Well, shucks, folks, it seems the crypto river has taken a twist! 🌪️ Bitcoin and Ether ETFs had themselves a right ol’ tumble, while Solana and XRP ETFs were sittin’ pretty, collectin’ their dues. Market sentiment? Mixed like a Missouri mud pie-traditional leaders strugglin’ while the young’uns soak up the spotlight.

Solana and XRP ETFs Hold Firm as Bitcoin and Ether Take a Dip in the Mudhole

Trading days, eh? They’re like a game of horseshoes-sometimes you’re close, and sometimes you’re just throwin’ money in the dirt. 🏇 Thursday, Dec. 4, was a real doozy. Bitcoin and Ether ETF investors pulled back faster than a hound dog from a bath, while Solana and the fresh-faced XRP ETF market quietly lapped up the crumbs.

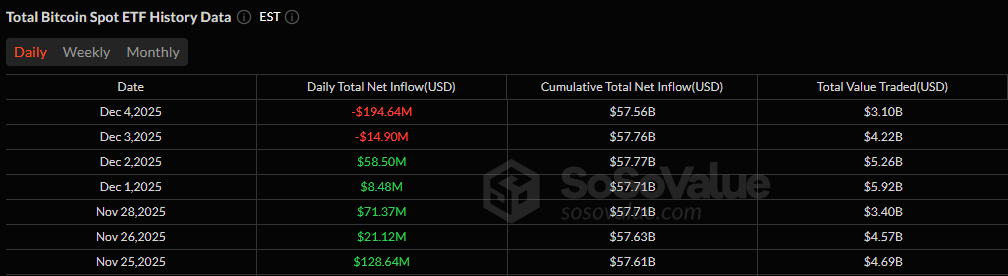

Bitcoin ETFs led the charge into the red with a $194.64 million outflow, endin’ their brief moment of peace. Blackrock’s IBIT shed $112.96 million-guess that’s what happens when you’re the big dog in the yard. 🐕🦺

Fidelity’s FBTC followed suit with a $54.20 million outflow, Vaneck’s HODL lost $14.34 million, and Grayscale’s GBTC said goodbye to another $10.13 million. Bitwise’s BITB closed the red parade with $3.01 million in exits. Despite the ruckus, total trading hit $3.10 billion, and net assets stayed plump at $120.68 billion.

Ether ETFs didn’t fare much better, endin’ the day with a $41.57 million net outflow. Grayscale’s ETHE took the brunt with $30.96 million in redemptions, and the Ether Mini Trust lost $21.04 million. Fidelity’s FETH added another $17.92 million to the pile. BlackRock’s ETHA tried to save the day with a $28.35 million inflow, but it was like bringin’ a spoon to a knife fight. 🥄⚔️

Solana ETFs, on the other hand, kept their heads above water with a $4.59 million inflow. Fidelity’s FSOL led with $2.05 million, Grayscale’s GSOL added $1.54 million, and Bitwise’s BSOL and Canary’s SOLC chipped in $734.66K and $269.69K, respectively. Total value traded hit $42.39 million, keepin’ net assets steady at $910.07 million.

In the new kid’s corner, XRP ETFs stayed green as a shamrock, pullin’ in $12.84 million. Franklin’s XRPZ topped the charts with $5.70 million, followed by Bitwise’s XRP ($3.76 million), Grayscale’s GXRP ($2.04 million), and Canary XRPC ($1.34 million). 🍀

FAQ📉

- Why did Bitcoin and Ether ETFs see major outflows?

Well, seems like the big boys-IBIT, FBTC, ETHE, and FETH-decided to take a dip in the red sea. 🌊 - Why did Solana ETFs stay positive despite the market’s tantrum?

Steady as she goes-FSOL, GSOL, BSOL, and SOLC kept the ship afloat. 🚢 - What’s drivin’ the new inflows into XRP ETFs?

Investors are chasin’ the shiny new thing, diversifying like a squirrel with acorns. 🐿️ - Does this signal a shift in crypto ETF sentiment?

You betcha! Money’s movin’ from the old guard to the new kids on the block. 🏃♂️💨

Read More

- Gold Rate Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- EUR USD PREDICTION

- USD THB PREDICTION

- PEPE PREDICTION. PEPE cryptocurrency

- Satoshi’s 14-Year-Old Wallet Just Moved 150 BTC! 🚀

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- AI and Copyright: Mark Twain’s Take on the Modern Patent Circus

2025-12-05 22:28