💥 SSK Staking ETF Crushes Solana & XRP Futures, Rakes in $33M Volume! 💥

The new fund attracted $12 million in inflows and closed the day with $33 million in trading volume, according to Bloomberg ETF analyst Eric Balchunas.

The new fund attracted $12 million in inflows and closed the day with $33 million in trading volume, according to Bloomberg ETF analyst Eric Balchunas.

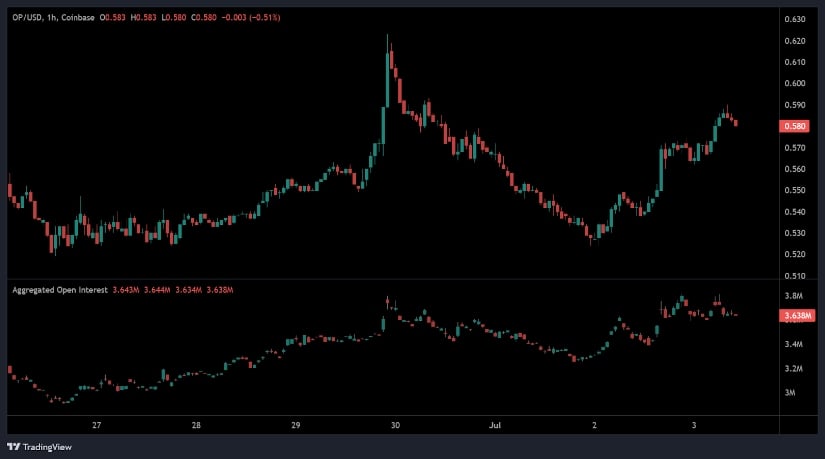

Let’s get down to business. 📊 On the 1-hour price chart, OP/USDT was like a teenager on a sugar high – all over the place! 🤯 After a consolidation base between $0.52 and $0.54, the price surged to $0.63, only to pull back and leave us all wondering, “What just happened?” 😱

As Pentoshi, now burdened with over 868,000 followers—presumably not all bots—preached to the masses, Ethereum is poised, nay destined, to frolic merrily past the $3,000 boundary before the leaves turn brown, thanks to a so-called “structural shift.” Whether that shift is tectonic, aesthetic, or simply existential is left infuriatingly vague.

In a recent interview with CNBC, Lee, with the air of a man who has just discovered the secret to eternal youth, suggests that the strategy employed by these spot Bitcoin ETFs might be part of the problem.

In a chat that could have been titled “Crypto Confessions,” Storm, speaking to Crypto In America, hinted that his legal team would tackle the allegations that he had personally profited from illicit funds through his role at Tornado Cash. But when it came to the big question—would he testify in his own defense?—Storm was as vague as a politician’s promise. 🤷♂️

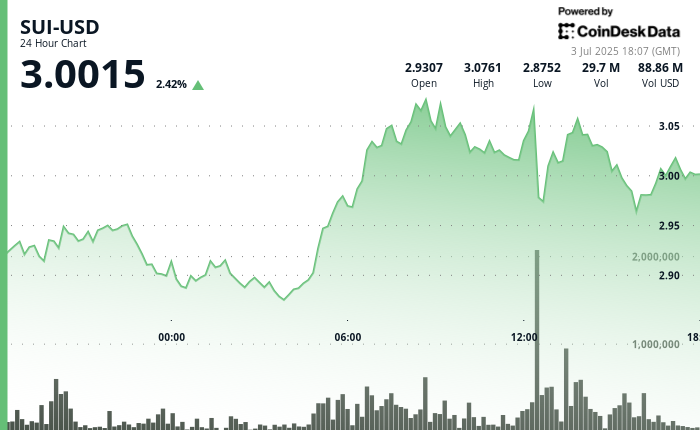

The news broke on June 26, which triggered more popping, fizzing, and hat-throwing among SUI’s loyal fans. The token zipped nearly 15% higher over the last seven days—no sign of putting its feet up yet.

