Are Bitcoin ETF Outflows a Sign of Impending Market Collapse?

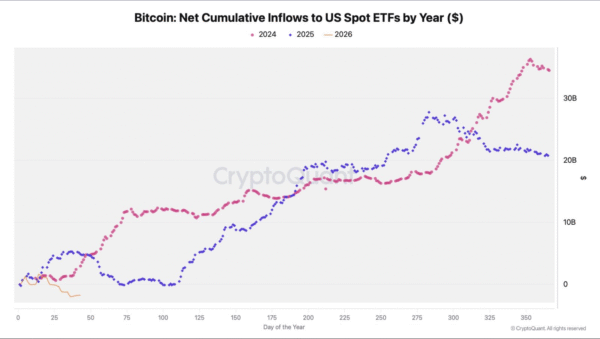

Bitcoin started the year facing downward pressure, as demand for investment products significantly decreased. Data suggests that the funds which drove the previous two price increases are now being withdrawn. This, combined with increased global economic and political instability, has created a cautious outlook for the market.