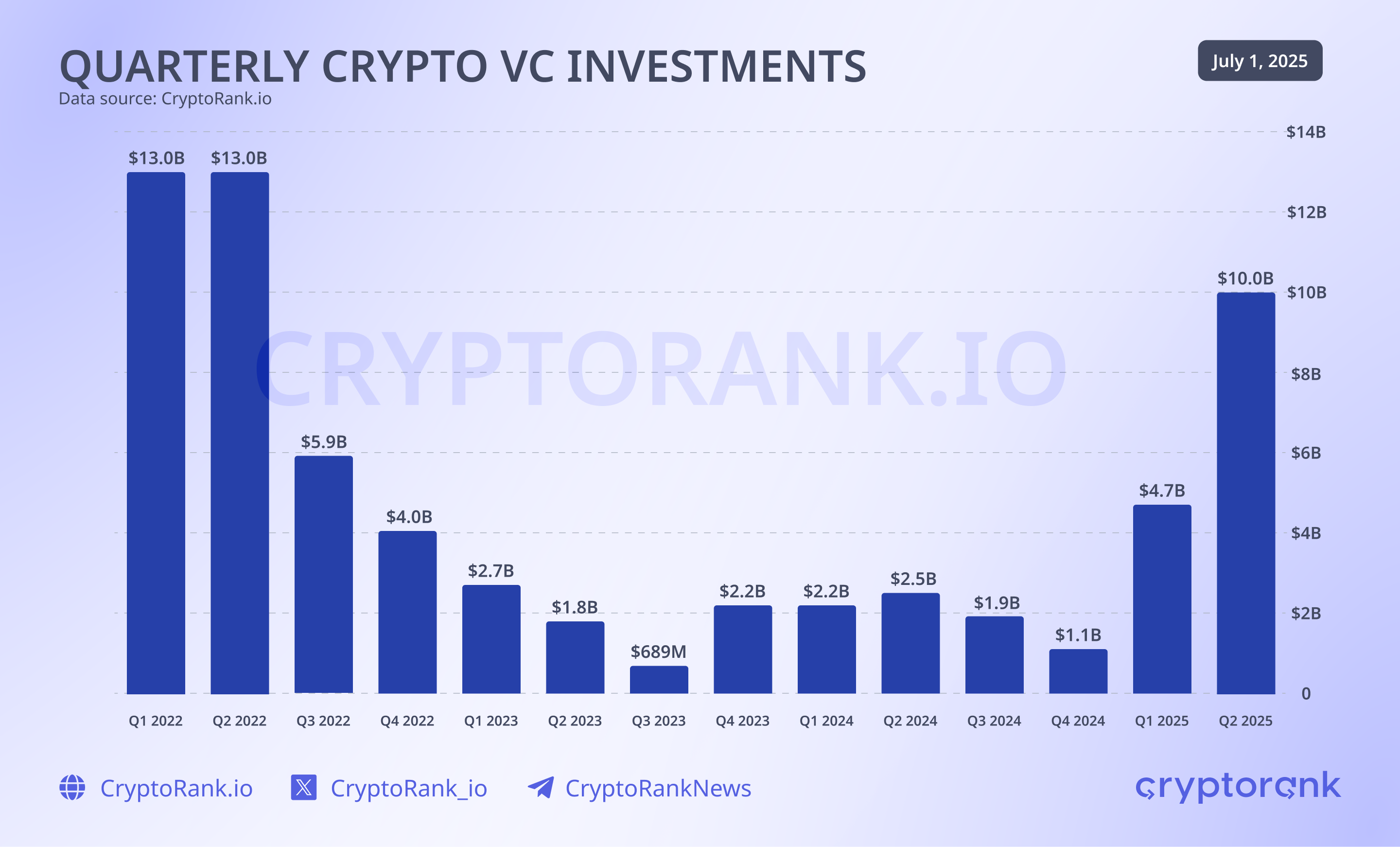

Hold onto your digital wallets, folks! The cryptocurrency market just flexed its muscles and surpassed the $10 billion mark—talk about a glow-up since the last three years!

Thanks to a little political love from U.S. officials and some big money rolling in, crypto is like a phoenix rising from the ashes. This isn’t a mere recovery; it’s a full-on comeback tour! 🎤🔥

Your Go-To Guide for Crypto Fundraising (or What Even Is This Sorcery?)

According to the crystal ball—or, you know, the latest CryptoRank report—Q2 2025 was a money-making dream where crypto raised over $10 billion. That’s like finding a 20-dollar bill in your winter coat you forgot you had! 💰

This astonishing number showcases a shift where big, serious money men and women are finally hopping on the crypto train. All aboard the institutional investment express! 🚂

What’s really fun is the new U.S. regime is like that cool teacher who actually lets you eat snacks in class. After years of feeling like crypto was stuck in a regulatory time-out, it’s now getting that sweet, sweet support to grow. Talk about a comeback kid! 🌟

There’s a very noticeable plot twist with capital flows—no more throwing cash at sketchy projects that look like they were built in someone’s basement. We’re talking about flesh-and-blood ventures with real products and fans lining up to buy them! 👏

