Oh, dear reader, gather ’round for a tale of woe and wonderment, where the mighty dollar dances with digital dragons—and everyone trips over their own feet. This week, the United States, in its infinite wisdom (or perhaps sheer mischief), unleashed a fresh barrage of trade tariffs. And lo! The cryptocurrency market, like an overly sensitive poet at a loud dinner party, collapsed into sobs. Bitcoin tumbled below $115,000, Ethereum teetered near $3,600, and altcoins such as Solana, Cardano, and Dogecoin plunged faster than a cat avoiding bath time. Ah, the drama! 😹📉

But why, you ask, does this calamity unfold before our very eyes? And what strange fate awaits BTC and ETH next?

The Great Tariff Tango: Why Crypto Markets Are Having a Meltdown

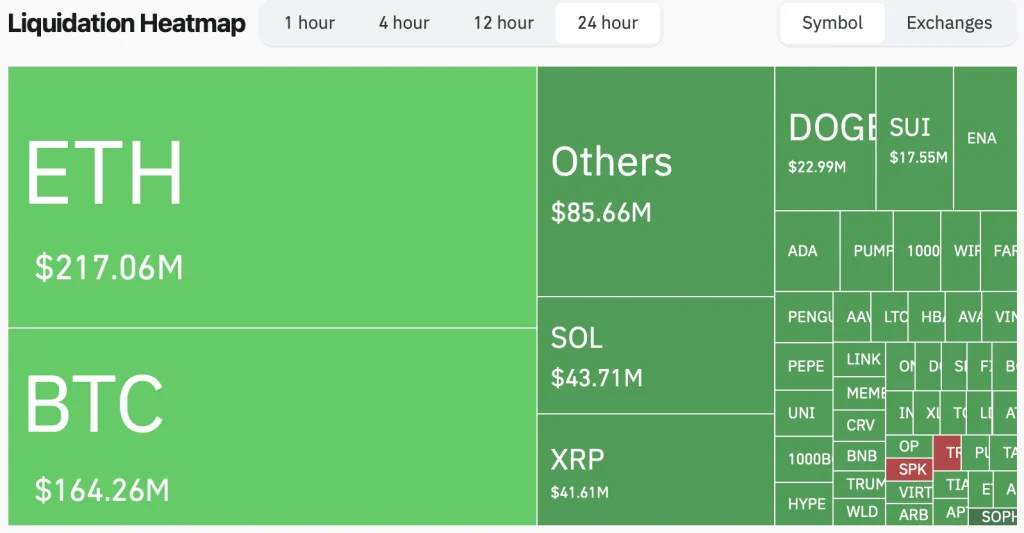

Ah, yes, the tariffs—those pesky policies aimed at Chinese tech imports and rare earth materials. Like a stone dropped into a pond, these ripples spread far and wide, unsettling even the most intrepid investors. You see, when uncertainty rears its ugly head, humans flee to safety like mice from a kitchen broom. Cryptocurrencies, being the unruly gamblers of the financial world, are promptly abandoned for “safer” assets. Within 24 hours of the tariffs taking effect, over $500 million in leveraged long positions were liquidated across exchanges. It was as if someone had accidentally hit the “sell everything” button while trying to order pizza online. 🍕💥

Bitcoin and Ethereum: Bruised but Not Broken

Now let us turn our gaze to poor Bitcoin, which has fallen below $115,000—a level once thought invincible, now breached like a poorly guarded castle gate. Ethereum, too, limps along near $3,600, clinging desperately to hope as if it were a lifeboat on stormy seas. According to Coinglass, more than 180,000 traders were liquidated, with total losses reaching $727 million. Yet, analysts squabble like siblings over dessert: Is this the beginning of a catastrophic collapse or merely a cleansing storm before sunshine returns? 🌩️🌈

History whispers that Bitcoin often recovers after global shocks, provided inflation calms down and central banks soften their stance. But until then, brace yourselves, dear readers, for volatility shall reign supreme!

What Awaits Us Next? Or, How to Survive the Financial Circus

As the dust settles—or rather, as it swirls chaotically around us—traders will focus on two critical questions:

- Will Bitcoin’s bulls muster the courage to defend support levels between $112K and $110K? Or will they retreat like cowards from a duel? 🐂⚔️

- Can Ethereum hold steady above $3,400, or will it crumble like a sandcastle under crashing waves? 🏖️🌊

- And finally, could a dovish pivot by central banks spark a miraculous recovery? One can dream, no? ✨🏦

In conclusion, dear reader, the U.S. tariffs have indeed stirred the crypto cauldron, causing much chaos and consternation. Yet, should inflation fears grow and fiat currencies falter, Bitcoin may yet rise again as a beacon of hope—or at least as a shiny distraction from reality. Until then, expect turbulence, laughter, tears, and perhaps a few fortunes made or lost. For in the land of crypto, nothing is certain except uncertainty itself. 🎢💰

Read More

- USD VND PREDICTION

- Altcoins? Seriously?

- Crypto, Trump & A Ballroom? 🤯

- Gold Rate Forecast

- Brent Oil Forecast

- IP PREDICTION. IP cryptocurrency

- Silver Rate Forecast

- EUR USD PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

2025-08-01 11:38