In the year 2025, when every merchant from the grocer to the philosopher’s cat seems to dabble in cryptocurrency, a new spectacle has emerged: futures-based Solana and XRP ETFs with capital inflows so lavish, even the ghosts of old money squirm in their crypts. They have-if you must know-gathered $1 billion since their launch. Naturally, this news arrived amid rumors swirling like Moscow tea, that the grand titan BlackRock might fancy a spot ETF for XRP. The air is thick with anticipation and the scent of undervalued assets.

SOL & XRP Futures: Welcome to the Circus

On August 9, Nate Geraci, president of The ETF Store-whose title is perhaps more majestic than his actual store-made a proclamation on X (the platform formerly known as Twitter, where pontification requires no license). According to him, the futures-based ETFs for Solana and XRP had seduced over $1 billion in capital. Their public debut in America was only months ago, barely time for a babushka to knit her second pair of socks. Naturally, investors were drawn to “futures contracts”-which are like promising to marry a suitcase of dollars next spring, unless inflation elopes with your prospects.

In March, Volatility Shares (the name alone inspires confidence, or acid reflux) dropped the pioneering Solana ETF. They provided not one but two products: the vanilla model, which amiably tracks Solana futures, and a 2x leveraged version which-if you’re lucky-will speed up your financial demise twice as fast.

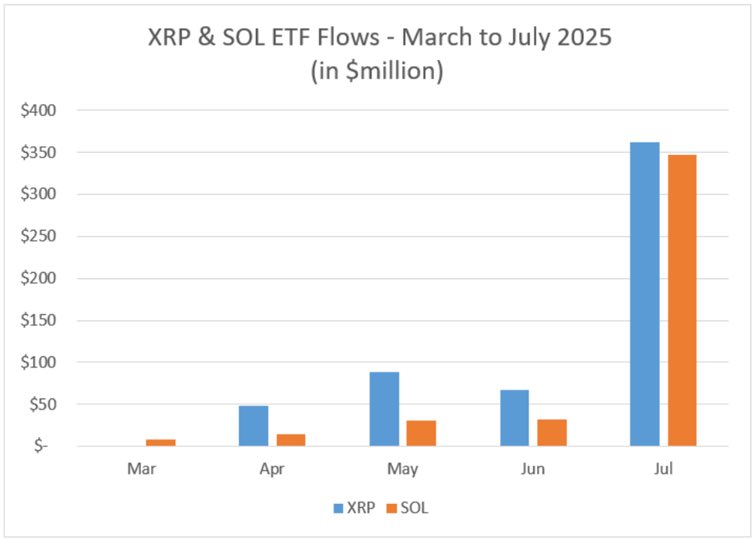

Teucrium saw the commotion and thought, “Why not?” launching a 2x leveraged XRP ETF in April. If you like your risk with more kick, this was your invitation. Volatility Shares, not to be left out, rolled in May with a non-leveraged XRP ETF. The chart below, unimpressed by poetry, reveals that until July the numbers were modest, then suddenly soared like a Russian poet hearing the word “vodka” at dinner: $350 million apiece in capital inflows.

Geraci, like any man with extravagant hopes and charts, included REX-Osprey’s Solana staking ETF-which sits on $150 million and, presumably, a mountain of existential dread. If this isn’t proof that spot ETFs for SOL and XRP will have a market, then water isn’t wet and Chekhov never questioned anyone’s motives at all.

Meanwhile, BlackRock Waits-Or Pretends To

Across town (metaphorically speaking), the United States Securities and Exchange Commission sits atop a mountain of ETF applications. Everyone wants approval, and probably a commemorative mug. As Bitcoinist reports, BlackRock has-ostensibly-declined to race for spot SOL and XRP ETFs. Of course, this means they’re probably already designing their victory parade.

Geraci, in another X post (clearly, he likes X more than most of his relatives), wondered aloud, “And I’m being told BlackRock doesn’t want a piece of this?” It’s the rhetorical equivalent of a Chekhov uncle squinting at a samovar and refusing to believe tea just pours itself.

And so the curtain falls, with ETFs billion-dollar richer, BlackRock feigning disinterest, and the market awaiting its next act like a provincial audience at a well-advertised, somewhat regrettable play. 🚬💸

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- Brent Oil Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- USD THB PREDICTION

- Gold Rate Forecast

- Bitcoin Frets and Fears: The Great Crash of 2025! 🚨💥

- SushiSwap’s Stirring Saga: The DeFi Drama That Left Us in Stitches! 😂🍣

- Crypto Chaos: 3 Stocks Dancing on the Edge of Madness 🌪️💸

2025-08-10 18:50