Bitcoin Takes a Nap as Economists Argue Over Numbers 🤷♂️

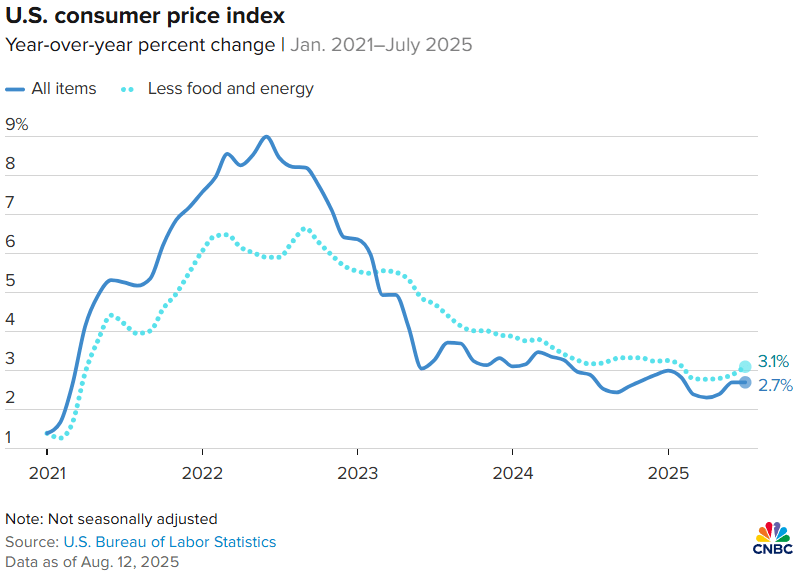

So, here we are. The U.S. Department of Labor Statistics released its July Consumer Price Index (CPI), and let’s just say it’s about as clear as mud. 🌧️ Overall inflation? Meh, lower than expected at 2.7%. But wait! Core inflation-because apparently, food and energy don’t count in “core” anything-shot up to 3.1%, the highest since dinosaurs roamed the Earth (or at least since 2023). Bitcoin, in true existential crisis mode, decided to sit this one out, hovering stubbornly around $119K after a brief flirtation with $122K over the weekend. Ah, romance.