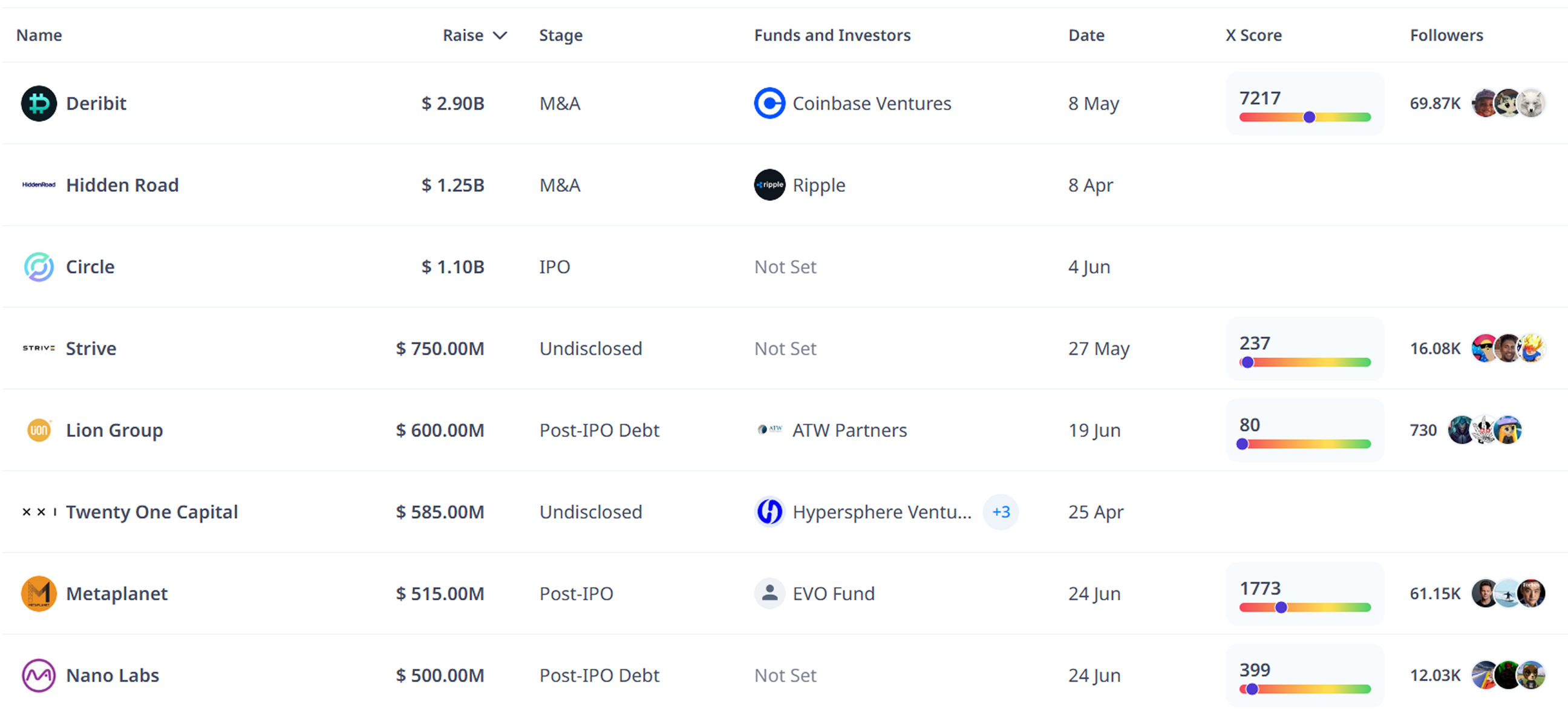

Late-stage financing is on the up and up, indicating that investors finally believe in products that actually work. And when it comes to IPOs and mergers, it’s getting hot in here! It’s no longer just a playground of startups but the big leagues of fintech. 💼

We’re seeing exchanges snatching up DeFi startups like they’re the hottest new sneakers. And companies like Circle are mingling with Wall Street, proving that crypto is the new “it” crowd of finance! Who knew being mainstream could look so good? 😎

The market’s not just throwing cash around like confetti; there’s an air of sophistication. Investors are focusing on real value, operational efficiency, and not just chasing the latest TikTok trend. Who knew crypto could grow up so fast? 🎓

With Web3 products proving they’re not just rebellious teenagers anymore, the crypto market is saying goodbye to the “mad scientist lab” phase and hello to its new identity as a global fintech player. Watch out world, we’ve matured! 🌍✨

The Crystal Ball Says… What’s Next?

Mason Nystrom from Pantera Capital recently delivered his hot takes on crypto VC like a well-prepared TED Talk. His insight? Fundraising is evolving, and if you’re not paying attention, you might miss the next big thing! 🚀

Nystrom posits that tokens, not traditional equity, will be the charming leading ladies in this investment narrative. Each token will be the brand ambassador of its project’s potential. Think of it as crypto’s stylish reboot. 🔄

Fintech VCs are putting on their party hats and heading straight for crypto, shaking things up for platforms in payments, digital banking, and tokenized assets. Anyone who doesn’t follow suit might end up being the last one picked for dodgeball. 😬

“Liquid Venture”—the new kid on the block—is all the rage. Because who doesn’t want flexible capital flows with easy entry and exit? It’s like a buffet—take what you want, when you want it! 🍽️

“Crypto continues to innovate on new capital market formation. And, as more assets move onchain, more companies will look towards onchain-first capital formation.” Wise words from Nystrom.

But let’s keep it real—things are about to get spicy! The competition is heating up, demanding clarity, skills, and tech smarts. Macroeconomic winds are pushing us forward, but the real secret sauce is each team’s ability to pivot, adapt, and rock the tech world. 🎸

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CAD PREDICTION

- EUR CNY PREDICTION

- EUR TRY PREDICTION

- Coinbase Spends $3Bn-A Whole Island Nation’s GDP-on One Dutch Derivatives Playground! 🥂

2025-07-18 08:21