Tether’s $162B Empire: From Stablecoin to Venture Czar! 🤑

The announcement, my dears, is nothing short of a seismic shift in Tether’s little drama.

The announcement, my dears, is nothing short of a seismic shift in Tether’s little drama.

The revelations borne from this bold experiment are indeed curious.

This delightful bounce follows two almost heroic retests of the $0.40 support, first in April, then again in mid-June. Both retreats featured such strong lower wicks on the chart, like the hands of desperate buyers, clutching at the last strands of hope. As Pi Network continues its dance under the long, cruel shadow of a descending trendline, all eyes now wonder—can it break free and soar into a glorious reversal?

Looks like the institutional crowd is turning their noses up at Bitcoin’s half-hearted tango, because ETH is suddenly the belle of the ball! BlackRock’s fund is now managing more than $10 billion in assets, while total ETH ETF holdings have practically gained a VIP pass, sitting pretty at nearly 4.5% of Ethereum’s market cap. Fidelity’s FETH is in the mix too, but like that quiet friend who always orders the salad. 🥗

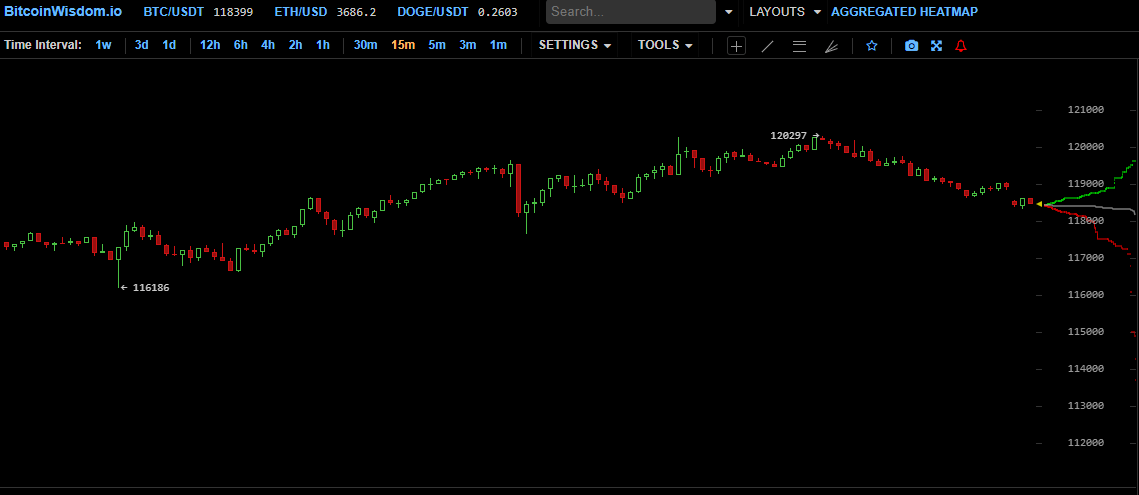

Following a brief sojourn below the $116,200 mark, bitcoin ( BTC) embarked upon a spirited ascent, shattering the imaginary ceiling of $120,000 on July 22. This endeavor seemed to reclaim some of its supremacy, engaging in a tug-of-war with the sprightly altcoin contenders.

Alderoty’s latest revelation? A staggering 55% of non-crypto holders confess that researching cryptocurrency feels as overwhelming as deciphering a Shakespearean sonnet while balancing on a unicycle. Truly, the modern age is a marvel of contradictions.

Polkadot’s at $4.45. Up 3% in 24 hours! That’s like getting a 3% raise and pretending you’re rich. Analyst Friedrich claims this could be the start of a “10X rally.” Sure, buddy. Next you’ll tell me crypto bros don’t smell like Doritos.

The wallet’s been playing it cool—slow and steady wins the race, or so they say—strategically scooping up tokens like a squirrel hoarding acorns before winter. This stealth tactic, favored by those institutional bigwigs who love a good game of market chess, suggests they’re slowly setting the stage for a potential breakout. Is it the calm before the storm, or just another crypto cough? Time will tell, but everyone’s eyes are glued to the charts—which lately look more promising than the latest rom-com.

David Schwartz, Ripple’s Chief Technology Officer – a man, one suspects, who views the status quo with the same affection one reserves for a particularly bothersome mosquito – has quite rightly pointed out the obvious. The American Bankers Association, those guardians of the…well, themselves, have requested a freeze on crypto bank licenses. Including, of course, the pesky applications from Ripple and Circle. If these institutions had their way, one imagines, we’d still be bartering with livestock. 🐄

The SEC, that ever-watchful guardian of propriety, initially permitted only cash redemptions for Bitcoin and Ethereum ETFs—how very pedestrian for such modern treasures.