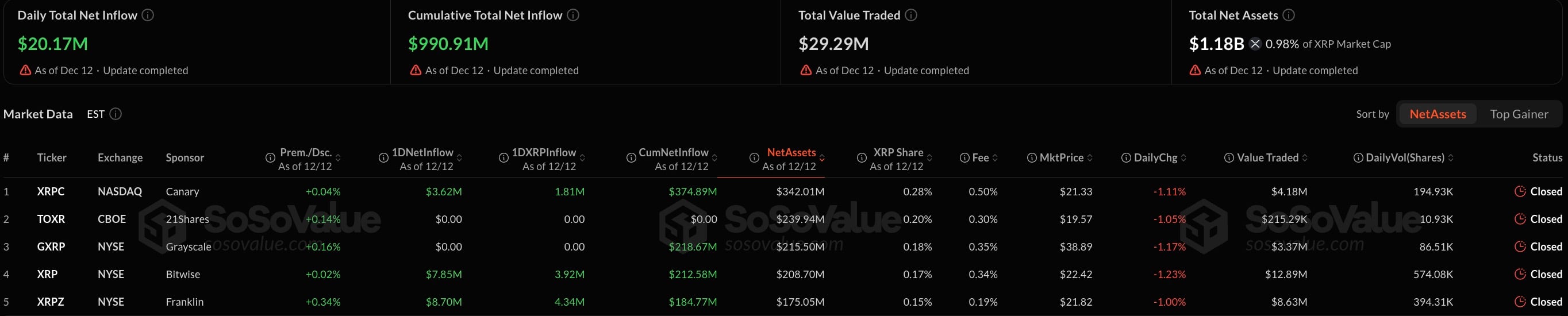

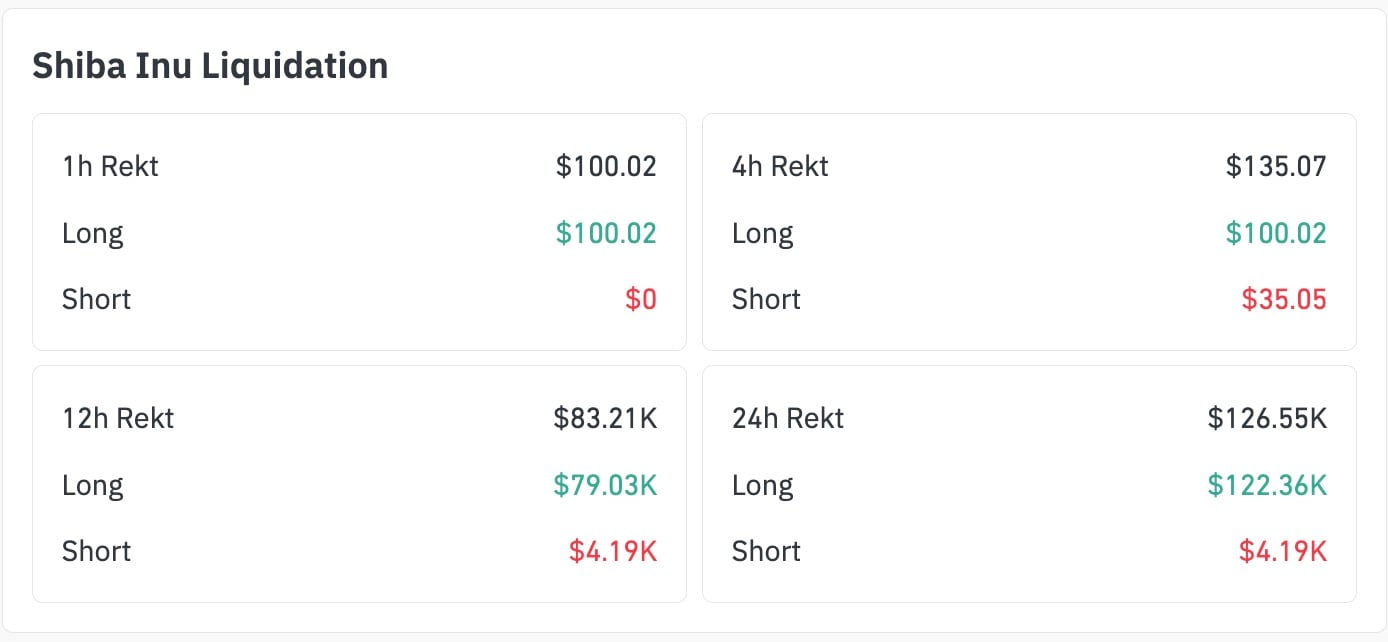

As the dawn breaks on yet another week in the unpredictable theater of cryptocurrency, we are greeted not with serenity but rather with tumultuous figures and dramatic price oscillations. A staggering $1.18 billion worth of XRP is now ensnared within the clutches of ETFs, siphoning off a noteworthy 0.98% of the entire supply. Meanwhile, the notorious Shiba Inu (SHIB) futures exhibit an absurd spectacle, showcasing a liquidation imbalance that rockets to 3,000%, leaving countless longs gasping for air as they are swept away. In a twist of fate more befitting a farce, JP Morgan has taken the plunge into Ethereum‘s murky waters, launching a tokenized money market product amidst the swirling chaos.

TL;DR

- XRP ETFs have now commandeered $1.18 billion, a sum representative of 0.98% of the total XRP supply, whilst the price limps near $2.

- SHIB futures declare a liquidation imbalance of 3,000%, with longs obliterated.

- JP Morgan introduces My OnChain Net Yield (MONY) on Ethereum’s Base network.

