While the broader market continues to struggle in the final week of October, an altcoin has managed to buck the trend. Aerodrome Finance’s AERO token has surged over 36% over the past week. 🐕🦺

The rally is fueled by a series of positive developments, which is to say, a few clever moves by the team. 🧠

What Is Driving AERO Token’s Rally Against the Market Trend? 🤔

October proved to be a challenging month for the entire cryptocurrency market, including major assets such as Bitcoin (BTC) and Ethereum (ETH), among others. Despite lower interest rates, the sector has continued to fall. It’s like a bad novel where the protagonist keeps losing money. 💸

In fact, it is down by nearly 5% just this week. The majority of the coins have recorded losses over the past seven days. Nonetheless, the AERO token stood out as a notable exception. Like a rebellious cat in a dog park. 🐱

BeInCrypto Markets data showed that the altcoin has continued to rally, gaining over 36% in the past week. The rally has also made AERO the best-performing token in the DEX sector, according to CoinGecko. Because apparently, even DEXs need a hero. 🦸♂️

Even today, as the broader market slipped 1.4% and the DEX sector declined by 7%, the token diverged from the trend, rising 2.57%. At the time of writing, AERO was trading at $1.08. A price that’s as stable as a house of cards in a hurricane. 🌪️

But what caused this rise? Well, there are not one but several factors. Because nothing in crypto is ever simple. 🤷♀️

1. The AERO Buyback Program 🔄

AERO began rebounding on October 23, the day Aerodrome Finance highlighted results from its latest buyback. The team revealed that Aerodrome Public Goods Fund repurchased 560,000 AERO tokens. Because nothing says “long-term commitment” like buying your own tokens and locking them up. 🕰️

“All tokens were 4y locked for long-term alignment. To date, more than 150 million AERO has been acquired and locked via the PGF, Flight School, and Relay,” the post read.

The consistent removal of tokens from circulation creates structural upward price pressure, as demand persists. It’s like a game of musical chairs, but the music never stops. 🎵

2. Animoca Brands’ Investment 🎯

Another key catalyst for AERO’s climb was Animoca Brands’ strategic investment. On October 28, the firm stated it had acquired and max-locked AERO as veAERO. Clearly, they’ve found the holy grail of crypto investments. 🕹️

According to Animoca Brands, Aerodrome’s well-designed tokenomics and strong execution position it as a key infrastructure player within Base. The locked veAERO position signals long-term alignment and participation in Aerodrome’s governance and growth. Because nothing says “trust” like locking your tokens for years. 🧩

“Aerodrome is a key component in the engine behind @base’s DeFi growth, and @coinbase is making it seamless for its CEX users to trade tokens which have liquidity on DEXs such as Aerodrome, thus driving more value to Aerodrome voters. With sustainable tokenomics for $AERO and the team’s ability to execute, Aerodrome has proven its standing as a key player in

@base infrastructure,” the firm said.

