Mark Twain’s Take on the U.S. House Crypto Tax Hearing 🤑

BIG DAY FOR CRYPTO HOLDERS!

US House scheduled a hearing on Crypto Tax policy today.

There has been some rumours that 0% capital gains tax will be implemented on US-based tokens.

BIG DAY FOR CRYPTO HOLDERS!

US House scheduled a hearing on Crypto Tax policy today.

There has been some rumours that 0% capital gains tax will be implemented on US-based tokens.

According to the ever-so-insightful Ali Martinez, who recently graced us with a post on X, the supply of these aquatic giants has seen a notable uptick. The metric to watch here, courtesy of the esteemed Santiment, is the “Supply Distribution.” This charming little chart tells us just how much of the precious asset these wallet groups are hoarding at any given moment.

Take SPX6900 and FLOKI, for instance. These two have been the talk of the town, drawing in more capital than a gold rush in the Wild West. SPX6900, with its fancy ecosystem upgrades and a bit of market flair, has been on a tear, gaining nearly 12% in just 24 hours. It’s like a steam locomotive that’s just discovered it can run on pure optimism. 🚂

Until this moment of bureaucratic thaw, firms in the shadowy “virtual asset” alleyway were banished from any government compassion—austerely walled off from tax amnesties, financial encouragement, and the warm embrace of discounted televisual fanfare. But lo, the ministry claims their frosty stance is softening, warmed by a new “shift in perception.” Legal and institutional snowplows now clear the way for digital wanderers, and the protection of users looks less like an afterthought and more like a scheduled event on the national calendar.

Their valiant effort? The analysis of over 50,000 data points across a flourishing menagerie of forty allegedly “promising” token launches—an exercise not unlike herding ferrets into a swimming pool, but with more spreadsheets.

MicroStrategy, now rebranded as Strategy, was the pioneer in this field, issuing debt to buy bitcoin and promising its shareholders a taste of the elusive BTC pie. And what a pie it is! 🍰 The company’s stock value has skyrocketed, gaining 500% since early 2024. Investors, eager to join the party, are flocking to these treasury companies like moths to a flame.

But can this network, with its focused strategy and robust infrastructure, maintain its impressive performance in the second half of 2025? Only time will tell, but one thing is certain: the drama is just beginning! 🎬

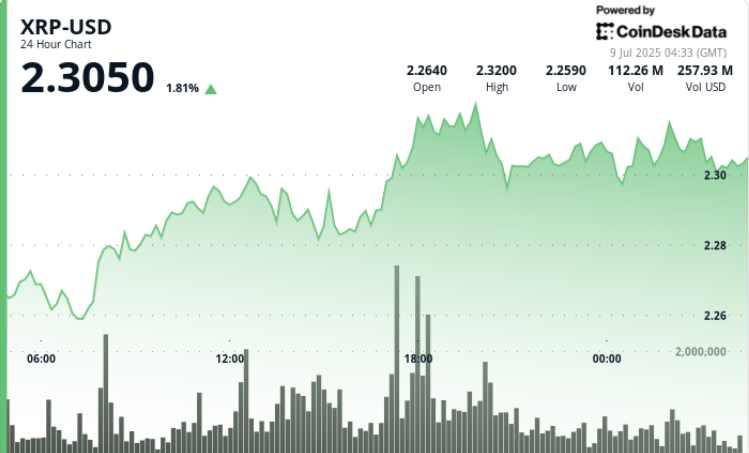

But, alas, dear reader, let us not forget the catalyst for this grand romance: Ripple’s application for a national trust bank charter with the U.S. Office of the Comptroller of the Currency. 📝

The move comes at a time when volatility and liquidations are peaking, forcing traders to reconsider near-term expectations for HYPE’s trajectory in a fragile setup. 😰

Oh, what a tangled web we weave when first we practice to deceive! The mounting legal pressures and structural flaws that have besieged Linqto have now culminated in a high-stakes reorganization, a drama that could forever alter the landscape of investor exposure to private equity access platforms. On the fateful day of July 8, the investment platform Linqto, which has long facilitated the indirect exposure to private pre-IPO companies, announced its voluntary Chapter 11 filing in the U.S. Bankruptcy Court for the Southern District of Texas. 📜💰