Bitcoin & FOMC: Will It Rally or Tumble? 🤑💔

Apparently, these rate cuts are supposed to make the economy go “yay!” by making borrowing cheaper. The Fed’s been on this kick since September and October, but let’s be real-has it actually worked? 🤔

Apparently, these rate cuts are supposed to make the economy go “yay!” by making borrowing cheaper. The Fed’s been on this kick since September and October, but let’s be real-has it actually worked? 🤔

Michael Saylor, the venerable patriarch of Strategy, has confirmed the receipt of this proposal, revealing that the firm had issued a formal response to the agency, expressing its disagreement on the exclusion plan. One might say it’s as if he’d been handed a lemon and was now politely asking for a refund, albeit with a bit more formality. 🍋

As of press time, UNI clung to $5.5, up 2.1%-a rebound so feeble it’s like trying to inflate a pool float with a straw. Oh, and it dropped below the Parabolic SAR? That’s crypto-speak for “sell here” written in crayon by a bear market toddler. 🚨

As the Federal Open Market Committee (FOMC) gears up for what is surely the most important meeting of the year (or possibly the millennium), Bitcoin (BTC) has been seen loitering around the $92.4k mark, which, in crypto terms, is basically the equivalent of a goldfish asking, “What’s Tuesday?” Meanwhile, the ETH/BTC pair has edged over 7% in the past three days, hovering around 0.0367 during mid-North American trading. If this sounds like a romance novel, it’s probably because someone’s plotting a sequel to “The Little Mermaid” with crypto twists.

Despite the growing whispers of real-world usefulness, XLM is still lingering near a critical support level, a place that’s like the safety net of a circus performer who might or might not fall through. Traders are split, debating whether the token is about to soar or if it’s just another chance for a tumble down the market’s well-worn path. 🪂📉

Wednesday’s big reveal: QVAC Health, an app that promises to let you track your biometrics without selling your soul to Silicon Valley. Groundbreaking! Or as we like to call it, “privacy, but make it 2023.” 🧠

SpaceX’s crypto wallet is now worth approximately $368.8 million, assuming Elon hasn’t decided to turn the Bitcoin into edible glitter. Last month, they moved over 1,100 BTC-an amount that makes you wonder if Elon has a secret stash hidden behind his desk. The pattern hints at some institutional custody shuffle, probably Elon’s way of saying, “Hey, bankers, look what I’m doing with your money.”

Yes, dear reader, from December 10, 2025, brave souls can bet their sanity on the NIGHT/USDT perpetual contract. No need to buy the token outright-just step into the ring and take a long or short position, as casually as one might choose between tea or vodka. This is the playground of high-frequency traders and hedge fund wizards, all without even touching the digital dust.

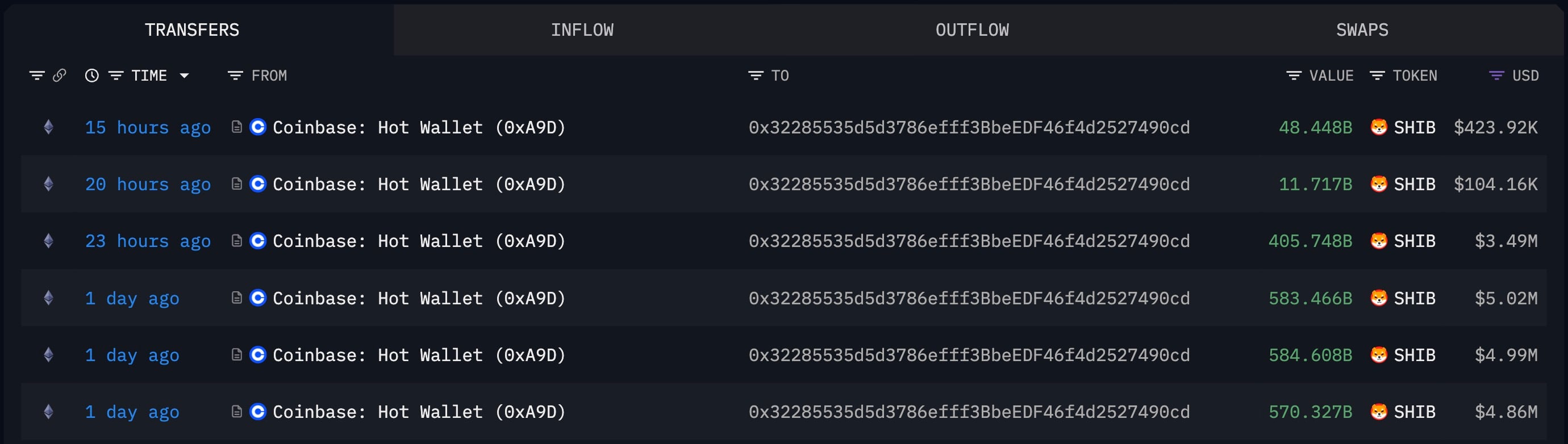

The crooks (or perhaps just very ambitious investors?) split their loot into six little parcels-ranging from 11.7 billion SHIB to a dainty 584.6 billion SHIB per package. At today’s prices, the lucky recipient now holds $18.76 million worth of SHIB. Classic move: stash your treasure before the tide turns. Or as the market might say, “Don’t put all your eggs in a wallet that’s prone to theft.” 🥚🔐

Behold, the details: Citadel Securities, Fortress Investment Group, and their ilk have not merely purchased shares in Ripple, but have woven a tapestry of protections so intricate that even the most astute observer might find themselves bewildered. These investors, ever the prudents, have secured the right to sell their shares back to Ripple at a guaranteed 10% annual return, should the company not grace the public markets before the appointed time. A most ingenious arrangement, ensuring that even if Ripple’s fortunes wane, the investors shall depart with their gains, like a well-tailored gown that never loses its luster.