3. Revenue and Token Emissions 💸

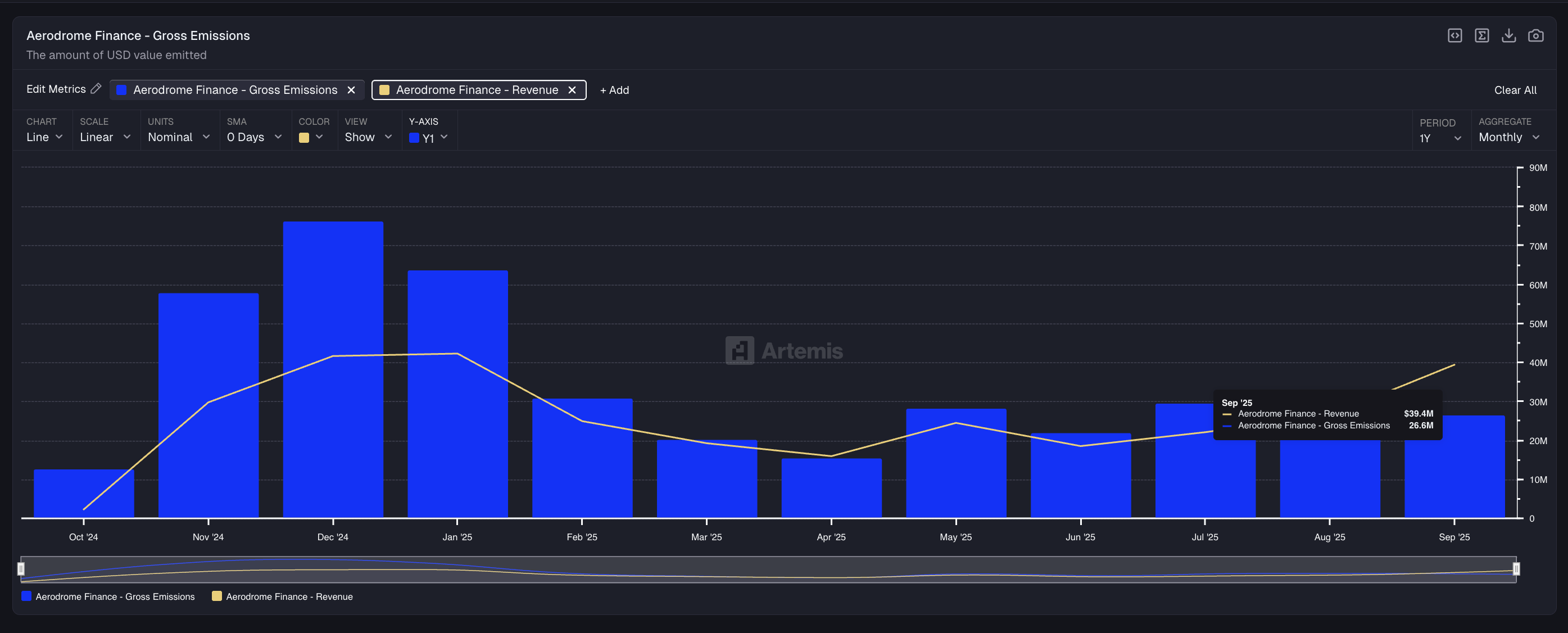

Lastly, AERO’s rally was also fueled by improved protocol fundamentals. In September 2025, Aerodrome Finance achieved a milestone as its revenue exceeded emissions. It’s like getting a raise and then deciding to stop paying your bills. 🤯

Data from Artemis showed $39.4 million in revenue and $26.6 million in emissions, resulting in a net value accrual of $12.8 million. This development addressed previous concerns about emission sustainability. Because nothing says “sustainability” like a 47% surplus. 📈

“@wagmiAlexander and team have been able to build a business where amount of fees from users that goes to locked veAERO holders and tokens burn > rewards / emissions to LPs. We’re shifting towards a world beyond the revenue meta and into revenue less emissions for sustainable long term growth that benefit token holders,” Artemis remarked.

The growth has continued. In an October 30 update, Aerodrome noted that it has achieved record efficiency, returning $1.50 for every $1 emitted, maintaining 11% annualized inflation (8% net after locks), and posting all-time-high trading volume per dollar emitted. Because why not make your inflation rate sound like a 1980s rock band? 🎸

“In light of this strength, the Aero Fed will stabilize emissions, supporting growth & long-term onchain expansion,” the team added.

With improved tokenomics, buybacks, reduced emissions, and notable institutional backing, AERO’s momentum may continue if Aerodrome maintains its revenue growth and macroeconomic trends allow. Sustaining success into November will depend on these factors and wider crypto market reactions. Because nothing says “uncertainty” like a crypto market. 🤷♂️

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- Bitcoin’s Golden Descent: A Tale of Volatility and Exploits 🚀

- Web3’s Chaotic Infrastructure Gets a Cheeky Makeover 🚀🤖

- Pi Network’s Node Update: A Techy’s Dream or a Developer’s Nightmare? 🤯

- How Bitcoin’s Miners Keep Their Cool (And Why That Matters!)

- Bostic Bails Out? Trump’s Fed Takeover Nears!

- Bitcoin’s Boom Turned Bust? Risk Managers Sound the Alarm!

2025-10-31 16:56