Darling, it was a positively thrilling week in the world of cryptocurrency, wasn’t it? Our dear friend Bitcoin, who’s been rather coy lately, has finally decided to show us what he’s made of and has broken out of his consolidation, reaching a new all-time high. 💸💰

Now, let’s not forget that just a few weeks ago, BTC had a bit of a tiff with the Israel-Iran conflict and dipped below $100,000. But, like a true diva, he quickly bounced back and remained in a tight range between $105,000 and $110,000. However, the middle of the week saw him begin a massive leg up that broke the upper boundary on Wednesday, and he spiked to a fresh peak at $112,000. 🚀🚀

Although he retracted slightly in the following hours, his run was just getting started. On Thursday evening, he flew to $113,000 and later $116,000. The gains continued on Friday as he soared to almost $119,000, registering his current all-time high. 🌟✨

Despite losing some ground since then and retracing to just over $117,000 as of press time, he’s still up by 8% weekly. His market cap has shot up to $2.340 trillion, while his dominance over the alts has taken a hit this week and is down to 62.4%. 💼📈

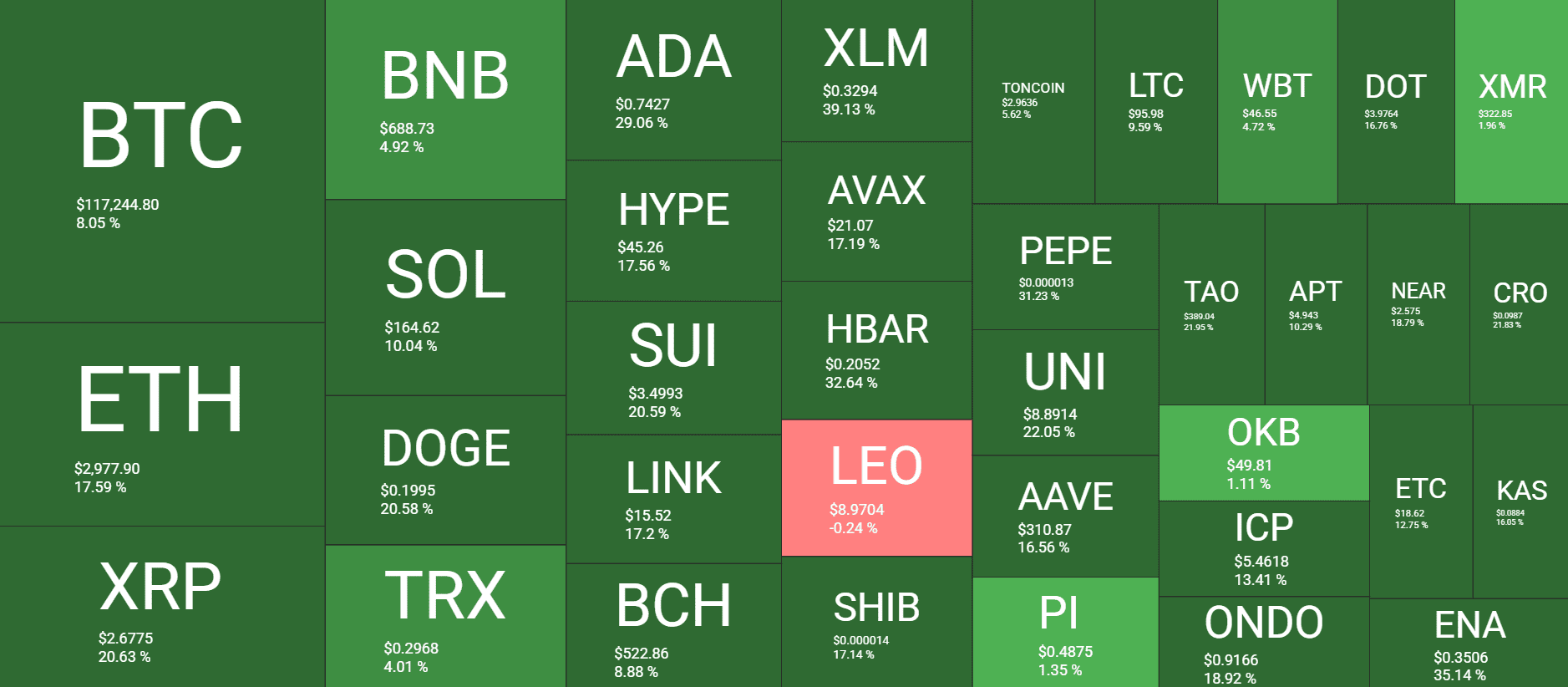

The reason for this is that many altcoins have marked mindblowing weekly pumps. Some of the leaders include ETH (17%), XRP (20%), DOGE (20%), ADA (30%), SUI (20%), LINK (17%), XLM (39%), and HBAR (32%). HYPE is also up by double digits (17%) and pumped to a new all-time high of over $46. 🎉🎊

These impressive price increases come as a bit of a surprise, given the latest tariff developments from Trump against other countries. In the past week alone, the POTUS has announced numerous tariffs against Canada, the EU, the UK, Japan, South Korea, Brazil, and other nations, some of which are up to 35%. 💼💸

Market Data

Market Cap: $3.75T | 24H Vol: $262B | BTC Dominance: 62.4%

BTC: $117,550 (+8.2%) | ETH: $2,990 (+17.7%) | XRP: $2.73 (+22.4%)

This Week’s Crypto Headlines You Can’t Miss

New Bitcoin Record At $118K: On-Chain Clues Reveal This Rally Is Different. Following this historic run and new all-time high, analysts, commentators, and everyone in between rushed to offer their opinion on what drove the asset and how high it can go. According to CryptoQuant, this rally is different due to several factors you can check here. 📈🔍

Bitcoin Tapped $112,000: Dormant Whales Stir, Retail Nowhere to Be Found. Before today’s peak, which marked the first one for the month at $112,000, reports emerged that retail investors were still nowhere to be found. Instead, the majority of the gains were attributed to larger and institutional investors. 🐳💰

Ripple Taps The Oldest US Bank to Custody RLUSD. BNY Mellon, the oldest US bank and one of the most consistently bullish on the cryptocurrency industry, will serve as the custodian for Ripple’s stablecoin, RLUSD. The asset reached a substantial milestone this week, hitting $500 million in market cap. 🏦💸

BNB Chain Completes 32nd Quarterly Burn — Could This Fuel a Rally? BNB’s burning program continues to operate as expected. The latest token burn, completed earlier this week, saw over $1 billion worth of BNB being sent to null addresses. 🔥🔥

GMX Hacker Returns Stolen $40 Million, Accepts $5M Bounty. Despite the positive market moves and new peaks, one crypto company faced an exploit, in which the attacker siphoned roughly $42 million worth of digital assets. Nevertheless, the perpetrator agreed to a bounty proposition and returned most of the funds. 🕵️♂️💰

BlackRock’s Ethereum ETF Sees $300M Record Inflow Day, ETH Tops $3K. ETH’s price jump to a new multi-week high of over $3,000 came in the aftermath of a record-setting inflow day into the spot Ethereum ETFs. Naturally, BlackRock’s product led the pack, with $300 million in net inflows. 📈💹

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Solana, and HYPE – click here for the complete price analysis. 📊🔍

Read More

- USD CNY PREDICTION

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Gold Rate Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- USD VND PREDICTION

- Silver Rate Forecast

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- Ripple’s RLUSD Invades Africa: Stablecoin or Scam? 😱

2025-07-11 17:08