As I sat in my armchair, sipping my tea and staring out the window, I couldn’t help but think about the latest 99Bitcoins Q2 State of Crypto Market Report 📊. The numbers were staggering: institutional demand was up, Bitcoin had hit a new all-time high of $111,980, and crypto hiring had spiked 753% 🚀.

But what struck me most was the sense of calm that pervaded the report. No, this wasn’t a market driven by retail hype and speculation. This was a market driven by institutions, by the big players who had finally decided to take crypto seriously 🤑.

And yet, despite the rally, the total market cap was still 12% below its peak. It was as if the market was saying, “Ah, yes, we’re doing well, but we’re not quite there yet.” A bit like a Russian winter, where the snow is still falling, but the sun is already shining through the clouds ❄️☀️.

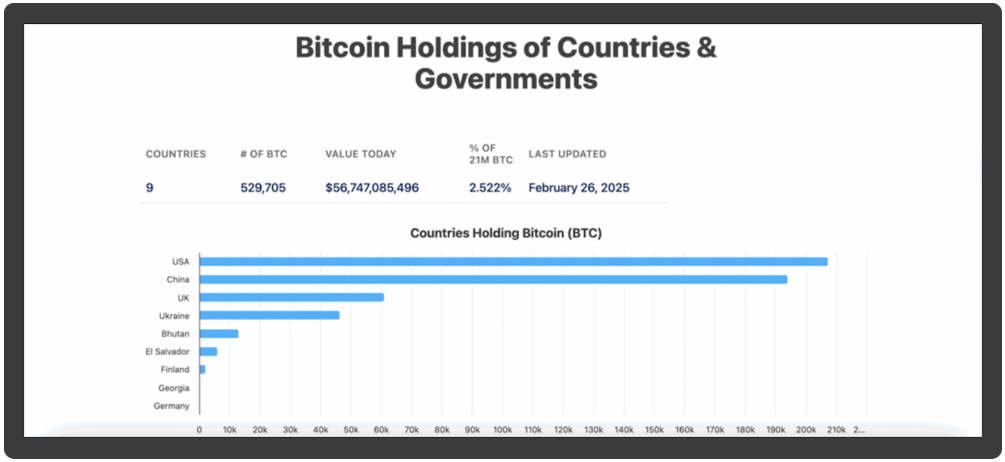

I turned to the section on Bitcoin, and my eyes widened as I read about its 25.66% gain in Q2. It was like a Tolstoy novel, where the hero rises above the chaos and emerges victorious 📚. And the drivers of this rally? Institutional inflows, ETF demand, and growing sovereign interest. Ah, the plot thickens 🤔.

I chuckled to myself as I read the quote from Chris Wright of 21Shares: “We believe that Bitcoin ETFs will attract 50% more inflows this year compared to last year.” Ah, the optimism of the young 🙃. But I couldn’t help but feel a sense of excitement, a sense that maybe, just maybe, this was the start of something big 🎉.

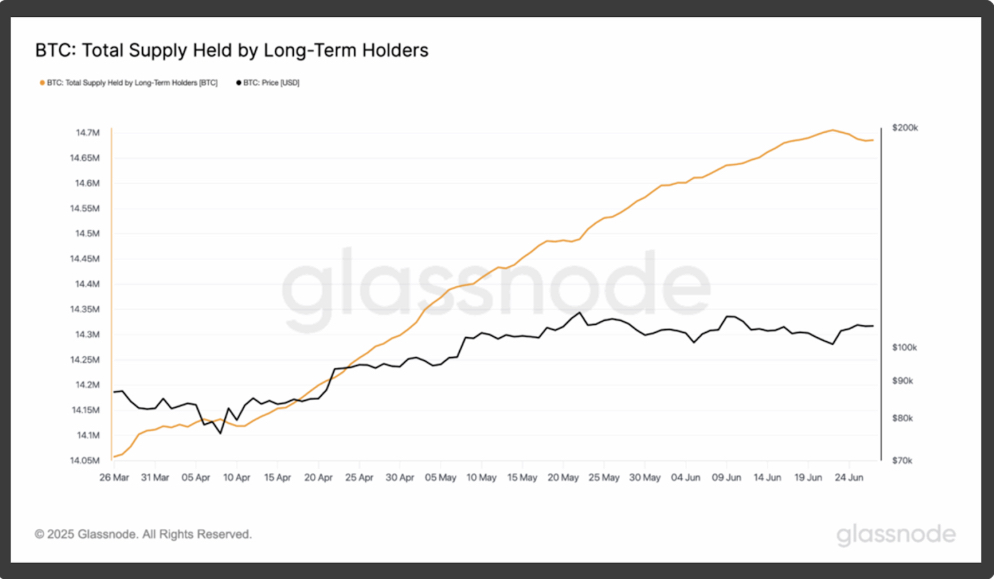

As I delved deeper into the report, I came across the section on institutions taking the wheel. Ah, yes, this was the real story. Retail traders had shifted their focus to altcoins, chasing faster gains, while institutions quietly accumulated Bitcoin 🤑. It was like a game of chess, where the pawns were being moved around, but the real players were the ones making the strategic moves 🏰.

And then there was the section on stablecoins and DeFi. Ah, yes, this was the future. The Circle IPO had popped 168% on day one, and 81% of crypto-aware SMBs wanted to use stablecoins for daily ops 📈. It was like a snowball rolling down a hill, gathering speed and size as it went ❄️.

As I finished reading the report, I couldn’t help but feel a sense of awe at the complexity of it all. It was like a Russian novel, with multiple plot threads and characters, all intersecting and influencing each other 📚. But one thing was clear: this was a bull market with depth, driven by institutions, regulatory tailwinds, and real product traction 🚀.

And so, I sat back in my armchair, sipped my tea, and smiled to myself. Ah, yes, this was going to be an interesting ride 🎢.

Read the full report here: State of Crypto Q2 2025 – 99Bitcoins

This article is for informational purposes only and does not constitute financial advice. Please always do your own research (DYOR) before investing in crypto 🤓.

Read More

- USD CNY PREDICTION

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Gold Rate Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- USD VND PREDICTION

- Silver Rate Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

2025-07-11 19:22