XRP: Stuck in a Rut or Just Taking a Crypto Nap? 😴💤

Traders are side-eyeing you like you’re the last slice of pizza no one wants to commit to. 🍕👀 All this attention, but no one’s making a move. Classic XRP. sips tea ☕

Traders are side-eyeing you like you’re the last slice of pizza no one wants to commit to. 🍕👀 All this attention, but no one’s making a move. Classic XRP. sips tea ☕

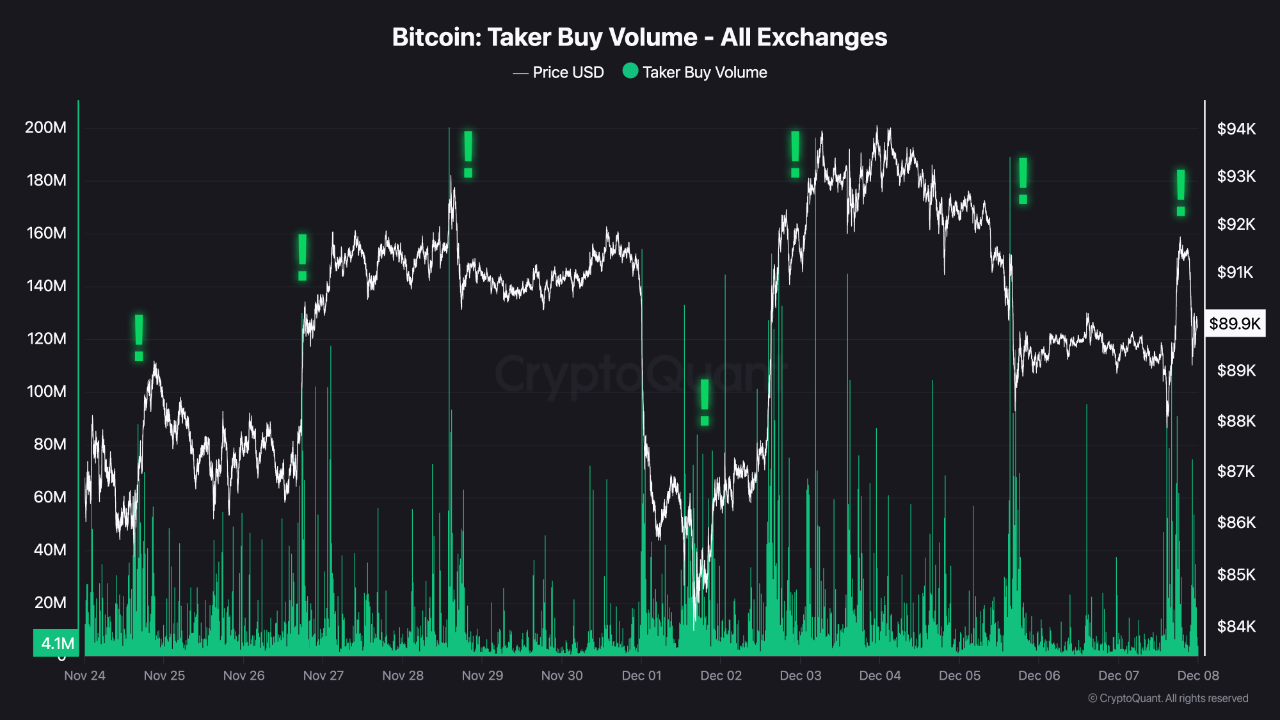

CryptoQuant folks, those bright-eyed prophets of the crypto realm, tell us that Bitcoin’s Taker Buy Volume has been bouncing around like a frog on a hot skillet over the past two weeks. Each dip seems to send whales (big fish) rushing in, seemingly thinking this is the best time to grab a bargain. But beware-they warn the buyers might be losing steam, like a locomotive running out of coal.

In the last 24 hours, BTC has been trading in a tighter range than my jeans after Thanksgiving dinner-$91k to $92k. Daily volumes are fluctuating between $25 billion and $56 billion, which is basically a “meh” compared to its $1.8 trillion market cap. Circulating supply? Just under 20 million coins, because scarcity is so hot right now. 🔥

In a move that’s as sudden as a Vogon reading his poetry, Aster has bumped its daily buyback program from $3 million to $4 million, starting December 8, 2025. Why? Well, they’ve got fees piling up like unpaid bar tabs, and they’re determined to bring them on-chain faster than you can say “42.” This should give $ASTER holders a cozy blanket of support during market rollercoasters, which, let’s face it, are more common than a hitchhiker’s towel. 🌪️

The central bank of Argentina is discussing a proposal to lift its ban on the cryptocurrency activities of banks in the country. The framework would enable trading and custody services and would be a step up from prohibition. The goal of the plan is to bring Bitcoin, stablecoins, and other digital assets into compliance and to increase the standards for KYC and AML. 🚨 Finally, someone’s trying to stop crypto enthusiasts from buying houses with Dogecoin! 🏠💸

This influx of capital has lifted the total assets under management (AuM) to a respectable $180 billion, a 7.9% rise from the November lows. Yet, it remains a far cry from the sector’s glittering peak of $264 billion. 😕

These days, Aster seems to be the poster child for such cycles. In Q3, the token soared into risk-on mode like a kid who just discovered sugar, climbing a wild 300% in a single quarter. Oh, and by the way, it even managed to challenge Hyperliquid [HYPE] for the spotlight.

At the moment, the probability of a rate cut is sitting at 87.2% while a 12.8% chance of no interest rate slash exists. If the former occurs, cryptocurrencies could rise as Lower rates typically drive capital into risk assets like crypto. However, a hawkish surprise could suppress demand, especially with Bitcoin down 20% over 90 days. 🚀

Let us, for a moment, remove our tinfoil hats and pretend this is all serious business (though frankly, it feels like watching bankers try yoga – noble, but awkward). Polygon’s native token, that once-sprightly MATIC, now shivers in the crypto winter, its chart resembling the pulse of a hibernating badger. 😵💫

Imagine that: banks, those stalwarts of stability, now tasked with managing digital assets like they’re just another line of credit. The new “regulatory framework” is basically a sleight of hand, ensuring crypto plays by the same rules as, say, a pirate’s treasure map. KYC and AML? Because nothing says “trust us” like asking for your passport and a detailed account of your life choices. 🧾