windy drawing room.

This bit of fuss matters because it reveals the digital asset ballroom’s growing complexity. When ETFs that bet against Bitcoin holders are booming, one suspects a lack of one cohesive liquidity orchestra-a chorus that can sing in harmony across the whole market rather than each singer sticking to his own sepia-tinted aria.

Traders are scattered across platforms and schemes, often paying through the nose to hop from safe harbors to risk-on escapades. To thrive in such a place, one needs not merely a trading floor but a proper 실행 layer-a bridge that connects the fragmented silos and ferries liquidity from one blockchain parish to another.

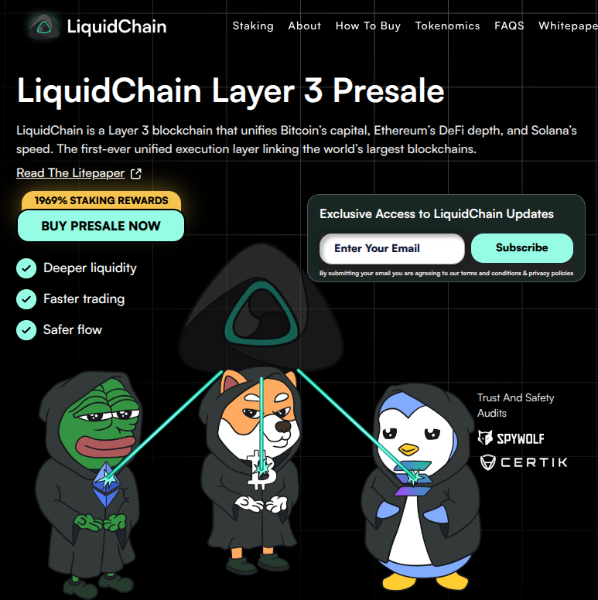

As the “short” story hogs the headlines, minds drift toward projects that can knit these disconnected markets into a proper, well-dressed union. Enter LiquidChain ($LIQUID), a scheme whose aim is to conjure an environment where liquidity flows as smoothly as a well-bred chauffeur through the streets, whether carnage reigns or a bull is prancing about the lawn.

This mood swing toward unity paves the way for Layer 3 innovations that act as the connective tissue for the crypto world.

LiquidChain ($LIQUID) Steps in With a Unified Layer 3 Architecture

LiquidChain ($LIQUID) aspires to be the definitive Layer 3 blockchain, coaxing Bitcoin’s capital, Ethereum’s DeFi depth, and Solana’s speed into one splendidly efficient pot. In a market obsessed with carnage, LiquidChain offers a “Solana-class” VM where assets can be represented verifiably without the circus of clumsy bridges.

This clever bit of architecture dispenses with stranded silos and gives developers a single platform to reach every corner of the cryptosphere. Whether the market is pumping like a fever or dumping like a failed soufflé, LiquidChain promises immediate access to combined liquidity pools across all the big networks.

The backbone is trust-minimized cross-chain proofs and messaging, ensuring every transaction is settled atomically and securely across chains. In plainer words, deeper liquidity, faster trading, and a flow that doesn’t wobble like a wobbly table after a few sherries.

The presale is live and has already crossed the $524K mark, with early birds eyeing the colossal potential for ecosystem growth. The current price of $0.0135 per $LIQUID token offers a tempting ground-floor entry into what could become the scaffolding for the next grand bull run.

SECURE YOUR $LIQUID AND UNIFY YOUR TRADES.

High-Performance Staking and the $LIQUID Vision for 2026

One of the more dashing aspects of the LiquidChain affair is its staking scheme, boasting a staggering 1965% in staking rewards. A figure that makes you blink and think you’ve misread your calculator, yet there it stands, ready to bootstrap liquidity and reward early adopters who buy into the Layer 3 dream.

The tokenomics are laid out with a respectable appetite: 35% earmarked for continuous development and 32.5% for viral marketing and global exposure. In other words, there’s plenty of pastry to keep the bakehouse open as the project grows its slice of the liquidity pie.

LIQUID’s roadmap comprises four key stages, culminating in partnerships with DeFi protocols and exchanges. By streamlining the developer experience and offering a high-performance VM, LiquidChain is setting a fresh standard for blockchain interoperability.

As ‘short’ ETFs continue to hit record highs, the demand for a holistic, unified layer will only grow.

JOIN THE LIQUIDCHAIN PRESALE NOW.

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- LUNC’s Wild Ride: Bull or Just a Bull🐂 in a China Shop?🛒

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Shiba Inu Shakes, Barks & 🐕💥

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Breaking News: Fed Bids Adieu to Crypto Oversight! Is This a Good Thing? 🤔

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

2026-02-04 13:57