Behold, the crypto markets, that most capricious of societies, have shown but little change in the past 24 hours, save for the illustrious Bitcoin, whose price, like a fickle suitor, experienced a minor retreat. The token, ever the paragon of composure, maintained a tight consolidation until the advent of the American trading hour, when it plummeted by over $1,500 in mere minutes. Thus, it concluded the day’s proceedings at approximately $67,500, a far cry from its earlier heights of $69,200. The trading volume, though consistent at $35 billion, hinted at a rather average level of engagement among the traders, who seem to have lost their zeal.

Curiously, the other top cryptos, those esteemed companions of the market, remain ensnared within a narrow range. Ethereum, that most resolute of tokens, consolidates beneath the local resistance at $2,000, while XRP persists at $1.45, a most unyielding figure. Solana hovers near $85, BNB ascends above $615, and Dogecoin, that mischievous little scamp, remains above $0.1. The market capitalization, ever the showy flirt, surged briefly above $2.3 trillion, yet the volume waned marginally from $98 billion to $84 billion. In these times of improved sentiment, the Santiment data, that most enigmatic of oracles, tells a different tale.

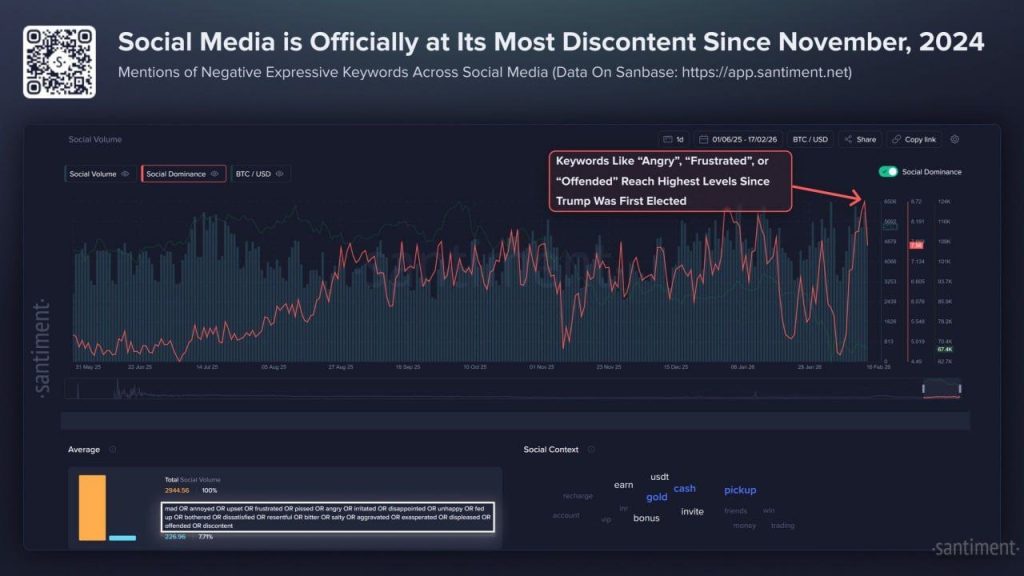

The chart above reveals a most dire state of affairs, wherein traders’ sentiments have turned exceedingly negative. The market participants, it seems, have been overwhelmed with disappointment, anger, and fear, as keywords such as ‘Angry’, ‘Frustrated’, or ‘offended’ have reached their zenith since the election of a certain Mr. Trump. These extreme negative sentiments, one might surmise, often herald an opportunity for those daring souls who dare to contravene the crowd.

Bitcoin-Led Selling, Liquidations and Weak Institutional Demand

Bitcoin’s price fell 0.78%, a most lamentable decline that accounted for over 80% of the total market’s woes. The drop, it is said, triggered $67.01 million in forced liquidations over 24 hours, with long positions comprising 74% of the total. This suggests the market, ever the follower, is heeding Bitcoin’s lead, and thus a sustained break below the $65,000 spot bid zone may provoke another wave of liquidations, much to the dismay of the traders.

On the other hand, the spot Bitcoin ETFs have witnessed four consecutive weeks of outflows, with over $133 million departing last week alone. The on-chain data, that most reliable of indicators, suggests the current accumulation is notably weaker than during the November 2025 bounce. This implies the institutional buying has cooled, and hence, a reversal in weekly ETF net flows from negative to positive may signal renewed institutional confidence, though one dares not hope too fervently.

Near-Term Outlook: Here’s What to Watch Out for This Week

The immediate outlook rests upon Bitcoin’s ability to defend the $65,000 to $67,000 range, a most delicate situation. Key resistance lies at the 7-day simple moving average near $70,000. The next major macro catalyst, that most anticipated event, is the release of U.S. PCE inflation data on February 28. Holding the support is crucial to avert a deeper correction, and a rise above $70,000 would help neutralize the short-term bearish structure, though one suspects the market will not be so easily pacified.

Overall, the current dip, though seemingly dire, is driven by Bitcoin’s weakness, amplified by liquidations and tempered by institutional inflows. The crypto market, ever the moody maiden, seeks a base as the sentiment is stuck in extreme fear. Thus, the question for the week arises: shall spot demand absorb the selling pressure at the $65,000 support, or shall fatigue set in for a retest of lower levels? One can only speculate, with bated breath.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Bitcoin Faces ‘Nation-State Rug Pull’ Risk, Warns Willy Woo

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- XRP XTRAVAGANZA: Is This the Crypto Comeback of the Century? 🚀💸

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- Bitcoin’s $110K Tango: Will It Waltz Higher or Stumble? 💃🕺

- Lido’s $10M Buyback: A Masterplan or a Muddle? 🤔

2026-02-18 12:25