Crypto Circus: XRP Naps, DOGE Whimpers, SHIB Clings to Life by a Pixel

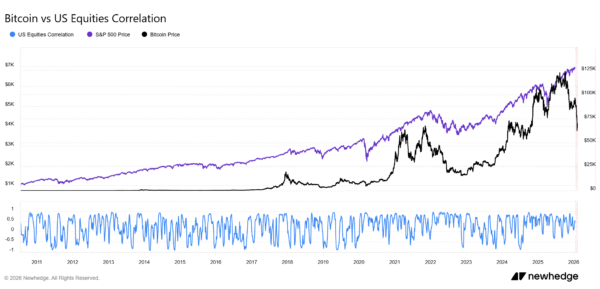

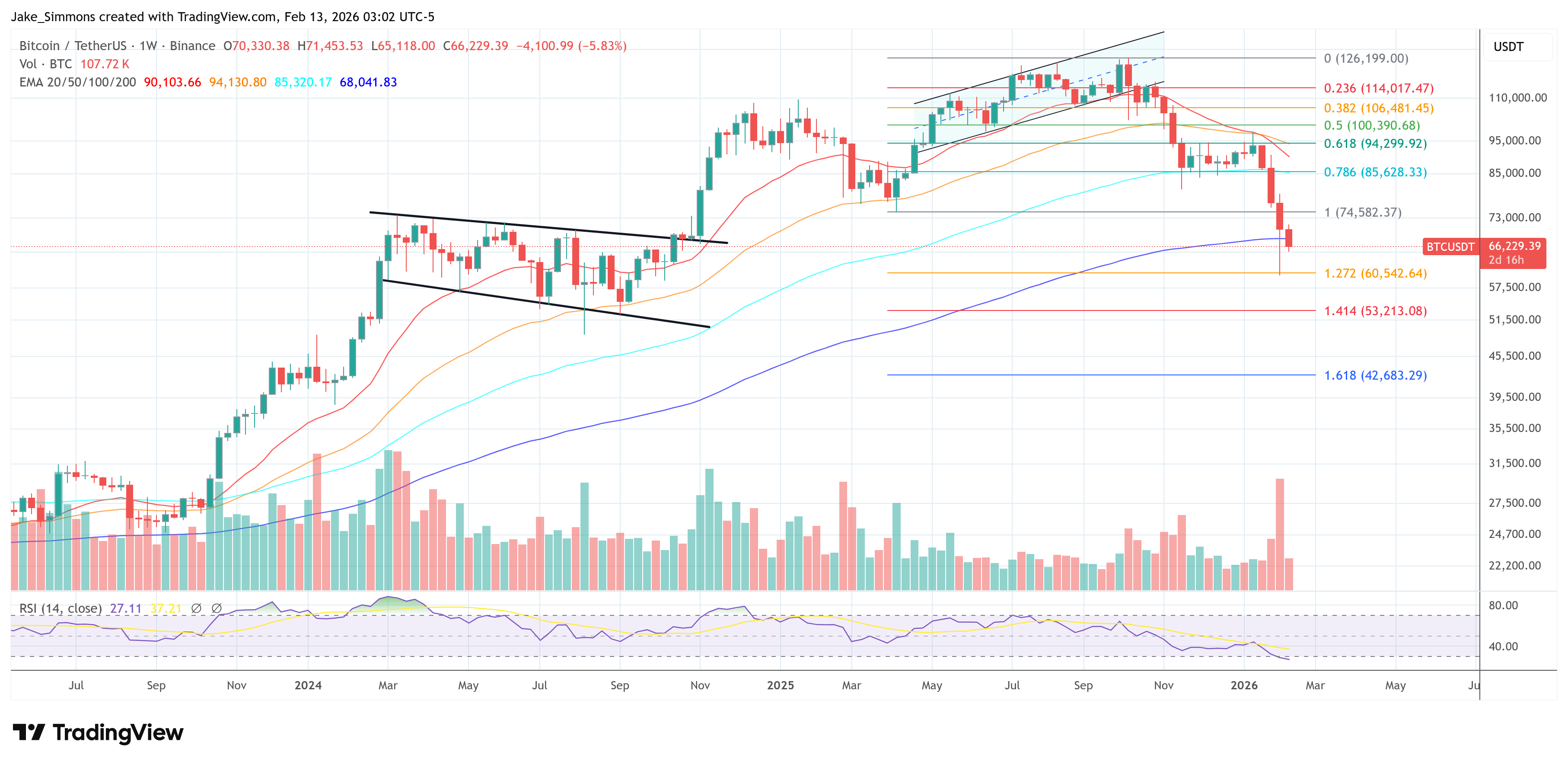

Of course, XRP’s broader structure still looks like it’s been through a blender, trading below major moving averages that are slouching downward like teenagers at a family reunion. But hey, at least the panic-selling has subsided. For now. Two things could jolt this snooze fest back to life: Bitcoin’s mood swings (because let’s face it, crypto is just Bitcoin’s puppet show) and the antics of leveraged traders, who are either rebuilding long positions or liquidating faster than a reality TV star’s marriage.