Crypto Chaos Tamed: Dutch Platform Gets License to Go Wild Across EU 🧀🚀

Bitvavo CEO Mark Nuvelstijn emerged blinking into the regulatory daylight and solemnly declared,

Bitvavo CEO Mark Nuvelstijn emerged blinking into the regulatory daylight and solemnly declared,

Enter stage left: analyst Michaël van de Poppe, declaring that Bitcoin now has “an extremely bullish setup.” Which, translated from Analyst into English, means it’s time to make dramatic hand gestures towards the future. There’s talk of a new all-time high that could arrive as soon as this week—so, hold onto your digital wallets and your faint hopes.

Not much to report on the Bitcoin front—unless you count “absolutely nothing” as a scoop. The price is loitering at $107,000, testing everyone’s patience (and possibly moonlighting as a stablecoin just to keep us on our toes). Volatility has taken the day off—liquidations are only down 4%, which means the bulls are at least pretending to do something important. Bravo, lads.

Sure, these tokens make the crazy world of crypto look almost functional: swaps, loans, late-night cross-border transfers that sound a little shadier than Venmo-ing your mate for pizza. But the billion-dollar question: are these digital poker chips actual “money,” or just Monopoly pieces for adults with trust issues?

Enter stage left: M-log1, top analyst, part-time soothsayer, full-time enjoyer of carnage. “ETH is back in range,” he declares—perhaps with less rapturous applause than he expected. He hypothesizes, quite persuasively, that ETH’s price action has not only shaken out the weak, but left enough psychological tremors to open up the higher battlefield ($2,600–$2,800, for those who collect such topographical curiosities) for the bulls’ next Bayeux Tapestry of price discovery.

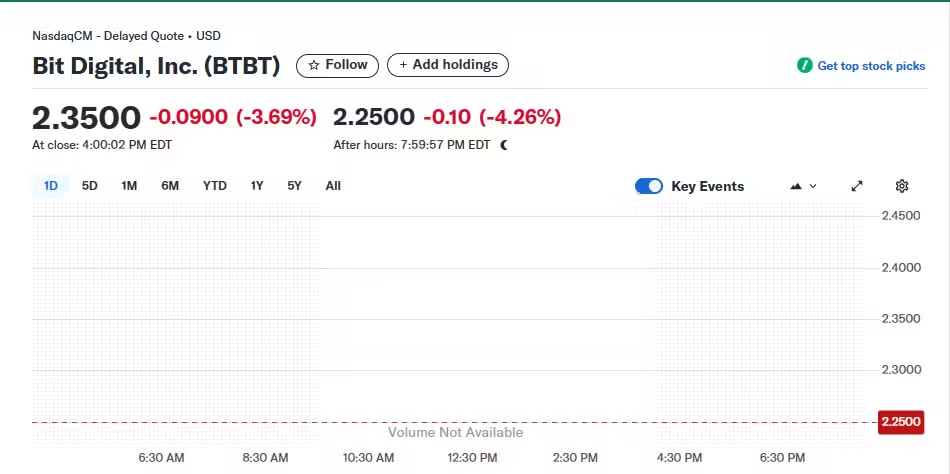

On Wednesday, the company revealed it’s basically putting its Bitcoin mining biz up on Craigslist: “Bitcoin Mining Operations—slightly used, comes with free existential crisis—best offer!” Any bitcoin they scrounge up from this garage sale will be used to pump up their Ethereum staking plans. Because what’s hotter than riding a crypto rollercoaster? Swapping it for a scarier one, of course! 🤑

Look! There goes trading volume—it’s dropped so hard, you’d think it’s gone off to a beach holiday somewhere. Bulls and bears are tiptoeing around, both equally clueless about whether to charge or hibernate. The last time we saw this kind of volume drought was when Grandpa tried to use the WiFi. That’s usually a sign: something loud is about to happen, especially with XRP squatting just under the 50-day and 100-day EMAs like a suspicious cat waiting for a mouse to appear.