Imagine if DeFi waltzed into a Mayfair club, took one look at the regulated exchanges, and said, “Clear the floor, darlings, I’m here to mingle.” Byreal’s platform is just that—a glorious blend of dear old DeFi openness and the robust liquidity one usually finds guarded by a stern doorman. The inner workings—some mysterious hybrid of Request for Quote and Concentrated Liquidity Market Maker—allow trades swifter and smoother than a gossip in a drawing room. Gasless, price-insensitive, and so impervious to MEV trickery, not even the cleverest cardsharp could cheat the system. Solana underpins it all, dashing off trades with a 200ms quote time, making other blockchains look positively Victorian.

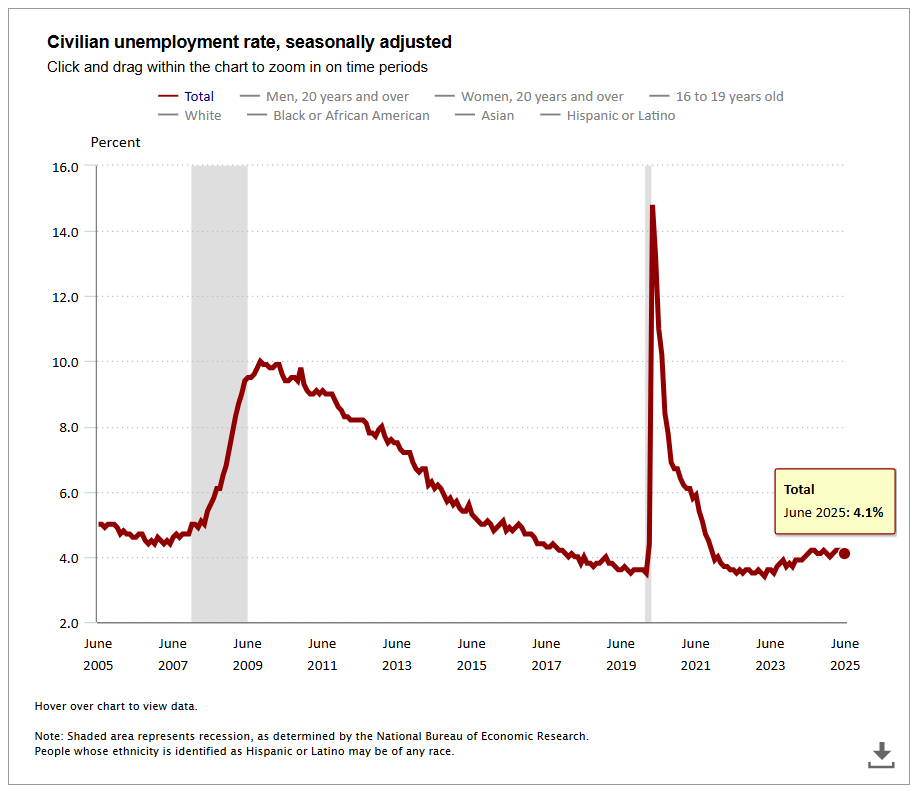

The good folks at the U.S. Bureau of Labor Statistics released some job data that made Wall Street do a happy dance on Thursday. The economy added a solid 147,000 jobs last month, and the unemployment rate dropped to a cozy 4.1%. Meanwhile, Bitcoin? It barely twitched. But hey, stocks went bananas, especially since the “experts” thought we’d only see 110,000 new jobs and an uptick in unemployment to 4.3%. Guess they were a tad off, eh?

Behold! The picture is clear as the bottom of a wine bottle at the end of a Parisian soirée: the future jangles not between stodgy banks and crypto wizards, but in the miraculous blending of both—like an accountant who secretly loves Molière’s comedies.

The situation combines massive financial resources, political strain, and Elon Musk’s efforts to redefine the future of artificial intelligence.