Ah, the Trump clan’s very own digital alchemy-World Financial Liberty (WFLI)-has found itself neck-deep in the murky swamp of blockchain theatrics, having slapped a blacklist sticker on none other than Justin Sun’s crypto wallet, shortly after he shuffled a modest $9 million in shiny WLFI tokens to assorted exchanges. A gentle tiff in the garden of decentralized finance, or as one might now ponder with a wry smile, does the “D” in DeFi stand for “Decentralization” or “Dictatorship”?

Like an old vaudeville act, this uproar brings to mind the timeless truth: alliances in politics and business are thinner than a Bitcoin transaction fee, and just as fleeting. One day you’re comrades in arms, the next you’re ripping each other’s tokens apart.

Trigger point: The tempestuous tides of WLFI

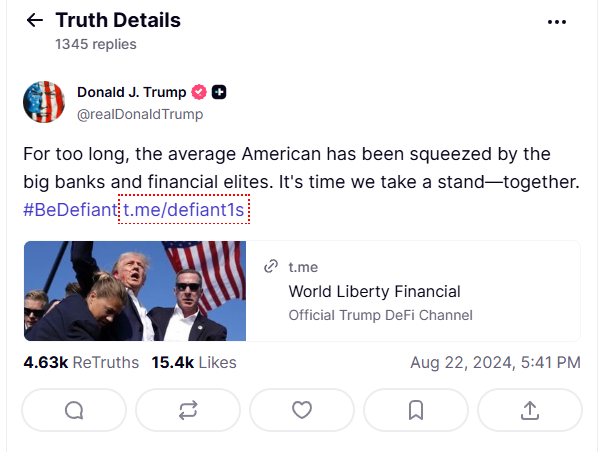

Conceived in the grand year of 2024 by the Trump family-proof that money truly does grow on Twitter feeds-WFLI debuted its majestic governance token, $WLFI, on September 1, 2025, launching at a princely $0.20 per token. Donald Trump Jr., or as I imagine him, the self-styled herald of financial liberty, crowed on X about this masterpiece: the “governance backbone of a real ecosystem changing how money moves.” If only money moved as fast as his tweets! 🦅

Big day – @WorldLibertyFi just launched the $WLFI token. This isn’t some meme coin, it’s the governance backbone of a real ecosystem changing how money moves. Freedom + finance + America FIRST. Home Team. 🦅

– Donald Trump Jr. (@DonaldJTrumpJr) September 1, 2025

The launch came with a promise of 100 billion tokens-a number so big it might as well have been plucked from a billionaire’s bedtime math exercise. Distributed across Ethereum, Solana, and BNB Chain in a confusingly cryptic cocktail, the blog on Medium assured us of precisely 24,669,070,265 tokens circulating upon kick-off-because who doesn’t love a number that sounds like a drunk poet trying to rhyme?

Funding the ongoing digital fiesta were ten billion tokens set aside for ecosystem growth, with Alt5 Sigma Corporation greedily pocketing nearly 7.78 billion. Marketing and liquidity gulped down 2.88 billion more, while public sales held a humble 4 billion. And lest we forget the treasury hoard-almost 20 million tokens tucked away like forgotten loot, along with various pockets reserved for the team and strategic partnership pals, all under a contract deathly silent on the subject of “blacklisting.”

Crypto experts initially ogled the token with all the anticipation of a child on Christmas morning-only to be left clutching empty gift boxes as volatility swooped in like the Grinch. Price halved, dropping with the grace of a lead balloon from $0.40 to $0.20, an unfortunate 40% nosedive.

Yet the darkest paradox: during his presidential crusade, Don the Elder thundered against banks “blacklisting, freezing, and controlling” the financial system. Now, like a cosmic joke wrapped in red, white, and blue, his family does the same on their own hot mess of a token.

Enter Justin Sun, blockchain maverick and (for now) victim of this digital purgatory. After ferrying $9 million in WLFI tokens through various exchange corridors, WFLI responded-not with a handshake-but by shoving his wallet onto a blacklist faster than you can say “blockchain sovereignty.”

Action by WLFI: Barking up the wrong blockchain

September 4 marked the date when WLFI froze a staggering 595 million unlocked tokens-Justin’s sizable second-largest investor stake, valued around $107 million. A move that smelled less like prudent governance and more like a toddler tantrum at the sandbox.