$1.18 billion of XRP devoured by ETFs

Despite the price meandering aimlessly, the narrative surrounding XRP’s ETF is swelling like a balloon at a child’s birthday party. According to the most recent data, the net assets tucked away in U.S. XRP spot ETFs have reached the eye-popping figure of $1.18 billion, equating to a hefty 0.98% of XRP’s total market capitalization. Who knew that a piece of paper could be so powerful?

This means that nearly 1% of all XRP circulating in the wild is currently locked away in regulated investment vehicles-like a treasure chest buried deep in a digital vault. It is not merely lounging about on the exchange order books, playing a risky game of hide-and-seek with volatility. No, it is securely stored, untouched, like grandma’s secret cookie recipe.

The intriguing part of this saga lies in the timeline. With XRP prices stubbornly hovering around $2-a level that feels more like a psychological torture chamber than a mere price point-traders are left twiddling their thumbs in stagnation. Yet, here we find ETFs, ever the opportunists, seizing the moment. The contrast between the static price and the relentless accumulation of assets tells a story worthy of a Tolstoy novel.

ETFs continue to gobble up XRP even as the market flounders in indecision. This dissonance usually resolves itself in time, though not without a few dramatic twists along the way. The price may resemble a frozen pond, but beneath the surface, a veritable tempest brews.

The $2 mark has transformed into a pressure cooker, with bulls convinced it’s a solid foundation while bears claim it proves their point of market fatigue. Neither side emerges victorious. With nearly 1% of the supply already in the grasp of ETFs, even a slight uptick in demand could tip the scales dramatically. Talk about a game of high stakes poker! 🎲

Shiba Inu (SHIB) prints a staggering 3,000% liquidation imbalance

As XRP remains tense and composed like a well-mannered gentleman, the world of Shiba Inu derivatives collapses into utter chaos. One cannot help but chuckle at the absurdity!

The latest revelations from CoinGlass reveal a liquidation split that resembles a lopsided tug-of-war-approximately $122,000 in long liquidations versus a paltry $4,000 in shorts, yielding a liquidation imbalance bordering on 3,000%. What a delightful disaster! 💥

It seems SHIB traders, emboldened by a series of lackluster moves, kept doubling down on bullish bets in a market devoid of any momentum. Each slight dip sent leveraged longs spiraling into oblivion. Meanwhile, bears hardly bothered to show up, resulting in a hair-raising lack of short exposure.

The outcome? A never-ending cycle of folly: bulls dive into longs anticipating a breakout, only to find themselves ensnared in a sideways chop, where patience is not just tested… it is mercilessly punished. What a masterclass in futility! 🐢

Ironically, this imbalance also births latent risks lurking in the shadows. With shorts largely absent, any unexpected surge could trigger a frenzy of forced buying. But don’t get too excited; a rally is no guarantee. SHIB remains stuck in a perpetual merry-go-round, endlessly rotating among traders.

JP Morgan opts for Ethereum in its inaugural tokenized money market adventure

In a move that could only be described as bold, JP Morgan has unveiled its first tokenized money market fund on Ethereum, as reported by the Wall Street Journal. This marks a significant leap into on-chain asset management, eschewing the usual payments or experimental settlements.

The product, whimsically dubbed My OnChain Net Yield (or MONY for those who prefer brevity), saw JP Morgan toss $100 million of its own treasure into the pot at launch, subsequently opening the doors to select investors with wallets fat enough to meet the minimum investment threshold of $1 million. Surely, it’s a playground for the elite! 💰

MONY operates with the grace of a ballerina on the blockchain stage, delivering returns that are comparable to traditional money market funds, but with the élan of blockchain-based issuance and settlement. Investors can choose to enter this exclusive club with fiat currency or USDC, marrying traditional cash management with the wild west of crypto. What a union!

However, let’s not confuse MONY with a deposit token or stablecoin. No, dear reader, MONY is a legitimate investment fund utilizing Ethereum’s infrastructure, fully committed to the pursuit of yield. JP Morgan isn’t merely toying with token wrappers; they are actively orchestrating a performance on the grand stage of public blockchain. Bravo!

Ethereum has been chosen as the favored execution layer, a label that underscores its status as the go-to network for institutional-grade tokenization. This audacious move comes after years of private blockchain testing and indicates a watershed moment: actual capital being deployed directly on the blockchain. Seize the moment! 🚀

Following this announcement, Ethereum experienced a mild uplift of about 3%. How quaint!

Crypto market outlook

The forthcoming sessions promise continuity rather than surprises. XRP traders are glued to the ETF absorption against the looming $2 ceiling, SHIB is caught in its own liquidation mechanics, and Ethereum is poised to react to JP Morgan’s bold entrance.

- XRP: The price is languishing near $2, with immediate support at $1.88-$1.92. If it can hold that zone, stability remains intact. A break above $2.12 opens the gates to $2.28-$2.35. However, failure below $1.88 could expose $1.72-$1.75, where real demand lies in wait.

- Ethereum (ETH): Reacted positively to JP Morgan’s launch with a 3% bump. As long as ETH clings to the above $3,200, the market anticipates continuation toward $3,550. Losing $3,100, however, might cool the excitement and bring $2,950 back into the spotlight.

- Shiba Inu (SHIB): Remains ensnared in a range market dominated by derivatives. Support holds near $0.0000086-0.0000088, while resistance looms at $0.00001.

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

- Gold Rate Forecast

- Bitcoin’s New Kid: Can $HYPER Be the Next Crypto Gold Rush? 🐆🚀

- Shocking UK Law Turns Cryptos into Private Property-The Future of Digital Assets?

- Solana Resilient? Yeah, Sure, Even Hackers Love It Too!

2025-12-15 15:18