The process? Simple—as long as your definition of “simple” includes several layers of cryptographic voodoo. Your ADA and LTC get tucked away safely in Coinbase custody, where they’re watched over like rare butterflies. In return, you get cbADA or cbLTC, which you can mint or burn at will. Regular audits assure us there’s actually something in the cookie jar, rather than just tumbleweeds and broken dreams.

As of this dazzling moment, Ethereum finds itself sprawled at $2,416, just under EMA’s disdainful gaze. If you think you’ve seen this accumulation phase before, darling, it’s because you absolutely have—right before the last time ETH decided to waltz skywards.

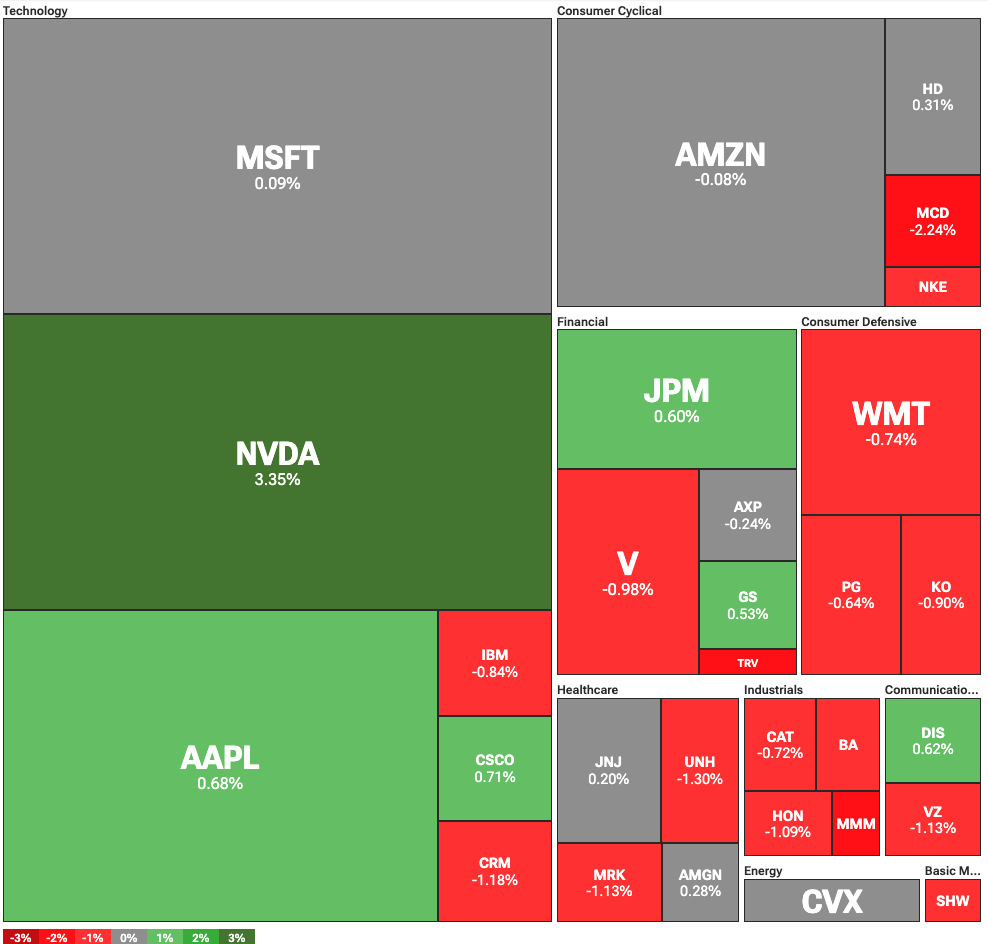

The grand assemblies of Wall Street were in a state of curious imbalance; while the venerable Dow Jones—so stately, so ponderous!—declined by 151.95 points (let us not be too dramatic, merely 0.35%), the sprightly and slightly scandalous Nasdaq ascended by 0.24%, wagging its finger at tradition. The S&P 500, meanwhile, maintained an air of polite indifference at a handsome 6,090 points, daring anyone to recall its dazzling February debut at 6,144. (We all know how society is with records: one moment a paragon, the next a mere footnote.)