Oh, the humanity! Bitcoin ETFs waved goodbye to $227 million, and Ether ETFs had their fourth straight day of “nope, not today” with $167 million in outflows on September 4. That’s nearly $400 million in collective tears. 😭

Bitcoin Says “Adios” to $227 Million While Ether Keeps the Redemption Party Going

Remember when crypto ETFs were the cool kids at the party? Well, the music stopped, and suddenly everyone’s checking their wallets. Investors yanked a cool $394 million from Bitcoin and Ether funds on Thursday, September 4, because apparently, FOMO turned into FOMO (Fear Of Missing Out… on losing more money). 🤑

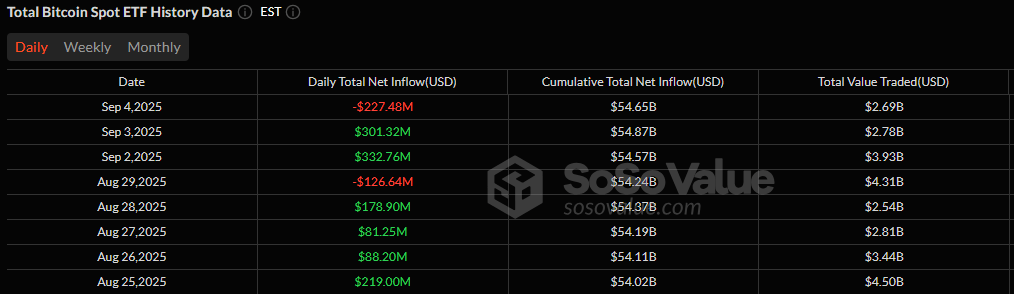

Bitcoin ETFs were like, “You first,” with $227.48 million in outflows. Ark 21Shares’ ARKB led the exodus with a $125.49 million “peace out,” while Fidelity’s FBTC lost $117.45 million. Bitwise’s BITB and Grayscale’s GBTC also joined the pity party with $66.37 million and $22.42 million in withdrawals, respectively. 🎉

Even the smaller players got the memo: Vaneck’s HODL (-$17.88 million), Grayscale’s Bitcoin Mini Trust (-$4.86 million), Valkyrie’s BRRR (-$4.66 million), and Franklin’s EZBC (-$3.18 million) all said, “Nah, we’re good.” But hey, Blackrock’s IBIT was like, “I got this,” pulling in $134.82 million. Still, Bitcoin ETF net assets dropped to $142.30 billion, with $2.69 billion traded. 💸

Ether ETFs were like, “Hold my beer,” with $167.41 million in outflows, making it their fourth day of “not today, Satan.” Fidelity’s FETH took the biggest hit, bleeding $216.68 million. Bitwise’s ETHW (-$45.66 million), Grayscale’s ETHE (-$26.44 million), and Vaneck’s ETHV (-$17.22 million) also joined the sob fest. Even the mini trusts and smaller funds were like, “Yeah, we’re out.” 🍷

But wait! Blackrock’s ETHA was the designated driver, soaking up $148.80 million. Total value traded? $2.61 billion. Net assets? Down to $27.78 billion. Ouch. 😬

So, here we are, with both Bitcoin and Ether ETFs in the red, and Thursday’s vibe was basically, “Caution: Crypto Market Ahead.” But hey, at least Blackrock’s funds are still the cool kids in the corner, sipping their institutional safe haven smoothies. 🥤

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Shiba Inu Shakes, Barks & 🐕💥

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

- Brent Oil Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

2025-09-05 14:03