Thanks to the vigilant eyes of Aarkham Intelligence, we know Sun’s wallet (cryptographically abbreviated as 0x5AB) sent $8.89 million to a mysterious recipient (0xbdF…74B0) at precisely 09:18 UTC. Moments later, the recipient’s address faced the blockchain equivalent of a restraining order-a blacklist, which means Justin’s tokens were imprisoned in place, visible but inert, frozen in a quantum blockchain limbo.

Later that day, World Liberty issued a cryptic statement acknowledging “community concerns” about blacklists, all while politely sidestepping mention of Sun or his hefty tokens. Ah, the art of saying nothing while saying everything.

This blacklist drama arrived like an uninvited glitch. Originally, the smart contract made no mention of jet-black lists, with this feature sneakily injected mere days before token transfers were supposed to begin. And for early investors? They were promised the ability to casually offload 20% of their holdings, an irony now as stale as last year’s pizza crust.

Was Justin Sun sold down the river-or just thrown in the blockchain lake?

An intrepid analyst from Nansen sniffed out a pre-blacklist 50 million token transfer by Sun, fueling the fire. Yet, our beleaguered astronaut-cum-crypto-mogul reassured the planet via X that these moves were nothing but “a few general exchange deposit tests with very small amounts,” followed by “address dispersion,” which reads to us mere mortals like “I was just playing with my Lego digital blocks.”

Our address only carried out a few general exchange deposit tests with very small amounts, followed by an address dispersion. No buying or selling was involved, so it could not possibly have any impact on the market.

– H.E. Justin Sun 👨🚀 (Astronaut Version) (@justinsuntron) September 4, 2025

In a plea dripping with diplomatic sugar, Sun called on WFLI to thaw his frozen assets, championing the lofty ideals of fairness, openness, and trust-concepts as rare in DeFi headlines as honest politicians at a dinner party. He warned that unilateral asset freezes risk deterring investors faster than a bad Yelp review.

Critics, wielding pitchforks of logic, point out that this blacklisting bonanza had no external regulatory puppet masters pulling strings. Why, then, freeze Sun’s account just after KYC clearance and multiple small transfers? Especially when WLFI’s own creed claims its holders “do not owe any duties to each other or to the Company”-so much for neighborly love in crypto-ville.

This case is not isolated-yet wildly singular

The sport of blacklisting is no novelty in DeFi. Over the past half-decade, stablecoins like Tether and USDC have flexed their blacklist muscles, freezing wallets linked to hacks, scams, and-if you believe the conspiracy-the occasional wayward hacker who forgot the safe word. Tether once iced $35 million of stolen USDT post-KuCoin hack, ostensibly to protect victims but really to remind everyone who wields the real power.

The key difference? Those stablecoin heavies wield centralized contracts crafted with the explicit ability to banish rogue wallets-deftly sanctioned by law enforcement, OFAC edicts, and the enchantments of financial compliance. They play by rules, even if those rules look like a secret handshake no one outside the circle understands.

WFLI, however, with its DeFi buzzword badge, boasts “guardian” or “admin” rights in its smart contracts-gifted by its creators-to unilaterally blacklist wallets, not because Big Brother mandated it, but because internal drama demanded it. Justin Sun’s public un-personing? A consequence of alleged token dumping and market manipulation, although you’re free to see the affair as an episode of Game of Tokens.

The lingering question: Is WLFI truly decentralized-or just decentralized-sounding?

The fracas between WFLI and Justin Sun is more than frozen tokens and twitter wars. It’s a slow-motion circus asking if these politically charged crypto projects can maintain any genuine idealism while juggling dollars and allegiances. Where Tether and USDC freeze assets under the stern gaze of regulators, WFLI’s impromptu blacklisting of a heavy hitter undermines its own decentralization narrative and could send investors running faster than Elon Musk launches a new meme coin.

If WLFI can freeze its biggest benefactors on a whim, the whole DeFi riddle grows murkier: is WLFI the utopian dream it markets itself as, or merely “decentralized finance” in name only, with power resting in the hands of a few digital overlords? 🧐

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

- Bitcoin’s New Kid: Can $HYPER Be the Next Crypto Gold Rush? 🐆🚀

- Shocking UK Law Turns Cryptos into Private Property-The Future of Digital Assets?

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

2025-09-06 16:46